UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-41872

DDC Enterprise Limited

Room 1601-1602, 16/F, Hollywood Centre

233 Hollywood Road

Sheung Wan, Hong Kong

+ 852-2803-0688

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

When used in this Form 6-K, unless otherwise indicated,

the terms “the Company,” “DDC,” “we,” “us” and “our”

refer to DDC Enterprise Limited and its subsidiaries.

On May 16, 2024, the Company received a written

notice from NYSE Regulation (the “NYSE Notice”) stating that the Company is not in compliance with the continued listing

standards of the NYSE American LLC (“NYSE American”, or the “Exchange”) under the timely filing

criteria included in Section 1007 of the NYSE American Company Guide (the “Company Guide”) because the Company failed

to timely file with the Securities and Exchange Commission (the “SEC”) its Annual Report on Form 20-F for the fiscal

year ended December 31, 2023 (the “2023 Form 20-F”), which was due on May 15, 2024 (the “Filing Delinquency”).

In accordance with Section 1007 of the Company

Guide, the Company will have six months from the date of the Filing Delinquency (the “Initial Cure Period”), to file

the 2023 Form 20-F with the SEC. The Exchange will monitor the Company and the status of the 2023 Form 20-F and any subsequent delayed

filings, including through contact with the Company, until the Filing Delinquency is cured. If the Company fails to file the 2023 Form

20-F during the Initial Cure Period, the Exchange may, in its sole discretion, grant an up to six-month additional cure period (the “Additional

Cure Period”). The Company can regain compliance with the Exchange’s continued listing standards at any time during the

Initial Cure Period or Additional Cure Period, as applicable, by filing the 2023 Form 20-F and any subsequent delayed filings with the

SEC. If the Exchange determines that an Additional Cure Period is not appropriate, suspension and delisting procedures will commence in

accordance with the procedures set out in Section 1010 of the Company Guide. If the Exchange determines that an Additional Cure Period

is appropriate and the Company fails to file the 2023 Form 20-F and any subsequent delayed filings by the end of that period, suspension

and delisting procedures will generally commence.

Notwithstanding the foregoing, however, the Exchange

may, in its sole discretion, decide (i) not to afford the Company any Initial Cure Period or Additional Cure Period, as the case may be,

at all or (ii) at any time during the Initial Cure Period or Additional Cure Period, to truncate the Initial Cure Period or Additional

Cure Period, as the case may be, and immediately commence suspension and delisting procedures if the Company is subject to delisting pursuant

to any other provision of the Company Guide, including if the Exchange believes, in the its sole discretion, that continued listing and

trading of the Company’s securities on the Exchange is inadvisable or unwarranted in accordance with Sections 1001 through 1006

thereof.

As disclosed in the Form 12b-25 filed by the Company

with the SEC on April 30, 2024, the Company was unable, without unreasonable effort or expense, to file its 2023 Form 20-F as a result

of a delay experienced by the Company in completing its financial statements in the Annual Report. The Company was not able to file the

2023 Form 20-F within the fifteen-day extension period granted pursuant to Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

The Company is making all efforts to file the 2023 Form 20-F as soon as possible and in any event within the six-month Initial Cure Period.

However, there can be no assurance that the Company will ultimately regain compliance with all applicable Exchange listing standards.

In the interim, the Company’s Class A Ordinary

Shares will continue to be listed on the NYSE American while it attempts to regain compliance with the listing standards, subject to the

Company’s compliance with other continued listing requirements. The NYSE Notice does not affect the Company’s business operations

or its reporting obligations under the Securities and Exchange Commission regulations and rules.

On May 21, 2024, the Company issued a press release

announcing receipt of the NYSE Notice. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DDC Enterprise Limited. |

| |

|

|

| Date: May 21, 2024 |

By: |

/s/ Norma Ka Yin Chu |

| |

Name: |

Norma Ka Yin Chu |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

3

Exhibit 99.1

DDC ENTERPRISE LIMITED REPORTS ON NYSE AMERICAN

NONCOMPLIANCE NOTICE

NEW YORK, NEW YORK, MAY 21, 2024 — DDC

ENTERPRISE LIMITED (NYSE AMERICAN: DDC) (“DAYDAYCOOK” OR THE “COMPANY”) announced today that on May 16,

2024, the Company received a written notice from NYSE Regulation (the “NYSE Notice”) stating that the Company is not

in compliance with the continued listing standards of the NYSE American LLC (“NYSE American”, or the “Exchange”)

under the timely filing criteria included in Section 1007 of the NYSE American Company Guide (the “Company Guide”)

because the Company failed to timely file with the Securities and Exchange Commission (the “SEC”) its Annual Report

on Form 20-F for the fiscal year ended December 31, 2023 (the “2023 Form 20-F”), which was due on May 15, 2024 (the

“Filing Delinquency”).

In accordance with Section 1007 of the Company

Guide, the Company will have six months from the date of the Filing Delinquency (the “Initial Cure Period”), to file

the 2023 Form 20-F with the SEC. The Exchange will monitor the Company and the status of the 2023 Form 20-F and any subsequent delayed

filings, including through contact with the Company, until the Filing Delinquency is cured. If the Company fails to file the 2023 Form

20-F during the Initial Cure Period, the Exchange may, in its sole discretion, grant an up to six-month additional cure period (the “Additional

Cure Period”). The Company can regain compliance with the Exchange’s continued listing standards at any time during the

Initial Cure Period or Additional Cure Period, as applicable, by filing the 2023 Form 20-F and any subsequent delayed filings with the

SEC. If the Exchange determines that an Additional Cure Period is not appropriate, suspension and delisting procedures will commence in

accordance with the procedures set out in Section 1010 of the Company Guide. If the Exchange determines that an Additional Cure Period

is appropriate and the Company fails to file the 2023 Form 20-F and any subsequent delayed filings by the end of that period, suspension

and delisting procedures will generally commence.

Notwithstanding the foregoing, however, the Exchange

may, in its sole discretion, decide (i) not to afford the Company any Initial Cure Period or Additional Cure Period, as the case may be,

at all or (ii) at any time during the Initial Cure Period or Additional Cure Period, to truncate the Initial Cure Period or Additional

Cure Period, as the case may be, and immediately commence suspension and delisting procedures if the Company is subject to delisting pursuant

to any other provision of the Company Guide, including if the Exchange believes, in the its sole discretion, that continued listing and

trading of the Company’s securities on the Exchange is inadvisable or unwarranted in accordance with Sections 1001 through 1006

thereof.

As disclosed in the Form 12b-25 filed by the Company

with the SEC on April 30, 2024, the Company was unable, without unreasonable effort or expense, to file its 2023 Form 20-F as a result

of a delay experienced by the Company in completing its financial statements in the Annual Report. The Company was not able to file the

2023 Form 20-F within the fifteen-day extension period granted pursuant to Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

The Company is making all efforts to file the 2023 Form 20-F as soon as possible and in any event within the six-month Initial Cure Period.

However, there can be no assurance that the Company will ultimately regain compliance with all applicable Exchange listing standards.

In the interim, the Company’s Class A Ordinary

Shares will continue to be listed on the NYSE American while it attempts to regain compliance with the listing standards, subject to the

Company’s compliance with other continued listing requirements. The NYSE Notice does not affect the Company’s business operations

or its reporting obligations under the Securities and Exchange Commission regulations and rules.

About DayDayCook – A Leader in Food Innovation

Founded in 2012, DayDayCook

is a leading content-driven consumer brand offering easy and convenient ready-to-heat, ready-to-cook and ready-to-eat Asian food products.

The company focuses on innovative and healthy meal solutions with a fast-growing omnichannel sales network in China and the U.S., and

through a strong online presence globally. The Company builds brand recognition through culinary and lifestyle content across major social

media and e-commerce platforms.

Forward-Looking Statements

Certain statements in

this announcement are forward-looking statements, including, for example, statements about completing the acquisition, anticipated revenues,

growth and expansion. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s

current expectations and projections about future events that the Company believes may affect its financial condition, results of operations,

business strategy and financial needs. These forward-looking statements are also based on assumptions regarding the Company’s present

and future business strategies and the environment in which the Company will operate in the future. Investors can find many (but not all)

of these statements by the use of words such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “likely to” or

other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect

subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes

that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages

investors to review other factors that may affect its future results in the Company’s registration statement and other filings with

the SEC.

Contact:

Investors:

CORE IR

Matt Blazei

mattb@coreir.com

Media:

CORE PR

Kati Waldenburg

pr@coreir.com

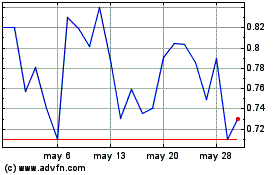

DDC Enterprise (AMEX:DDC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

DDC Enterprise (AMEX:DDC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024