Regulatory News:

Air Liquide (Paris:AI):

Key Figures (in millions of

euros)

Q1 2022

2022/2021 as published

2022/2021

comparable(a)

Group Revenue

6,887

+29.1%

+7.9%

of which Gas & Services

6,590

+29.1%

+7.1%

of which Engineering &

Construction

108

+42.4%

+40.3%

of which Global Markets &

Technologies

189

+22.0%

+18.3%

(a) Change excluding the currency, energy

(natural gas and electricity) and significant scope impacts, see

reconciliation in appendix.

Commenting on sales in the 1st quarter of 2022, Benoît Potier,

Chairman and CEO of the Air Liquide Group, said:

“There was strong growth in this first quarter, which reflects a

good level of activity and demonstrates the Group’s resilience in a

context marked, notably, by inflation and the war in Ukraine.

Group sales were up +8% on a comparable basis and

+29% based on published figures, notably reflecting the

sharp rise in energy prices contractually passed on to Large

Industries customers. Sales reached 6.9 billion euros,

including 6.6 billion for Gas & Services. This growth confirms

the strength of the Gas & Services businesses and the strong

momentum of the Engineering & Construction and Global Markets

& Technologies business lines.

Gas & Services, which represents over 95% of Group

sales, was up +7.1% on a comparable basis. This reflects

notably the strong growth of the Electronics business line

as well as Industrial Merchant which demonstrated, once

again, its ability to adapt prices to reflect rising costs. Despite

a high basis of comparison, the Healthcare business line

continued to grow. In terms of geographies, growth was particularly

strong in Europe and the Americas.

Regarding efficiencies, the Group continued to take

action to improve performance. In the 1st quarter of 2022, 77

million euros in efficiencies were generated in spite of a

highly inflationary context, and we confirm our target of over 400

million euros over the year. Cash flow remains high at more than

23% of sales excluding the energy effect.

Investment decisions over the quarter reached the very

high level of 913 million euros, with several Electronics

projects, particularly in Asia. The 12-month portfolio

of opportunities remains stable at 3.3 billion euros. The

proportion of projects linked to the energy transition exceeds

40%.

These investments will foster future growth. They will also

contribute to ADVANCE, Air Liquide’s new strategic plan for

2025. This plan, which combines financial and extra-financial

performance, is structured around four priorities: delivering

strong financial performance, decarbonizing industry, promoting

progress through technological innovation and acting for all. With

ADVANCE, the Group reaffirms its commitment to sustainable

development while continuing its growth trajectory.

In 2022, assuming no significant economic disruption, Air

Liquide is confident in its ability to further increase its

operating margin and to deliver recurring net profit growth at

constant exchange rates.(1)”

Highlights of the 1st quarter

- Corporate:

- Launch of ADVANCE, the new Air

Liquide strategic plan for 2025, which places sustainable

development at the heart of the Group’s strategy and combines

financial and extra-financial performance around four

priorities:

- Delivering strong financial

performance

- A continued sales growth of 5

to 6% on average per year(2).

- A Return On Capital Employed

(ROCE) of more than >10% starting from 2023.

- At the same time, a reduction of our

CO2 emissions in absolute terms starting around 2025, in line

with the Group’s Sustainable Development Objectives.

- Decarbonizing the industry, in

line with the Group’s objective to reduce its CO2 emissions by a

third between 2020 and 2035, and to be carbon neutral by 2050.

- Promoting progress through

technological innovation by focusing on new markets, in

particular hydrogen mobility, electronics, healthcare, industrial

merchant and high technologies.

- Acting for all by including the

perspective of the Group’s direct stakeholders (employees,

shareholders, suppliers, customers), as well as those of

society at large.

- Mobilization of the Group to support

victims of the war in Ukraine, notably through the Air Liquide

Foundation.

- Sustainable Development:

- Publication of Air Liquide’s first

Sustainable Development Report, which set out the Group’s

ambitions for Sustainable Development and its 2021 extra-financial

results.

- Attribution of “A-” rating by the CDP

in both categories of climate change and water management. This

rating recognizes the “Leadership Level” of the Group’s

commitment to the environment.

- In the United States, construction of Air

Liquide’s largest biomethane production plant in the

world.

- Decarbonizing the industry:

- Memorandum of Understanding signed

with Eni to decarbonize hard-to-abate industries in the

Mediterranean Basin.

- Selection of the Air Liquide and

EQIOM project by the European Innovation Fund with the

aim to transform the EQIOM plant in Lumbres, France, into one of

the first carbon-neutral cement plants in Europe.

- Selection by the European Innovation

Fund of the Kairos@C project, jointly developed by Air

Liquide and BASF, with the objective to develop the world's

largest cross-border carbon capture and storage (CCS) value

chain project around the port of Antwerp.

- Agreement signed with Sogestran to

develop shipping solutions for carbon management, as part of

carbon capture and storage projects.

- Low-carbon hydrogen:

- Support of the French government for

the Air Liquide Normand’Hy project to produce renewable

hydrogen on a large scale. This project will have an initial

capacity of 200 MW and will contribute to creating a French and

European low-carbon hydrogen industry, as well as to the

decarbonization of the Normandy industrial basin.

- Memorandum of Understanding signed

with Airbus, Incheon Airport and Korean Air to study the use

of hydrogen at Incheon International Airport.

- Electronics & Industry:

- Within the context of long-term

contracts with two world leaders in semiconductors for

the supply of ultra-high purity industrial gases in Japan,

Air Liquide has begun a staged investment of more than 300

million euros in four state-of-the-art production plants.

- Long-term agreements signed to supply

a semiconductor manufacturing site in Arizona, United States.

As part of this agreement, Air Liquide will invest nearly 60

million US dollars to build and operate onsite plants and

systems.

- Increased presence in India with

an investment of around 40 million euros in a new air separation

unit dedicated to Industrial Merchant activities, in the state

of Uttar Pradesh in northern India.

Group revenue totaled 6,887 million euros in the

1st quarter of 2022, up a strong +7.9% on a comparable

basis. This performance was delivered in a challenging context

of exceptionally high energy prices, strong inflation, strain on

supply chains and the war in Ukraine. The Group benefited from a

solid business model and proactive actions to increase prices in

the Industrial Merchant business. Introduced in the 2nd half of

2021, the effectiveness of these increases started to be seen from

the 4th quarter of 2021, with stronger pricing in the 1st quarter

of 2022. The Group’s published revenue saw very strong

growth of +29.1% with an energy impact that reached +16.4%

and with favorable currency (+4.2%) and significant scope (+0.6%)

impacts.

Gas & Services revenue totaled 6,590 million

euros, up by + 7.1% on a comparable basis. Sales as

published for the 1st quarter of 2022 showed a strong growth of

+29.1%, with a very high energy impact at +17.2% and with

positive currency (+4.2%) and significant scope (+0.6%)

impacts.

- Gas & Services revenue in the Americas region

totaled 2,331 million euros in the 1st quarter of 2022,

showing a strong increase of +9.0% on a comparable basis.

Growth in Large Industries reached +8.3%, driven by the dynamic

demand, particularly in the Chemicals and Steel industries. Up

+10.0%, Industrial Merchant revenue benefited from the acceleration

of pricing (+9.3%) and the increase in volumes.

Proximity care in the United States and the Home Healthcare

business in Latin America drove growth in the Healthcare business

line (+3.5%) in a context of lower demand for medical oxygen to

treat covid-19. Finally, all business segments within Electronics

contributed to the particularly dynamic growth (+10.0%).

- Revenue in Europe increased by +7.2% in the 1st

quarter of 2022 on a comparable basis and totaled 2,718 million

euros in a context of exceptionally high energy prices and the

war in Ukraine. While Large Industries showed a -4.5%

decrease in sales, growth accelerated in Industrial Merchant to

reach an exceptionally high level of +22.7%, driven by record

pricing of +19.4%. Healthcare continued to grow (+3.0%) despite

a particularly high basis of comparison in 2021, benefiting from

dynamic development in Home Healthcare.

- Sales in Asia-Pacific were up +4.4% on a

comparable basis in the 1st quarter of 2022 and totaled 1,340

million euros, driven by particularly dynamic growth across all

the Electronics business segments (+13.1%). Large Industries sales

were down slightly by -1.1%, impacted by soft demand in China and

by low hydrogen sales in South Korea. Industrial Merchant revenue

grew by +2.7%, benefiting in particular from solid growth in

China.

- Revenue in the Middle-East and Africa totaled 201

million euros, which was stable (-0.2%) on a comparable

basis and compared to the 1st quarter of 2021. Volumes increased

strongly in South Africa with the integration of the 16 Sasol

air separation units whose acquisition was finalized at the end

of the 1st half of 2021: sales of approximatively 35 million

euros in the 1st quarter were recognized as part of the

significant scope impact (and hence excluded from comparable

growth).

Large Industries sales were stable (+0.1%) on a

comparable basis compared to the 1st quarter of 2021, with mixed

activity depending on the region. In the Americas, demand was

robust across all markets, while in Europe and Asia, sales were

lower in the Steel and Refining industries. Demand in the Chemicals

industry remained solid globally. Industrial Merchant

business posted strong comparable growth of +11.9%, driven

by the acceleration of pricing which was up +10.7%,

even reaching +19.4% in Europe, and by solid volumes. Sales

comparable growth was particularly dynamic in Electronics,

at +13.7%, with all business segments showing strong growth.

Healthcare continued to grow (+2.6%) on a comparable

basis, supported by the momentum of Home Healthcare activity,

despite a particularly high basis of comparison in 2021 related to

the strong demand for medical oxygen to treat Covid-19.

Consolidated revenue from Engineering & Construction

totaled 108 million euros in the 1st quarter of 2022,

posting a strong growth of +40.3% and reflecting the

increase in order intake in recent quarters. Order intake reached

264 million euros.

The sales of Global Markets & Technologies totaled

189 million euros in the 1st quarter, up a strong

+18.3%, driven by the dynamic biogas activity and the

increase of sales for the hydrogen mobility. Order intake for Group

projects and third-party customers reached 214 million

euros, up compared to 2021.

Efficiencies(3) reached 77 million euros in the

1st quarter. This performance was delivered in a context of high

inflation unfavorable to procurement efficiencies. The projects

initiated at the beginning of 2022 are expected to increase their

contribution over the coming quarters, hence confirming the annual

objective set at more than 400 million euros. In this inflationary

environment, the priority of operations was the passthrough of

costs into pricing.

Cash flow from operating activities before changes in working

capital totaled 1,400 million euros, a strong increase

of +12.6% and +8.7% excluding the currency impact. It stood

at 23.3% of sales excluding the energy impact, stable

compared to the 1st quarter of 2021. It allowed, in particular, the

financing of industrial investments, which amounted to 784 million

euros, representing 13.0% of sales excluding the energy impact.

In the 1st quarter of 2022, industrial and financial

investment decisions reached the very high level of 913

million euros, compared to 603 million euros in the 1st

quarter of 2021. They included several carrier gases supply

projects in Asia but also in the United States and in Europe for

Electronics customers. The 12-month portfolio of investment

opportunities is stable at the high level of 3.3 billion

euros at the end of March. Projects related to the energy

transition account for more than 40% of the portfolio.

The additional contribution to revenue of unit start-ups

and ramp-ups amounted to 105 million euros in the 1st

quarter of 2022 and is expected to be between 410 and 435

million euros in 2022, higher than in 2021.

Analysis of 1st quarter 2022 revenue

Unless otherwise stated, all variations in revenue outlined

below are on a comparable basis, excluding currency, energy

(natural gas and electricity) and significant scope impacts.

REVENUE

Revenue (in millions of euros)

Q1 2021

Q1 2022

2022/2021 published

change

2022/2021 comparable

change

Gas & Services

5,103

6,590

+29.1%

+7.1%

Engineering & Construction

76

108

+42.4%

+40.3%

Global Markets & Technologies

155

189

+22.0%

+18.3%

TOTAL REVENUE

5,334

6,887

+29.1%

+7.9%

Group

Group revenue totaled 6,887 million euros in the

1st quarter of 2022, up a strong +7.9% on a comparable

basis. This performance was delivered in a challenging context

of exceptionally high energy prices, strong inflation, strain on

supply chains and the war in Ukraine. The Group benefited from a

solid business model and proactive actions to increase prices in

the Industrial Merchant business. Introduced in the 2nd half of

2021, the effectiveness of these increases started to be seen from

the 4th quarter of 2021, with stronger pricing in the 1st quarter

of 2022.

Engineering & Construction posted a strong growth of

+40.3%, which reflects the increase in order intake in

recent quarters. Global Markets & Technologies business

was up +18.3%, driven by strong momentum in biogas and sales

for hydrogen mobility. The Group’s published revenue saw

very strong growth of +29.1% with an energy impact that

reached +16.4% and with favorable currency (+4.2%) and significant

scope (+0.6%) impacts.

Gas & Services

Gas & Services revenue totaled 6,590 million

euros, up by +7.1% on a comparable basis. Large

Industries sales were stable (+0.1%) compared to the 1st

quarter of 2021, with mixed activity depending on the region. In

the Americas, demand was robust across all markets, while in Europe

and Asia, sales were lower in the Steel and Refining industries.

Demand in the Chemicals industry remained solid globally.

Industrial Merchant business posted strong growth of

+11.9%, driven by the acceleration of pricing which

was up +10.7%, even reaching +19.4% in Europe, and by solid

volumes. Sales growth was particularly dynamic in

Electronics, at +13.7%, with all business segments

showing strong growth. Healthcare continued to grow

(+2.6%), supported by the momentum of Home Healthcare

activity, despite a particularly high basis of comparison related

to the strong demand for medical oxygen to treat Covid-19 in 2021.

Sales as published for the 1st quarter of 2022 showed a

strong growth of +29.1%, with a very high energy impact at

+17.2% and with positive currency (+4.2%) and significant scope

(+0.6%) impacts.

Revenue by geography and business

line (in millions of euros)

Q1 2021

Q1 2022

2022/2021 published

change

2022/2021 comparable

change

Americas

2,003

2,331

+16.4%

+9.0%

Europe

1,797

2,718

+51.3%

+7.2%

Asia-Pacific

1,150

1,340

+16.5%

+4.4%

Middle East & Africa

153

201

+31.2%

-0.2%

GAS & SERVICES REVENUE

5,103

6,590

+29.1%

+7.1%

Large Industries

1,445

2,413

+67.0%

+0.1%

Industrial Merchant

2,253

2,638

+17.1%

+11.9%

Healthcare

914

955

+4.4%

+2.6%

Electronics

491

584

+19.0%

+13.7%

Americas

Gas & Services revenue in the Americas region totaled

2,331 million euros in the 1st quarter of 2022, showing a

strong increase of +9.0%. Growth in Large Industries reached

+8.3%, driven by the dynamic demand, particularly in the Chemicals

and Steel industries. Up +10.0%, Industrial Merchant revenue

benefited from the acceleration of pricing (+9.3%) and increase in

volumes. Proximity care in the United States and the Home

Healthcare business in Latin America drove growth in the Healthcare

business line (+3.5%) in a context of lower demand for medical

oxygen to treat covid-19. Finally, all business segments within

Electronics contributed to the particularly dynamic growth

(+10.0%).

Americas Gas & Services Q1 2022 Revenue

- Large Industries revenue posted a strong increase of

+8.3%. This growth reflects a good level of momentum in

demand, independently from a favorable basis of comparison in the

United States, as business was affected by a winter storm on the

Gulf Coast in February 2021. Air gases volumes were up, driven by a

high demand in the Chemicals and Steel industries. Hydrogen sales

increased in spite of several maintenance turnarounds at

refineries. The ramp-up of plants in the United States and Latin

America also contributed to this growth.

- In the Industrial Merchant business, the sharp increase

in sales of +10.0% was driven by the acceleration of the

pricing, which stands at +9.3%, as well as by the

robust growth in volumes. Indeed, the increase in volumes of bulk,

cylinders and hardgoods, was partially masked by a decrease in

helium volumes. In the United States, growth was strong in almost

all markets, particularly in Fabrication and the Energy and

Materials sectors.

- Healthcare continued to grow (+3.5%) in the 1st

quarter of 2022, despite a high basis of comparison in 2021 due to

the strong demand for medical oxygen to treat Covid-19. Sales in

Medical Gases rose sharply in the United States, supported by

strong momentum in proximity care and an acceleration of pricing.

In Latin America, sales growth in Home Healthcare offset soft

activity in Medical Gases compared to strong demand related to

covid-19 in the 1st quarter of 2021.

- Electronics posted a very strong growth of

+10.0%, supported by the momentum across all business

segments. Carrier Gases benefited in particular from the ramp-up of

several production plants and their resulting contribution.

Americas

- Air Liquide announces a long term agreement to supply

ultra high purity hydrogen, helium, and carbon dioxide to one of

the world’s largest semiconductor manufacturers. The Group plans to

invest approximately 50 million euros to build, own and

operate plants and production systems at a new manufacturing site

in Phoenix, Arizona, in support of this new agreement. Operations

and supply are expected to start in the second half of

2022.

Europe

Revenue in Europe increased by +7.2% in the 1st quarter

of 2022 and totaled 2,718 million euros in a context of

exceptionally high energy prices and the war in Ukraine.

While Large Industries showed a -4.5% decrease in sales, growth

accelerated in Industrial Merchant to reach an exceptionally high

level of +22.7%, driven by record pricing of +19.4%. Healthcare

continued to grow (+3.0%) despite a particularly high basis of

comparison in 2021, benefiting from dynamic development in Home

Healthcare.

Europe Gas & Services Q1 2022

Revenue

- Large Industries revenue declined by -4.5%. Sales

were soft in Refining. In the Chemicals sector, demand for air

gases remained stable while hydrogen sales were lower, impacted by

customer maintenance turnarounds. Air gases volumes for the Steel

Industry were lower in March, with some customers encountering

difficulties with the supply of raw materials.

- Industrial Merchant business line saw an exceptionally

high level of growth of +22.7%, driven by record high

pricing of +19.4%. Progression in volumes was also

very solid, despite softening bulk volumes during the quarter.

Sales increased across all markets, particularly in the Food,

Fabrication and Energy sectors.

- Healthcare continued to grow (+3.0%) despite a

particularly high basis of comparison in 2021. Oxygen and medical

equipment sales were down compared to the record-high demand that

was seen for the treatment of covid-19 in the 1st quarter of 2021.

However, growth was steady in the Home Healthcare business,

particularly for the treatment of diabetes. The business line also

benefited from the contribution of an acquisition in Poland that

was made in the 4th quarter of 2021. Finally, progression in the

sales of Specialty Ingredients continued to be very solid.

Europe

- Air Liquide receives support from the

French State*, in the requested amount of 190 million euros,

for its Air Liquide Normand’Hy large scale renewable

hydrogen production project. This electrolyzer with an

initial 200 MW capacity, which should notably provide

renewable hydrogen to TotalEnergies’ Normandy refinery, will use

Siemens Energy proton exchange membrane technology. This project,

for which the start-up is planned for in 2025, will significantly

contribute to the creation of a French and European low-carbon

hydrogen sector and to the decarbonization of the Normandy

industrial basin.

- Air Liquide continues its development

along the carbon value chain:

- Upstream, Air Liquide and EQIOM are joining forces with

the aim to transform EQIOM’s Lumbres plant into one of the first

carbon-neutral cement plants in Europe, by using innovative

technologies. Air Liquide will supply oxygen for the EQIOM

production process and leverage its proprietary technology

CryocapTM Oxy to capture and then liquefy CO2 emissions. The

project aims to capture around 8 million tons of CO2 over the

first ten years of operation. The project has been awarded

150 million euros funding by the European Commission, an

important step toward its application.

- Midstream, to support its aggregator role and complete

its offer, Air Liquide and Sogestran have signed an

agreement to form a joint-venture. It will provide

large-scale liquid CO2 shipping and barging solutions to

sequestration sites in Europe.

- Air Liquide and Eni have entered into a collaboration

agreement aimed at assessing decarbonization solutions in the

Mediterranean region of Europe, focused on hard-to-abate

industrial sectors. Eni, leveraging on its experience in gas

fields exploitation and management, will identify the most suitable

permanent CO2 storage locations in the Mediterranean sea, essential

in the downstream part of the carbon management chain. Air

Liquide will develop competitive CO2 abatement solutions, supported

by its experience and its technology.

* subject to a final validation by the

European Commission

Asia-Pacific

Sales in Asia-Pacific were up +4.4% in the 1st quarter of

2022 and totaled 1,340 million euros, driven by particularly

dynamic growth across all the Electronics business segments

(+13.1%). Large Industries sales were down slightly by -1.1%,

impacted by soft demand in China and by low hydrogen sales in South

Korea. Industrial Merchant revenue grew by +2.7%, benefiting in

particular from solid growth in China.

Asia-Pacific Gas & Services Q1 2022

Revenue

- Large Industries sales were down slightly by

-1.1% in the 1st quarter. Activity was soft in China, in

particular due to residual Dual Energy Control measures. In

addition, in South Korea, hydrogen sales for the Chemicals industry

were low this quarter. These lower levels of activity are almost

completely offset by the increase in sales of oxygen for the Steel

Industry in Japan and of electricity in Singapore (produced by a

cogeneration unit).

- Industrial Merchant revenue was up by +2.7%.

Growth in China (+9%) was driven in particular by cylinder gas

sales and the contribution of small on-site start-ups. The

situation was contrasted in the rest of Asia, with sales down in

Japan but up in Singapore and Australia. Sales increased in major

business sectors, including Fabrication, Materials and Energy.

Pricing was up compared to the 4th quarter of 2021 and stood

at +3.1%, with a strong contribution from China.

- The Electronics business showed a particularly dynamic

growth of +13.1%. Growth reached +15% in Carrier Gases,

which benefited from the contribution of a start-up in China in the

1st quarter and the ramp-up of several production plants. The

increase in Advanced Materials sales was above +15%, with strong

growth in activities in Singapore, China and Japan. Revenue from

Specialty Materials and Services also posted double-digit growth,

while the increase in Equipment and Installation sales was more

modest, compared to a high level of sales in China in the 1st

quarter of 2021.

Asia-Pacific

- Two major semiconductor market leaders have awarded Air Liquide

long-term contracts for the supply of ultra-high

purity industrial gases in Japan. In this context, Air Liquide

has begun a staged investment of more than 300 million euros

in four state-of-the-art gas plants in key Electronics

basins to produce nitrogen and other high purity gases.

Middle East and Africa

Revenue in the Middle-East and Africa totaled 201 million

euros, which was stable (-0.2%) compared to the 1st

quarter of 2021. In Large Industries, revenue was down: oxygen

volumes for the Steel industry rose sharply in Egypt, but hydrogen

sales to customers in the Yanbu basin in Saudi Arabia were lower.

Volumes increased strongly in South Africa with the integration of

the 16 Sasol air separation units whose acquisition was

finalized at the end of the 1st half of 2021: sales of

approximatively 35 million euros in the 1st quarter were

recognized as part of the significant scope impact (and

hence excluded from comparable growth). Growth in the Industrial

Merchant business remained solid, driven by dynamic volumes and a

marked increase of pricing at +4.6%, offsetting the impact of two

small divestitures in the Middle-East. In Healthcare, revenue was

down due to lower Medical Gas volumes for the treatment of

covid-19. Sales in the Home Healthcare business grew in Saudi

Arabia, particularly in diabetes treatment.

Middle East and Africa

- Air Liquide will invest around 40

million euros in a new Air Separation Unit (ASU) in Kosi (Uttar

Pradesh), Northern India, to supply Industrial Merchant

customers and oxygen for the hospitals. This unit will have

a production capacity of 350 tonnes per day, with a maximum

of 300 tonnes of oxygen. Air Liquide India will build, own and

operate this ASU, which is planned to start operating by the end

of 2023 and which should be fully powered by renewable

electricity by 2030.

- Air Liquide announced the sale of its

Industrial Merchant business in the United Arab

Emirates and Bahrain. It is part of the Group’s

strategy to regularly review its asset portfolio and focus on

selected fast developing areas and activities and improve its

return on capital employed. Air Liquide is well-positioned to

further grow its already strong presence in the Gulf

Cooperation Council (GCC) region in Large Industries and

Healthcare businesses and pursue the many opportunities

emerging with clean Hydrogen and Energy

Transition.

Engineering & Construction

Consolidated revenue from Engineering & Construction totaled

108 million euros in the 1st quarter of 2022, posting a

strong growth of +40.3% and reflecting the increase in order

intake in recent quarters.

Order intake totaled 264 million euros, which was down

slightly compared to the high level recorded in the 1st quarter of

2021. Orders for the Group represented more than half of the total

and are mainly related to projects in Asia, including nitrogen

generators for the Electronics and air separation units for Large

Industries.

Global Markets & Technologies

The sales of Global Markets & Technologies totaled 189

million euros in the 1st quarter, up a strong +18.3%.

Biogas enjoyed strong momentum, benefiting from the ramp-up of new

production units in Europe and from the rise in sales prices

relating to the energy price increase and from equipment sales in

the United States. Revenue for hydrogen mobility was up

significantly, driven by the sale of hydrogen filling stations in

China, Japan and Korea.

Order intake for Group projects and third-party customers are

increasing and totaled 214 million euros, up compared to

2021. It notably includes sales of Turbo-Brayton LNG reliquefaction

units, biogas processing equipment, hydrogen refueling stations and

equipment for the Electronics industry.

Global Markets &

Technologies

- Air Liquide continues its development

of biomethane activities with the construction in the USA of its

largest biomethane production unit in the world. This will

bring the worldwide biomethane production capacity of the Group to

1.8 TWh with 21 units. The new production unit in the State

of Illinois will allow Air Liquide to keep providing low-carbon

solutions to its customers in the industrial and transportation

sectors and to accompany them in the reduction of their

emissions.

- Air Liquide, Airbus, Korean Air and

Incheon International Airport Corporation signed a Memorandum of

Understanding to explore the use of hydrogen at Incheon

International Airport. More globally, the collaboration will also

study the development of a Korean airport infrastructure to

support the deployment of hydrogen-powered commercial

aircrafts. This partnership reflects a shared ambition to drive

the emergence of an innovative aviation sector dedicated to

supporting the Korean government's goal of carbon neutrality by

2050. In the Incheon airport, the Group has already invested in two

high capacity hydrogen refueling stations. Since August 2021, they

have been supplying demonstration trucks as well as hydrogen buses

and cars under a long-term contract.

Operating Performance

Efficiencies(4) reached 77 million euros in the

1st quarter, representing a saving of 2.0% of the cost base. This

performance was delivered in a context of high inflation

unfavorable to procurement efficiencies. The projects initiated at

the beginning of 2022 are expected to increase their contribution

over the coming quarters, hence confirming the annual objective set

at more than 400 million euros. In this inflationary environment,

the priority of operations was to transfer cost increases into

pricing.

Industrial efficiencies contributed more than 50% and

included energy efficiency projects in Large Industries and supply

chain optimization projects in Industrial Merchant. The Group's

digital transformation continued: in Large Industries with

the connection of new units to remote operation centers (Smart

Innovative Operations, SIO), in Industrial Merchant with the

acceleration of tools implementation to optimize delivery routes

(Integrated Bulk Operations, IBO) and in Healthcare with the

deployment of remote patient monitoring platforms. The

implementation of shared services centers and the pursuit of

the global continuous improvement program also contributed

to efficiencies.

Cash flow from operating activities before changes in working

capital totaled 1,400 million euros, a strong increase

of +12.6% and +8.7% excluding the currency impact. It

stood at 23.3% of sales excluding the energy impact, stable

compared to the 1st quarter of 2021. It allowed, in particular, the

financing of industrial investments, which amounted to 784 million

euros, representing 13.0% of sales excluding the energy impact.

Investment cycle

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

In the 1st quarter of 2022, industrial and financial

investment decisions reached the very high level of 913

million euros, compared to 603 million euros in the 1st

quarter of 2021.

The industrial investment decisions for the 1st quarter

of 2022 amounted to 880 million euros. Within the

Electronics business line, several carrier gases supply

projects in Asia but also in the United States and in Europe were

decided in the 1st quarter. Investment decisions in Large

Industries included the installation of an air separation unit

in Egypt, which will be connected to existing units with the

creation of a new local pipeline network. In Industrial

Merchant, the investment in a new liquid production capacity

has been decided in the United States.

Financial investment decisions amounted to 33 million

euros in the 1st quarter of 2022 and included several

acquisitions in Industrial Merchant in China.

The investment backlog reached the high level of 3.4

billion euros. Large Industries and Electronics projects

account for the vast majority of the investment backlog. These

investments’ future contribution to annual revenue has also grown,

amounting to approximately 1.2 billion euros per year after

full ramp-up of the units.

START-UPS

Several major units started up during the 1st

quarter of 2022. These include Advanced Materials and Carrier Gases

production plants for Electronics in Asia.

The additional contribution to revenue of unit start-ups

and ramp-ups amounted to 105 million euros in the 1st

quarter of 2022, including sales of 35 million euros from the Sasol

units in South Africa recognized as part of the significant scope

effect (and thus excluded from comparable growth).

In 2022, the additional contribution to revenue of unit

start-ups and ramp-ups is expected to be between 410 and 435

million euros, higher than in 2021. This includes the

contribution of the 16 Sasol units acquired in late June 2021,

which stands at approximately 135 million euros, and recognized as

part of the significant scope effect.

INVESTMENT OPPORTUNITIES

The 12-month portfolio of investment opportunities is

stable at the high level of 3.3 billion euros at the end of

March.

Projects related to the energy transition account for

more than 40% of the portfolio. These include projects for

renewable hydrogen production by electrolysis, facilities for the

capture of carbon dioxide emitted by the Group’s and its customers’

units, as well as hydrogen mobility projects in Europe and Asia.

New Carrier Gases plants have been added to the portfolio for the

Electronics business line, compensating for the projects

decided in the 1st quarter, which therefore left the portfolio.

Europe and Asia represent about 75% of this portfolio.

Europe remains the portfolio of opportunities’ leading

region with numerous energy transition projects. It is

followed by Asia, due to many Electronics projects,

and then by Americas with opportunities in Large

Industries and Electronics.

Outlook

There was strong growth in this 1st quarter, which reflects a

good level of activity and demonstrates the Group’s resilience in a

context marked, notably, by inflation and the war in Ukraine.

Group sales were up +8% on a comparable basis and

+29% based on published figures, notably reflecting the

sharp rise in energy prices contractually passed on to Large

Industries customers. Sales reached 6.9 billion euros,

including 6.6 billion for Gas & Services. This growth confirms

the strength of the Gas & Services businesses and the strong

momentum of the Engineering & Construction and Global Markets

& Technologies business lines.

Gas & Services, which represents over 95% of Group

sales, was up +7.1% on a comparable basis. This reflects

notably the strong growth of the Electronics business line

as well as Industrial Merchant which demonstrated, once

again, its ability to adapt prices to reflect rising costs. Despite

a high basis of comparison, the Healthcare business line

continued to grow. In terms of geographies, growth was particularly

strong in Europe and the Americas.

Regarding efficiencies, the Group continued to take

action to improve performance. In the 1st quarter of 2022, 77

million euros in efficiencies were generated in spite of a highly

inflationary context, and we confirm our target of over 400 million

euros over the year. Cash flow remains high at more than 23% of

sales excluding the energy effect.

Investment decisions over the quarter reached the very

high level of 913 million euros, with several Electronics

projects, particularly in Asia. The 12-month portfolio

of opportunities remains stable at 3.3 billion euros. The

proportion of projects linked to the energy transition exceeds

40%.

These investments will foster future growth. They will also

contribute to ADVANCE, Air Liquide’s new strategic plan for

2025. This plan, which combines financial and extra-financial

performance, is structured around four priorities: delivering

strong financial performance, decarbonizing industry, promoting

progress through technological innovation and acting for all. With

ADVANCE, the Group reaffirms its commitment to sustainable

development while continuing its growth trajectory.

In 2022, assuming no significant economic disruption, Air

Liquide is confident in its ability to further increase its

operating margin and to deliver recurring net profit growth at

constant exchange rates(5).

Appendices - Performance indicators

Performance indicators used by the Group that are not directly

defined in the financial statements have been prepared in

accordance with the AMF position 2015-12 about alternative

performance measures.

The performance indicators are the following:

- Comparable sales change

- Currency, energy and significant scope impacts

- Efficiencies

Definition of Currency, energy and significant scope

impacts

Since industrial and medical gases are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the eurozone. The

currency impact is calculated based on the aggregates for the

period converted at the exchange rate for the previous period.

In addition, the Group passes on variations in the cost of

energy (electricity and natural gas) to its customers via indexed

invoicing integrated into their medium and long-term contracts.

This indexing can lead to significant variations in sales (mainly

in the Large Industries Business Line) from one period to another

depending on fluctuations in prices on the energy market.

An energy impact is calculated based on the sales of each

of the main subsidiaries in Large Industries. Their consolidation

allows the determination of the energy impact for the Group as a

whole. The foreign exchange rate used is the average annual

exchange rate for the year N-1. Thus, at the subsidiary level, the

following formula provides the energy impact, calculated for

natural gas and electricity respectively:

Energy impact = Share of sales indexed to energy year (N-1) x

(Average energy price in year (N) - Average energy price in year

(N-1))

This indexation effect of electricity and natural gas does not

impact the operating income recurring.

The significant scope impact corresponds to the impact on

sales of all acquisitions or disposals of a significant size for

the Group. These changes in scope of consolidation are

determined:

- for acquisitions during the period, by deducting from the

aggregates for the period the contribution of the acquisition,

- for acquisitions during the previous period, by deducting from

the aggregates for the period the contribution of the acquisition

between January 1 of the current period and the anniversary date of

the acquisition,

- for disposals during the period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity as of the anniversary date of the disposal,

- for disposals during the previous period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity.

Comparable sales change

Comparable changes for sales exclude the currency, energy and

significant scope impacts described above. For the 1st quarter

2022, the calculations are the following:

(in millions of euros)

Q1 2022

Q1 2022/2021 Published

Growth

Currency impact

Natural gas impact

Electricity impact

Significant scope

impact

Q1 2022/2021 Comparable

Growth

Revenue

Group

6,887

+29.1%

225

607

267

35

+7.9%

Impacts in %

+4.2%

+11.4%

+5.0%

+0.6%

Gas & Services

6,590

+29.1%

218

607

267

35

+7.1%

Impacts in %

+4.2%

+11.9%

+5.3%

+0.6%

Efficiencies

Efficiencies represent a sustainable cost reduction

resulting from an action plan on a specific project. Efficiencies

are identified and managed on a per project basis. Each project is

followed by a team composed in alignment with the nature of the

project (purchasing, operations, human resources...).

The slideshow that accompanies this release

is available as of 9:00 am (Paris time) at www.airliquide.com.

Throughout the year, follow Air Liquide on Twitter:

@AirLiquideGroup.

UPCOMING EVENTS

Annual General Meeting of Shareholders: May 4, 2022

Dividend Ex-coupon Date: May 16, 2022

Dividend Payout Date: May 18, 2022

2021 First Half Revenue and Results: July 28, 2022

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 75 countries with

approximately 66,400 employees and serves more than 3.8 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Taking action today while preparing the future is at the heart

of Air Liquide’s strategy. With ADVANCE, its strategic plan for

2025, Air Liquide is targeting a global performance, combining

financial and extra-financial dimensions. Positioned on new

markets, the Group benefits from major assets such as its business

model combining resilience and strength, its ability to innovate

and its technological expertise. The Group develops solutions

contributing to climate and the energy transition—particularly with

hydrogen—and takes action to progress in areas of healthcare,

digital and high technologies.

Air Liquide’s revenue amounted to more than 23 billion euros in

2021. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, CAC 40 ESG, EURO STOXX

50 and FTSE4Good indexes.

________________________ 1 Operating margin excluding energy

passthrough impact. Recurring net profit excluding exceptional and

significant transactions that have no impact on the operating

income recurring, and excluding the impact of any US tax reform in

2022. 2 Compound Annual Growth Rate (CAGR) of sales on a comparable

basis over the 2021-2025 period 3 See definition in Appendix. 4 See

definition in Appendix. 5 Operating margin excluding energy

passthrough impact. Recurring net profit excluding exceptional and

significant transactions that have no impact on the operating

income recurring, and excluding the impact of any US tax reform in

2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220426006088/en/

Investor Relations IRTeam@airliquide.com

Media Relations media@airliquide.com

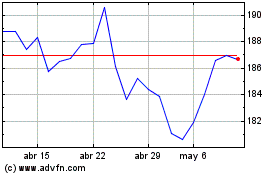

Air Liquide (EU:AI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Air Liquide (EU:AI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024