TIDMALL

RNS Number : 9672W

Atlantic Lithium Limited

15 December 2023

15 December 2023

Successful Completion of A$8 million Equity Placing

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF,

"Atlantic Lithium" or the "Company"), the African-focused lithium

exploration and development company targeting to deliver Ghana's

first lithium mine, is pleased to announce it has successfully

completed its institutional placement ("Equity Placing"), as

announced on 14 December 2023 ("Launch Announcement"), raising

A$8.0 million (equivalent to approximately GBP4.2 million) at a

price of A$0.44 (23.35 pence) per New Share ("Issue Price"). A

total of 18,181,819 new fully paid ordinary shares of no-par value

each in the Company will be issued ("New Shares").

Proceeds will enable the completion of the activities agreed

under the grant of the Mining Lease for the Project, key items of

early works and permitting-related Project expenditure, for further

extensional drilling to support the delivery of an upgraded Mineral

Resource Estimate for the Project in Q3 2024, and for working

capital purposes.

Canaccord Genuity (Australia) Limited ("Canaccord") is acting as

Lead Manager ("Lead Manager") to the Equity Placement. Wilsons

Advisory & Stockbroking is acting as Co-Manager

("Co-Manager").

Commenting, Neil Herbert, Executive Chairman of Atlantic

Lithium, said :

"Through the support of our existing institutional shareholder

base and in welcoming a number of new institutions onto our

register, we are pleased to have successfully raised A$8 million.

As we await the completion and the receipt of the funds from the

Minerals Income Investment Fund's investment, as well as the

completion of the off-take process that is currently underway, the

proceeds put the Company in a strong position to continue advancing

the Ewoyaa Lithium Project at pace.

"The Placing enables us to fund the numerous activities that are

underway or imminent that seek to add further value to the Project,

aligning with the growth ambitions of the Company.

"With a number of key milestones ahead of us, we look forward to

providing further updates on our progress in due course."

Allotment and Admission

Application will be made to the London Stock Exchange and the

Australian Securities Exchange for admission of the 18,181,819 New

Shares to trading on AIM and ASX, expected to take place at 8:00

a.m. on 22 December 2023 on AIM and 10:00 a.m. on 22 December 2023

Sydney time on ASX.

Total Voting Rights

Following Admission, there will be 630,423,479 Ordinary Shares

in issue carrying voting rights admitted to trading (on AIM and

ASX). This figure 630,423,479 may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the market abuse regulation (EU) no. 596/2014 as it forms part of

UK domestic law pursuant to the European Union (withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

For any further information, please contact:

Atlantic Lithium Limited

Neil Herbert (Executive Chairman)

Amanda Harsas (Finance Director and Company Secretary)

www.atlanticlithium.com.au

IR@atlanticlithium.com.au

Tel: +61 2 8072 0640

SP Angel Corporate Finance Yellow Jersey PR Limited Canaccord Genuity Limited

LLP Charles Goodwin Financial Adviser:

Nominated Adviser Bessie Elliot Raj Khatri (UK) /

Jeff Keating atlantic@yellowjerseypr.com Duncan St John, Christian

Charlie Bouverat Tel: +44 (0)20 3004 Calabrese (Australia)

Tel: +44 (0)20 3470 9512 Corporate Broking:

0470 James Asensio, Harry

Rees

Tel: +44 (0) 20 7523

4500

============================== ============================= =============================

Notes to Editors:

About Atlantic Lithium

www.atlanticlithium.com.au

Atlantic Lithium is an AIM and ASX-listed lithium company

advancing a portfolio of lithium projects in Ghana and Côte

d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is

a significant lithium spodumene pegmatite discovery on track to

become Ghana's first lithium-producing mine.

The Definitive Feasibility Study for the Project indicates the

production of 3.6Mt of spodumene concentrate over a 12-year mine

life, making it one of the top 10 largest spodumene concentrate

mines in the world.

The Project, which was awarded a Mining Lease in October 2023,

is being developed under a funding agreement with Piedmont Lithium

Inc.

Atlantic Lithium holds 509km(2) and 774km(2) of tenure across

Ghana and Côte d'Ivoire respectively, comprising significantly

under-explored, highly prospective licences.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTABFTMTIBMAJ

(END) Dow Jones Newswires

December 15, 2023 02:00 ET (07:00 GMT)

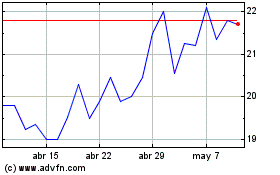

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025