Cambria Africa PLC Trading Update FY 2021 (0798D)

28 Febrero 2022 - 10:20AM

UK Regulatory

TIDMCMB

RNS Number : 0798D

Cambria Africa PLC

28 February 2022

Cambria Africa Plc

("Cambria" or the "Company")

Trading Update FY 2021

Unaudited EPS of 0.03 US cents and NAV of 1.16 US cents

Cambria Africa PLC ( AIM: CMB ) ("Cambria" or the "Company")

announces its unaudited FY 2021 accounts for the 12 months ended 31

August 2021. Audited results and annual report was delayed due to

the impact of the Omicron Virus on our resources and will become

available by end March 2021. A copy of this announcement is

available on the Company's website ( www.cambriaafrica.com ).

Cambria earned 0.03 US cents per share during FY 2021 compared

to a loss of 0.07 cents share in FY 2020. Despite the turnaround in

earnings, NAV declined by US $79,000 from 1.18 US cents to 1.16 US

cents per share. The decline despite the earnings contribution was

due to a market valuation drop of $200,000 for the Company's

business property from US $2.3 million to US $2.1 million

(valuation by Hollands conducted on the 27(th) of January 2022). As

at 28 February 2022, total cash on hand is $1.556(0.29 US cents)

million including $1.330 million in Cambria's accounts outside

Zimbabwe (85% of cash resources). Cash balances were down 6% from

the Fiscal Year end 2021 mainly related fees for maintaining the

listing. NAV is estimated to be at 1.15 cents per share as of 28

February 2022. The Company continues to rationalise its operations

by reducing staff costs and overheads - and maximizing the value to

shareholders from the remaining hard assets, intellectual property,

and cash.

Tradanet, a 51% owned subsidiary of Paynet Zimbabwe, which

processes microloans for CABS (Zimbabwe's largest building

society), is the Company's most profitable operation. The

turnaround is attributable to loan values and salaries catching up

with inflation.

Autopay - the Company's Payroll operation saw its revenues

decline as Paywell granted non-exclusive licenses to multiple

competitors including former employees. During the Fiscal Year

2021, the company reached a management agreement with Propay (Pvt)

Ltd and established former account executives as independent

contractors. This has resulted in significant cost containment and

aligning the incentives of Payroll executives with that of

Autopay.

Millchem's remaining business, the production of sanitisers and

disinfectants, traded marginally positive. The sector has been

characterised by significant competition and ease of entry by

multiple small players in the chemicals industry. With the lower

disposable income of the general population, high quality

sanitizers have lost market share. Our joint venture with Merken

(Pvt) Ltd. remains cash flow positive, but will likely wind down by

the end of this Fiscal Year if demand does not improve.

Officially, the value of the Zimbabwe dollar (ZWL) to the US

dollar fell by 2% since the prior trading year however these

figures belie the true depreciation in the market value and

purchasing power of the Zimbabwe dollar from FY ended 31 August

2020 to 31 August 2022. The fall in the purchasing power of the

local currency has continued in the six months since the end of the

Company's fiscal year. As elections near, uncertainty increases,

while economic policies remain fluid and unpredictable.

The strategic goals of the Company in FY 2021 have been, and

continue to be, as follows:

- Conserving of cash resources of US$1.65 million

- Achieving value for US $1.35 million held by the Reserve Bank

of Zimbabwe (RBZ) as "Legacy Debts" or "Blocked Funds". This asset

has been deprecated in our accounts to the official value until

such time as the RBZ honours this commitment.

- Achieving value for US $175,000 of Old Mutual shares at the

current JSE market value through repatriation of these shares to

the Johannesburg register where they were transferred from to the

Zimbabwe Stock Exchange (ZSE). This transfer was in reliance on

fungibility of dual listed shares. Fungibility of multi-listed

shares has been withdrawn by action of the Zimbabwe government and

acquiescence of Old Mutual plc. The shares continue to be suspended

on the ZSE

- Achieving and maximizing full international value for the

equivalent holding of $4.98 million in equivalent shares of Radar

Holdings plc at 35 US cents per share or US $1.743 million.

- Maximizing value for the Company's intellectual property both

in current and future operations.

We remain cautiously optimistic about achieving full value for

the Company's assets even beyond its NAV. At this point in time, we

feel it is still possible to increase shareholder wealth through

appreciation of the Company's share price to reflect at the very

least, its net equity, which is for all intents and purposes is

debt free. This should bring the market valuation as of 28 February

2022 of 0.3752 US cents per share closer to the Company's current

NAV of 1.15 US cents per share a three-fold difference.

Cambria remains poised to take advantage of a turnaround in the

economy through the stabilization of market-driven policies, which

may yet take hold in Zimbabwe. Until such time, we will pursue the

above mentioned strategies to maintain and improve shareholder

value.

Extension of Reporting Deadline

Due to the effect of COVID-19 pandemic, the Company will not be

able to post its annual audited report and accounts for the

financial year ended 31 August 2021 (the "Annual Report") to

shareholders by 28 February 2022. The Company has applied, pursuant

to the guidance provided in "Inside AIM" on 27 January 2021, for an

additional period to publish the Annual Report. The Company has

been granted the extension and therefore the Company will publish

the Annual Report by no later than 31 March 2022.

Contacts

Cambria Africa Plc www.cambriaafrica.com

Samir Shasha +44 (0)20 3287 8814

WH Ireland Limited https://www.whirelandplc.com/

James Joyce / Ben Good +44 (0) 20 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTTPMFTMTBTBPT

(END) Dow Jones Newswires

February 28, 2022 11:20 ET (16:20 GMT)

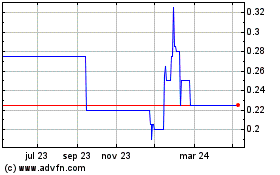

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025