Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

15 Agosto 2024 - 1:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 12b-25

NOTIFICATION OF LATE FILING

|

|

|

(Check one): |

|

[ ] Form 10-K [ ] Form 20-F [ ] Form 11-K [X] Form 10-Q [ ] Form 10-D [ ] Form N-SAR [ ] Form N-CSR |

|

|

|

|

For Period Ended: June 30, 2024 |

|

|

[ ] Transition Report on Form 10-K |

[ ] Transition Report on Form 20-F |

[ ] Transition Report on Form 11-K |

[ ] Transition Report on Form 10-Q |

[ ] Transition Report on Form N-SAR |

|

|

|

|

For the Transition Period Ended: |

|

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

Bitcoin Depot Inc.

(Full Name of Registrant)

3343 Peachtree Road NE, Suite 750

Atlanta, GA 30326

(Address of Principal Executive Offices)

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

|

|

|

|

|

|

|

|

|

|

[x] |

|

(a) |

|

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

|

(b) |

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

|

(c) |

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

Bitcoin Depot Inc. (the “Company”) is unable to file, without unreasonable effort or expense, its quarterly report on Form 10-Q for the period ending June 30, 2024 (the “Form 10-Q”). Additional time is needed for the Company to complete its financial closing process to produce a complete and accurate quarterly report. As a result of the foregoing, additional information is necessary to be provided to the Company's independent registered accounting firm in order to complete their review procedures over interim financial information. The Company anticipates it will file its Form 10-Q for the period ending June 30, 2024, on or before August 19, 2024.

Based on currently available information, in connection with filing its Form 10-Q, the Company expects to report that its disclosure controls and procedures were not effective for the period covered by the report due to the existence of material weaknesses in the effectiveness of its internal control over financial reporting that remain unremeditated as of June 30, 2024. The material weaknesses have not resulted in any material misstatements or omissions in previously reported financial statements and the Company does not expect such material weaknesses will impact the financial information to be reported in the Form 10-Q.

PART IV — OTHER INFORMATION

|

|

|

(1) |

|

Name and telephone number of person to contact in regard to this notification |

|

|

|

|

|

|

|

|

|

Mr. Brandon Mintz |

|

|

|

(678) |

|

|

|

435-9604 |

(Name) |

|

|

|

(Area Code) |

|

|

|

(Telephone Number) |

|

|

|

(2) |

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). ☒ Yes ☐ No |

|

|

|

(3) |

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☐ Yes ☒ No |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The following are certain preliminary unaudited results reported by the Company for the quarter ended June 30, 2024, in a press release issued on August 13, 2023, a copy of which was included as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated August 13, 2024; however, results may be subject to change after the completion of the audit:

•Revenue in the second quarter of 2024 was $163.1 million, down 17% from $197.5 million for the second quarter of 2023. Revenue in the second quarter of 2024 was up $24.5 million or 18% from the first quarter of 2024.

•Net income for the second quarter of 2024 was $4.4 million, compared to a net loss of $4.0 million for the second quarter of 2023. Net income in the second quarter of 2024 was up $8.6 million or 203% from a net loss of $4.2 million in the first quarter of 2024.

•Cash and cash equivalents were $43.9 million as of the end of the second quarter of 2024.

Cautionary Note Regarding Forward-Looking Statements

This notification on Form 12b-25 contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “our vision,” “plan,” “potential,” “preliminary,” “predict,” “should,” “will,” or “would” or the negative thereof or other variations thereof or comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. Risks and uncertainties that may cause these forward-looking statements to be inaccurate include, among others, finalization of the Company’s fourth and year end quarter financial statements and completion of standard quarter and year-end close processes. For a further list and description of such risks and uncertainties, please refer to the Company’s filings with the SEC that are available at www.sec.gov. The Company cautions you that the list of important factors included in the Company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this notification may not in fact occur. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

SIGNATURES

Bitcoin Depot Inc. has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Date: August 15, 2024 |

By: |

/s/ Brandon Mintz |

|

|

Brandon Mintz |

|

|

President and Chief Executive Officer |

GSR II Meteora Acquisition (NASDAQ:GSRMU)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

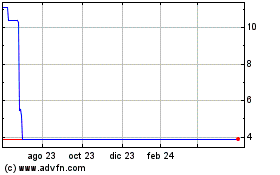

GSR II Meteora Acquisition (NASDAQ:GSRMU)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024