false

0000914156

0000914156

2024-08-26

2024-08-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

Current Report Pursuant to

Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): August 26, 2024

| UFP Technologies, Inc. |

| (Exact Name of Registrant as Specified in Charter) |

| Delaware |

| (State or Other Jurisdiction of Incorporation) |

| 001-12648 |

|

04-2314970 |

| (Commission File Number) |

|

(I.R.S. Employer Identification Number) |

| |

|

|

| 100 Hale Street, Newburyport, MA - USA |

|

01950-3504 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| 978-352-2200 |

| (Registrant’s telephone number, including area code) |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

UFPT |

The NASDAQ Stock Market L.L.C. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

UFP Technologies, Inc. (the “Company”)

has attached hereto as Exhibit 99.1 a copy of updated presentation materials concerning its business that it intends to use in connection

with meetings with investors and other interested parties and in connection with presentations and speeches to various audiences.

Limitation on Incorporation by Reference.

The information furnished in this Item 7.01, including the presentation attached hereto as Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements.

Except for historical information contained in the presentation attached as an exhibit hereto, the presentation contains forward-looking

statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied

by these statements. Please refer to the cautionary notes in the presentation regarding these forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| 99.1 |

|

Presentation |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 26, 2024 |

UFP TECHNOLOGIES, INC. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Ronald J. Lataille |

|

| |

|

Ronald J. Lataille, Chief Financial |

| |

|

Officer and Senior Vice President |

Exhibit 99.1

Welcome Investors March 2022 Welcome Investors August 2024

Forward Looking Statements 2 Certain statements in this presentation may be considered “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward - looking statements generally relate to future events or the Company’ s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “be lie ve,” “predict,” or similar words. These forward - looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements. These forward - looking statements include, among other things, statements regarding: the Company’s prospects, anticipated advantages the Company expects to rea liz e from its acquisition strategies, the Company’s financial performance, targets, goals, and metrics, the Company’s revenue, gross margin and operati ng margin targets, participation in multiple markets, its engineering and product development resources, the benefits of the Company’s product development busin ess (including its margin and customer relationship), the Company’s business opportunities and competitive advantages, the Company’s growth potential and s tra tegies for growth, and statements about customer and industry demand. Investors are cautioned that such forward - looking statements are not guarantees of future performance and involve risks and unce rtainties, including without limitation risks associated with the identification of suitable acquisition candidates and the successful, efficient executio n o f acquisition transactions and integration of any such acquisition candidates, economic conditions that affect sales of the products of the Company’s custom ers , adverse changes in general economic and geopolitical conditions, including, without limitation, global supply chain disruptions, labor cost increases an d i nflation, the ongoing conflict between Russia and Ukraine, other similar conflicts and civil unrest in Haiti, which is in proximity to our manufacturing facilities in the Dominican Republic, could have a material adverse effect on our business and results of operations, the ability of the Company to obtain new customers, the ability of the Company to fulfill its obligations on long - term contracts and to retain current customers, particularly our customer who accounted for more than 28% of our revenue for 2023, the ability of the Company to maintain and grow its current margins, the ability of the Company to achieve its revenue, gross mar gin and operating margin targets, the Company’s ability to adapt to changing market needs and other factors as well as other risks and uncertainties that are detai led in the documents filed by the Company with the Securities and Exchange Commission (“SEC”). Accordingly, actual results may differ materially. The risks and un certainties included above are not exhaustive. Readers are referred to the documents filed by the Company with the SEC, specifically the last reports on For ms 10 - K and 10 - Q. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to refle ct any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. Use of Non - GAAP Financial Measures This presentation includes non - generally accepted accounting principles (“GAAP”) performance measures. The Company uses these no n - GAAP financial measures to facilitate management's financial and operational decision - making, including evaluation of the Company’s historical operating results. The Company’s management believes these non - GAAP measures are useful in evaluating the Company’s operating performance and are similar measure s reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in ana lyzing operating performance and prospects. These non - GAAP financial measures reflect an additional way of viewing aspects of the Company's operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends af fecting the Company’s business. By providing these non - GAAP measures, the Company’s management intends to provide investors with a meaningful, consist ent comparison of the Company’s performance for the periods presented. These non - GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company's definition of these non - GAAP measures may differ from similarly titl ed measures of performance used by other companies in other industries or within the same industry .

Who We Are UFP Technologies is an innovative designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging, and other highly engineered custom products. 3 Ticker: UFPT Headquarters: Newburyport, MA Annual Revenue: ~$565 million ~4,000 Associates/ Temps Established: 1963 20 Manufacturing Facilities Key Stats: 5 Design R&D Centers Market Cap: ~$2.4 Billion 1 Share Count: ~7.7 million 1 1. As of 8/9/2024

We help our customers develop, improve, manufacture, or protect their products through: 4 Design & engineering capabilities Materials expertise Strategic locations Precision manufacturing Shaping Innovation

Our Process Innovative process from design and engineering to manufacturing and delivery 5

Product Development Business 6 We bring deep experience in flexible material - based device manufacturing, from components and packaging, to final device assembly High Margin Added Expertise Stronger Customer Relationships Long Term Manufacturing 1 2 3 4 BENEFITS

Primary Focus Areas 90% 10% • Automotive • Aerospace & Defense • Industrial / Other Single use and single patient, polymer based medical devices and sterile packaging. Custom engineered components and protective solutions incorporating highly specialized materials for: 7 * Proforma revenue as of August 9, 2024

MedTech 8 1. Fortune Business Insights - $518 billion as of 2023. 6.3% CAGR for a forecast period of 2024 - 2032. 2. Medical Design & Outsourcing 2023 MedTech Big 100. 3. Proforma revenue as of 8/21/2024 MedTech Revenue By Segment 3 $518 billion, 6.3% CAGR 1 Global Medical Device Market Customers include 25 of the top 30 largest medical device manufacturers in the world 2 Applications Expertise • Robotic Surgery Drapes • Orthopedic Sterile Packaging • Catheter & Guidewire Sterile Packaging • IV Port Cleaners • Surgical Site Preparation • Minimally Invasive Surgery Ports • Negative Pressure Wound Therapy • MedSurg Beds ZŽďŽƟĐ ^ƵƌŐĞƌLJ ^ƚĞƌŝůĞ�ĚƌĂƉĞƐ�ƉƌŽǀŝĚĞ�ƉƌŽƚĞĐƟŽŶ� ƚŽ�ƚŚĞ�ƌŽďŽƚ�ǁŚŝůĞ�ŵĂŝŶƚĂŝŶŶŐ� ƉƌĞĐŝƐĞ�ƌĂŶŐĞ�ŽĨ�ŵŽƟŽŶ /ŶƚĞƌǀĞŶƟŽŶĂů� Θ� ^ƵƌŐŝĐĂů �ĞǀŝĐĞƐ ͕ ƐƵď Ͳ ĂƐƐĞŵďůŝĞƐ ͕� ĐŽŵƉŽŶĞŶƚƐ� Θ� ƉĂĐŬĂŐŝŶŐ�ƵƐĞĚ� ĚƵƌŝŶŐ�ƐƵƌŐŝĐĂů�ƉƌŽĐĞĚƵƌĞƐ KƌƚŚŽƉĞĚŝĐƐ ^ƚĞƌŝůĞ ďĂƌƌŝĞƌ�ƉƌŽƚĞĐƟǀĞ� ƉĂĐŬĂŐŝŶŐ�ĨŽƌ�ŝŵƉůĂŶƚƐ dŚĞƌĂƉĞƵƟĐƐ WƌŽĚƵĐƚƐ�ĨŽƌ�ĨĂƐƚĞƌ� ƌĞĐŽǀĞƌLJ�Žƌ�ĂƐƐŝƐŝƟŶŐ�ŝŶ� ĂĐƟǀŝƟĞƐ�ŽĨ�ĚĂŝůLJ�ůŝǀŝŶŐ ^ƵƌĨĂĐĞƐ� Θ� ^ƵƉƉŽƌƚ �ĞĚƐ ͕ ƉŽƐŝƟŽŶŝŶŐ�ĚĞǀŝĐĞƐ ͕�Θ� ƚĞŵƉĞƌĂƚƵƌĞ�ĐŽŶƚƌŽů�ƉĂĚƐ tŽƵŶĚ��ĂƌĞ� EĞŐĂƟǀĞ�WƌĞƐƐƵƌĞ�tŽƵŶĚ� �ĂƌĞ�ĐŽŵƉŽŶĞŶƚƐ�ƚŽ� ƉƌŽŵŽƚĞ�ĨĂƐƚĞƌ�ŚĞĂůŝŶŐ /ŶĨĞĐƟŽŶ�WƌĞǀĞŶƟŽŶ WƌŽĚƵĐƚƐ ƚŽ�ƉƌĞǀĞŶƚ�ĂŶĚ�ĐŽŶƚƌŽů� ŚŽƐƉŝƚĂů�ĂĐƋƵŝƌĞĚ�ŝŶĨĞĐƟŽŶƐ� ; ,�/ Ϳ

MedTech Portfolio Robotic Drapes Revascularization Device Needleless Injection Port Cleaner MedSurg Bed Negative Pressure Wound Therapy Compression Device 9

Advanced Components 10 INDUSTRIAL AUTOMOTIVE AEROSPACE & DEFENSE Highly engineered components and packaging used in targeted large and growing niches Our products are present on many of the world’s leading brands including GM, Ford, Mercedes, Tesla, Boeing and Lockheed Martin UFP Differentiation Precision molding Innovative design engineering Material expertise Complex laminated composites Dedicated in house tooling & equipment manufacturing AS9100 certified Strategic manufacturing locations 1 2 3 4 5 6 7

Advanced Components Portfolio Military Gear Protective Helmets Law Enforcement Military Protective Case Systems Automotive Interior Trim 11

Growth Strategy 12 Internal Growth: Market To Our Sweet Spot Strategic Acquisitions TWO - PRONGED

13 Organic Growth Opportunity Focus on high growth niche segments (MedTech – approximately 90% of revenue and growing) » Single - use, single - patient » Customer funded development Market to our sweet spot and differentiated capabilities » Leverage technology differentiation » Engineering resources » Exclusive access to specialty materials » Scale (footprint, clean room manufacturing) Expand business with existing customers » Offer complementary products and services » Additional value - add services

14 Acquisition Growth Opportunity Continue to Focus on Higher - Growth, Higher - Margin MedTech Opportunities that Create Value » Become more valuable to our customers » Strategic focus – new capability, geography, growing market segment, materials » Add scale » Look for synergistic opportunities » Cultural fit Goal is for acquisitions to be accretive within the first year. Experienced and disciplined management team with 19 acquisitions completed

Business Profile • Location: o Dover, NH • Associates: 83 Products & Services • Micro thermoforming of thin gauge specialty films • EMI shielding and insulations for implantable devices • High temperature films (+500) • Low temperature films ( - 400) Technologies • Thermoforming (small parts) • Heat Sealing • Clean Room Assembly • Tooling Development • Ability to Automate Key Markets Served • Medical o Pacemaker o Cardiac Defibrillator o Cardiac Monitor o Neuromodulator • Advanced Material Products Key Materials • Films • Textiles Thin Film Molding for Implantable Medical Devices

Business Profile • Locations: o St. Charles, Illinois o Santiago, Dom Rep • Associates: 700 Key Market Served • Safe patient handling • Patient transfer • Patient Comfort Key Materials • Engineered textiles o 2 directional Products & Services • Single patient medical solutions • Low - cost manufacturing • Specialty fabrics expertise in converting and assembly Technologies • Complex cut and sew work cells • Final packaging, kitting, and distribution Single use safe patient handling systems

Business Profile • Location: o Tallahassee, FL • Associates: 25 Key Markets Served • Stick to skin applications • Biocompatible tapes and adhesives • RAS drapes Key Materials • Medical grade tapes • Positioning labels • Specialty adhesives 3M Healthcare adhesive converter with high - speed die - cutting and converting expertise Products & Services • Multi - layered laminates with specialty adhesives • High speed die - cutting • Product assembly • Custom packaging Technologies • Rotary die cutting • Flexographic printing • Controlled environment mfg.

Business Profile • Locations: o Navan, Ireland o Singapore • Associates: 50 Key Markets Served • Orthopedics • Wound care • Infection Prevention Key Materials • Medical foams • High performance films Products & Services • Sterile packaging components • Die cut medical parts • Cleanroom assembly Technologies • Rotary die cutting • RF welding • Cleanroom fabrication Foam & flexible thermoplastic polyurethane (TPU) solutions for use in a wide range of medical devices.

Locations 19 1.3 Million SF Manufacturing Space 39 Cleanrooms & CERs New Locations: + Dover, NH + St. Charles, IL + Tallahassee, FL + Santiago, DO + Navan, IE + Singapore

Why Invest? 20 Significant market growth opportunities Barriers to entry Strong customer relationships Experienced management team Proven growth strategy Attractive financial metrics

21 Significant Market Growth Opportunities Market Focused On » Better Patient Outcomes » Infection Prevention » Reducing Healthcare Costs Focused on fast growing segments Global Footprint » Bringing New Opportunities

Barriers To Entry » Advanced systems (extensive quality certifications) » In addition to existing equipment, engineers will design product specific innovations in order to meet customer needs Systems » In - house custom equipment manufacturing capabilities Custom Equipment » Numerous patents relating to foam, packaging, tool control, radio frequency welding, automotive super - forming processes, and other products » Significant manufacturing knowhow Intellectual Property » Global footprint – competition is generally smaller companies that have limited resources and access to materials Scale » Veteran engineering team for product design and development; more than 100 members of the engineering group Engineering Resources » Exclusive access to several specialty medical grade materials » Offers broad array of materials to meet customer needs » Over 60 years in business and strong supplier relationships/partnerships Greater Access to Materials 22

Management Team 23 Chris Litterio SVP, Human Resources & General Counsel Former Managing Partner and head of employment law at a major Boston law firm; 7 - years at the company Steve Cardin VP & COO, MedTech 28 years in the medical device industry; 5 - years at the company Jason Holt CCO Former VP & GM at ITW; 6 - years at the company R. Jeffrey Bailly Chairman & CEO 36 - year history at the company Ronald Lataille CFO, Sr. VP & Treasurer 27 - year history at the company Mitchell Rock President 30 - year history at the company.

Proven Growth Strategy 24 Creating Shareholder Value

Financial Targets 25

Financial Targets 26 3 to 5 Year Financial Targets 12 - 18% Revenue Growth 28 - 31% Gross Margin 15 - 18% Operating Margin

12% to 18 % Targeted Revenue Growth Internal Growth + Acquisitions $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 2020 2021 2022 2023 June 2024 TTM 27 Revenue TTM = 12 - month period ended June 30, 2024

Gross Margin Target – 28% to 31% Operating Leverage from Mix Shift + Acquisition synergies + Efficiencies 28 Gross Profit Margin Target: 28 - 31% 24.9% 24.8% 25.5% 28.1% 29.3% 18.0% 20.0% 22.0% 24.0% 26.0% 28.0% 30.0% 32.0% 2020 2021 2022 2023 Q2 2024 YTD

Operating Margin Target - 15% to 18% Operating leverage from mix shift + acquisition synergies + efficiencies 29 Adjusted* Operating Margin Target: 15 - 18% *See non - GAAP reconciliation on slide 31 9.6% 10.50% 12.6% 14.8% 16.7% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2020 2021 2022 2023 Q2 2024 YTD

UFP Historical Stock Performance 20 Years 30 *Measured as the percent increase from August 9, 2004 through August 9, 2024. Ϭ й ϭϬϬϬ й ϮϬϬϬ й ϯϬϬϬ й ϰϬϬϬ й ϱϬϬϬ й ϲϬϬϬ й ϳϬϬϬ й ϴϬϬϬ й ϵϬϬϬ й ϭϬϬϬϬ й ϭϭϬϬϬ й ϭϮϬϬϬ й �ƵŐ Ͳ Ϭϰ �ƵŐ Ͳ Ϭϲ �ƵŐ Ͳ Ϭϴ �ƵŐ Ͳ ϭϬ �ƵŐ Ͳ ϭϮ �ƵŐ Ͳ ϭϰ �ƵŐ Ͳ ϭϲ �ƵŐ Ͳ ϭϴ �ƵŐ Ͳ ϮϬ �ƵŐ Ͳ ϮϮ �ƵŐ Ͳ Ϯϰ h&W�dĞĐŚŶŽůŽŐŝĞƐ�/ŶĐ� ; h&Wd Ϳ� WƌŝĐĞ� й� �ŚĂŶŐĞ ZƵƐƐĞůů� ϮϬϬϬ� ; Δ Zhd Ϳ� >ĞǀĞů� й� �ŚĂŶŐĞ ^ Θ W� ϱϬϬ� ; Δ ^Wy Ϳ� >ĞǀĞů� й� �ŚĂŶŐĞ ϯϬϭ й ϰϬϮ й ϭϬ ͕ ϵϱϮ й

R. Jeffrey Bailly Chairman, CEO & President Newburyport, Massachusetts Ronald Lataille CFO, Sr. VP & Treasurer Newburyport, Massachusetts UFP Technologies 100 Hale St. Newburyport, MA 01950 978 - 352 - 2200 investorinfo@ufpt.com www.ufpt.com

Appendix Reconciliation of Non - GAAP Results 32 (in Millions) 2019 2020 2021 2022 2023 Q2 2024 YTD Revenue, As Reported $ 198.4 $ 179.4 $ 206.3 $ 354.0 $ 400.1 $ 215.2 Operating Income, as reported 24.7 16.7 21.2 55.4 55.7 33.9 Add: Acquisition/ Restructuring related Costs - - 0.4 1.0 - 0.9 Add earnout fair value adjustment - - - 9.8 3.5 0.5 Less: Gain or Add: Loss on Sale of fixed assets - 0.5 - (6.1) 0.1 0.7 Less: Sale of MFT - - - (15.6) - - Adjusted Operating Income $ 24.7 $ 17.2 $ 21.6 $ 44.5 $ 59.3 $ 36.0 Adjusted Operating Margin 12.4% 9.6% 10.5% 12.6% 14.8% 16.7%

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

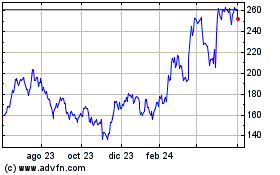

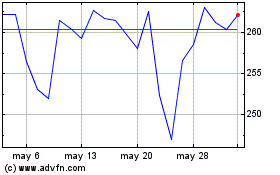

Ufp Technologies (NASDAQ:UFPT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ufp Technologies (NASDAQ:UFPT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024