UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No, 3)

ARC

DOCUMENT SOLUTIONS, INC. |

| (Name

of Issuer) |

| |

Common

Stock, par value $0.001 per share |

| (Title

of Class of Securities) |

| |

00191G103 |

| (CUSIP

Number) |

Kumarakulasingam

Suriyakumar

Suriyakumar

Family Trust

Shiyulli

Suriyakumar 2013 Irrevocable Trust

Seiyonne

Suriyakumar 2013 Irrevocable Trust

Dilantha

Wijesuriya

Jorge

Avalos

Rahul

Roy

Sujeewa

Sean Pathiratne

TechPrint

Holdings, LLC

Copies

to:

Mitchell

S. Nussbaum, Esq.

Angela

M. Dowd, Esq,.

Loeb

& Loeb LLP

345

Park Avenue

New

York, New York 10154

(212)

407-4000

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September

10, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D,

and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box ☐.

Note:

Six copies of this statement, including all exhibits, should be filed with the Commission. See Rule 13d-1(a) for other parties to whom

copies are to be sent.

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

| |

|

| |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however see the Notes). |

(Continued

on following pages)

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

KUMARAKULASINGAM

SURIYAKUMAR |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

BK,

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

2,055,576 |

| 8 |

SHARED

VOTING POWER

2,732,171 |

| 9 |

SOLE

DISPOSITIVE POWER

2,055,576 |

| 10 |

SHARED

DISPOSITIVE POWER

6,417,446 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,473,042 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.6%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,249,749 shares of common stock, par value $0.001 per share (the “Common Stock”) of ARC Document Solutions,

Inc. (“Issuer” or the “Company”) issued and outstanding as of July 26, 2024, the Reporting Person beneficially

owns approximately 19.6% of the issued and outstanding Common Stock of the Issuer. Does not include certain shares of Common Stock

that the Reporting Person may be deemed to beneficially own pursuant to his membership in a Rule 13d-5 group but does include (i)

1,732,171 shares of Common Stock held by the Suriyakumar Family Trust, for which the Reporting Person and his spouse, share voting

and dispositive power (ii) an additional 1,000,000 shares of Common Stock that the Reporting Person may be deemed to beneficially

own that are held by the Shiyulli Suriyakumar 2013 Irrevocable Trust and the Seiyonne Suriyakumar 2013 Irrevocable Trust which trusts

were established by the Reporting Person for estate planning purposes, but as to which the Reporting Person disclaims beneficial

ownership except to the extent of his pecuniary interest therein and (iii) an additional 3,685,275 shares of Common Stock that the

Reporting Person may be deemed to beneficially own by virtue of the Rollover Agreement (as defined herein) that are held by the other

Rollover Stockholders (as defined herein) by virtue of his role as Manager of TechPrint Holdings, LLC. See Items 3 and 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

SURIYAKUMAR

FAMILY TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH: |

7 |

SOLE

VOTING POWER

1,732,171 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

1,732,171 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,732,171 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

4.0% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar and his spouse, as trustees of the Reporting Person,

share voting and dispositive power over these shares. Does not include certain shares of Common Stock that the Reporting Person may

be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

SHIYULLI

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

500,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

500,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

500,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.2%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

1.2% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar shares voting and dispositive power over these shares.

Does not include certain shares of Common Stock that the Reporting Person may be deemed to beneficially own pursuant to its membership

in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

SEIYONNE

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

US |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

500,000 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

500,000 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

500,000 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.2%* |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

1.2% of the issued and outstanding Common Stock of the Issuer. Mr. Suriyakumar shares voting and dispositive power over these shares.

Does not include certain shares of Common Stock that the Reporting Person may be deemed to beneficially own pursuant to its membership

in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

DILANTHA

WIJESURIYA |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

1,149,038 |

| 8 |

SHARED

VOTING POWER

647,771 |

| 9 |

SOLE

DISPOSITIVE POWER

1,149,038 |

| 10 |

SHARED

DISPOSITIVE POWER

647,771 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,796,809 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.2%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

4.2% of the issued and outstanding Common Stock of the Issuer. Includes 971,156 shares of Common Stock issuable upon exercise of

outstanding stock options exercisable within 60 days of the date of this report, and 647,771 shares held by the Wijesuriya Family

Trust. Mr. Wijesuriya and his spouse, as trustees of the Wijesuriya Family Trust share voting and dispositive power over the shares

held by the trust. Does not include certain shares of Common Stock that the Reporting Person may be deemed to beneficially own pursuant

to its membership in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

JORGE

AVALOS |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

737,025 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

737,025 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

737,025 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.7%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

1.7% of the issued and outstanding Common Stock of the Issuer. Includes 183,678 shares of Common Stock issuable upon exercise of

outstanding stock options exercisable within 60 days of the date of this report. .Does not include certain shares of Common Stock

that the Reporting Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

RAHUL

ROY |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

708,167 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

708,167 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

708,167 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES

CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.6%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

1.6t% of the issued and outstanding Common Stock of the Issuer. Includes 240,666 shares issuable upon exercise of outstanding stock

options exercisable within 60 days of this report. .Does not include certain shares of Common Stock that the Reporting Person may

be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

SUJEEWA

SEAN PATHIRATNE |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

443,274 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

443,274 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

443,274 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.0%* |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| * |

Based

on the 43,249,749 shares of Common Stock issued and outstanding as of July 26, 2024, the Reporting Person beneficially owns approximately

1.0% of the issued and outstanding Common Stock of the Issuer. Does not include certain shares of Common Stock that the Reporting

Person may be deemed to beneficially own pursuant to its membership in a Rule 13d-5 group. See Item 5. |

CUSIP

No. 00191G 10 3

| 1 |

NAME

OF REPORTING PERSON

TECHPRINT

HOLDINGS, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

(b) |

☒

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

BK,

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

NUMBER

OF SHARES

BENEFICIALLY

OWNED

BY

EACH REPORTING

PERSON WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

8,473,042 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,473,042 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.6%* |

| 14 |

TYPE

OF REPORTING PERSON

CO |

| * |

Based on the 43,249,749 shares

of Common Stock issued and outstanding as of July 26, 2024 and by virtue of the Rollover Agreement (as defined herein), the Reporting

Person beneficially owns approximately 19.6% of the issued and outstanding Common Stock of the Issuer.See Items 3 and 5. |

CUSIP

No. 00191G 10 3

Introductory

Note

This

Amendment No.3 (this “Amendment No.3”) to statement on Schedule 13D, is filed with respect to shares of Common Stock of the

Issuer on behalf of the group that may be deemed to be formed under Rule 13d-5 consisting of (i) Mr. Kumarakulasingam Suriyakumar (“Mr.

Suriyakumar” or the “Founder”), director, chairman and chief executive officer of the Issuer; (ii) the Suriyakumar

Family Trust (the “Family Trust”), by and through Mr. Suriyakumar as trustee; (iii) the Shiyulli Suriyakumar 2013 Irrevocable

Trust (the “Shiyulli Trust”), by and through Ms. Shiyulli Suriyakumar (“Ms. Suriyakumar”) as trustee; (iv) the

Seiyonne Suriyakumar 2013 Irrevocable Trust (the “Seiyonne Trust”), by and through Mr. Seiyonne Suriyakumar (“Mr. Seiyonne

Suriyakumar”) as trustee; (v) Mr. Dilantha Wijesuriya, Chief Operating Officer of the Issuer (“Mr. Wijesuriya”); (vi)

Mr. Jorge Avalos, Chief Financial Officer of the Issuer (“Mr. Avalos”); (vii) Mr. Rahul Roy, Chief Technical Officer of the

Issuer (“Mr. Roy”); (viii) Mr. Sujeewa Sean Pathiratne, a private investor (“Mr. Pathiratne”) and (ix) TechPrint

Holdings, Inc., a Delaware limited liability company (“TechPrint” or the “Acquirer” and collectively with Mr.

Suriyakumar, the Family Trust, the Shiyulli Trust, the Seiyonne Trust, Mr. Wijesuriya, Mr. Avalos, Mr. Roy and Mr. Pathiratne, the “

Reporting Persons”).

This

Amendment No. 3 amends and supplements the Schedule 13D, with respect to the Issuer filed by the Reporting Persons with the Securities

and Exchange Commission (as amended and supplemented to date, the “Schedule 13D”). Except as provided herein, this Schedule

13D does not modify any of the information previously reported on the Schedule 13D.

Item

3 Source and Amount of Funds or Other Consideration

The

information set forth in this Item 4 shall be deemed to supplement Item 3 of the Schedule 13D/A filed by the Reporting Persons on August

29, 2024.

On

September 10, 2024, (i) the Acquirer (ii) TechPrint Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Acquirer

(“Merger Sub”) and (iii) the Company entered into Amendment No. 1 (the “Merger Agreement Amendment”) to the agreement

and plan of merger, dated as of August 27, 2024 (the “Original Merger Agreement” and collectively with the Merger Agreement

Amendment, the “Merger Agreement”), by and among the Acquirer, Merger Sub and the Company. The Merger Agreement Amendment

clarifies and ensures the Intended Tax Treatment (as such term is defined in the Merger Agreement) with respect to the contribution by

the Rollover Stockholders (as defined below) of their shares of Common Stock (including shares received with respect to In-the-Money

Company Options and Company RSAs) (as such terms are defined in the Merger Agreement) to the Acquirer in exchange for equity interests

in Acquirer. The information disclosed in this paragraph is qualified in its entirety by reference to the Merger Agreement Amendment,

a copy of which has been filed as Exhibit 7.01 to this Amendment No. 3, and is incorporated herein by reference in its entirety as Exhibit

7.01.

On

September 10 2024, concurrently with the execution and delivery of the Merger Agreement Amendment, the Acquirer and each of (i) Mr. Suriyakumar;

(ii) the Family Trust; (iii) the Shiyulli Trust; (iv) the Seiyonne Trust; (v) Mr. Wijesuriya; (vi) Mr. Avalos; (vii) Mr. Roy and (viii)

Mr. Pathiratne (collectively, the “Rollover Stockholders”) entered into Amendment No.1 (the “Rollover Agreement Amendment”)

to the Rollover Agreement dated August 27, 2024 by and among the Acquirer and the Rollover Stockholders (the “Original Rollover

Agreement” and collectively with the Rollover Agreement Amendment, the “Rollover Agreement”). The Rollover Agreement

Amendment amends certain provisions of the Original Rollover Agreement with respect to certain procedural and tax matters related to

the contribution by the Rollover Stockholder to Acquirer immediately prior to the Effective Time (as such term is defined in the Rollover

Agreement) of shares of Common Stock of the Company held by the Rollover Stockholders. The information disclosed in this paragraph is

qualified in its entirety by reference to the Rollover Agreement Amendment, a copy of which has been filed as Exhibit 7.02 to this Amendment

No. 3, and is incorporated herein by reference in its entirety as Exhibit 7.02.

Item

4. Purpose of Transaction.

The

information set forth in this Item 4 shall be deemed to supplement Item 4 of the Schedule 13D/A filed by the Reporting Persons on August

29, 2024.

On

September 10, 2024, concurrently with the execution of the Merger Agreement Amendment and the Rollover Agreement Amendment, the Company,

the Acquirer and the Rollover Stockholders entered into Amendment No. 1 (the “Voting Agreement Amendment”) to the Voting

Agreement dated as of August 27, 2024 by and among the Company, the Acquirer and the Rollover Stockholders (the “Original Voting

Agreement” and , collectively with the Voting Agreement Amendment, the “Voting Agreement”). The Voting Agreement Amendment

amends the Original Voting Agreement to update Schedule A thereto and to clarify that Company RSAs (as defined therein) owned by the

Rollover Stockholders are intended to be subject to the Voting Agreement and other covenants included therein. The information disclosed

in this paragraph is qualified in its entirety by reference to the Voting Agreement Amendment, a copy of which has been filed as Exhibit

7.03 to this Amendment No. 3, and is incorporated herein by reference in its entirety as Exhibit 7.03.

The

information required by Item 4 not otherwise provided herein is set forth in Item 3 and is incorporated herein by reference.

Item

6 Contracts, Arrangements, Understandings, or Relationships with respect to Securities of the Company.

On

September 10, 2024, the Acquirer, Merger Sub and the Company entered into the Merger Agreement Amendment. The description of the Merger

Agreement Amendment in Item 3 is incorporated herein by reference. On September 10, 2024, concurrently with the execution of the Merger

Agreement Amendment: the Rollover Stockholders and the Acquirer entered into the Rollover Agreement Amendment. The description of the

Rollover Agreement Amendment in Item 3 is incorporated herein by reference. On September 10, 2024, concurrently with the execution of

the Merger Agreement Amendment and the Rollover Agreement Amendment, the Rollover Stockholders, the Acquirer and the Company entered

into the Voting Agreement Amendment. The description of the Voting Agreement Amendment in Item 4 is incorporated herein by reference.

The

summaries of the provisions of each of the agreements referenced in this statement on Schedule 13D are not intended to be complete and

are qualified in their entirety by reference to the full texts of such agreements. The agreements listed in this Item 6 are filed herewith

as Exhibits 7.01 through 7.03 to this Amendment No. 3 and are incorporated herein by reference.

Item

7. Material to be Filed as Exhibits.

SIGNATURES

After

reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement

is true, complete and correct.

Dated:

September 12, 2024

| |

/s/

Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam

Suriyakumar |

| |

|

|

| |

SURIYAKUMAR

FAMILY TRUST |

| |

|

|

| |

By: |

/s/

Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam

Suriyakumar |

| |

Title: |

Trustee |

| |

|

|

| |

SHIYULLI

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

| |

By: |

/s/

Shiyulli Suriyakumar |

| |

Name: |

Shiyulli

Suriyakumar |

| |

Title: |

Trustee |

| |

|

|

| |

SEIYONNE

SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

| |

By: |

/s/

Seiyonne Suriyakumar |

| |

Name: |

Seiyonne

Suriyakumar |

| |

Title: |

Trustee |

| |

/s/

Dilantha Wijesuriya |

| |

Name: |

Dilantha

Wijesuriya |

| |

|

|

| |

/s/

Jorge Avalos |

| |

Name: |

Jorge

Avalos |

| |

|

|

| |

/s/

Rahul Roy |

| |

Name: |

Rahul

Roy |

| |

|

|

| |

/s/

Sujeewa Sean Pathiratne |

| |

Name: |

Sujeewa

Sean Pathiratne |

| |

TECHPRINT HOLDINGS,

LLC |

| |

|

|

| |

By: |

/s/ Kumarakulasingam

Suriyakumar |

| |

Name: |

Kumarakulasingam Suriyakumar |

| |

Title: |

Manager |

Exhibit

7.01

AMENDMENT

NO. 1

TO

AGREEMENT

AND PLAN OF MERGER

This

AMENDMENT NO. 1 TO AGREEMENT AND PLAN OF MERGER (this “Amendment”), dated as of September 10, 2024 (the “Effective

Date”), is made and entered into by and among TechPrint Holdings, LLC, a Delaware limited liability company (“Parent”),

TechPrint Merger Sub, Inc., a Delaware corporation and a wholly owned Subsidiary of Parent (“Merger Sub”), and ARC

Document Solutions, Inc., a Delaware corporation (the “Company”). Parent, Merger Sub and the Company are referred

to herein as the “Parties” and each, a “Party”.

RECITALS

WHEREAS,

the Parties entered into that certain Agreement and Plan of Merger, dated as of August 27, 2024 (the “Original Agreement”;

capitalized terms used but not defined herein shall have the meanings ascribed to them in the Original Agreement);

WHEREAS,

pursuant to Section 9.2 thereof, the Original Agreement may be amended by the Parties; and

WHEREAS,

the Parties now desire to amend the Original Agreement as set forth herein.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the Parties hereby agree as follows:

1.

Amendments to the Original Agreement. As of the Effective Date, the Original Agreement is hereby amended as follows:

(a)

The Recitals of the Original Agreement is hereby amended by inserting the following clause immediately after the ninth WHEREAS clause:

“WHEREAS,

immediately following the consummation of the Merger and after giving effect to the transactions contemplated by the Equity Commitment

Letter, Parent will contribute to the Surviving Corporation cash in an amount determined by Parent and permitted by the Commitment Letters;”

(b)

The first sentence of Section 4.1(a) of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Each

share of common stock, par value $0.001 per share, of the Company (a “Share” and collectively, the “Shares”)

issued and outstanding immediately prior to the Effective Time (other than Shares issued and outstanding immediately prior to the Effective

Time that are to be cancelled in accordance with Section 4.1(b) or treated in the manner provided in Section 4.1(c) (including

Rollover Shares) and any Dissenting Shares (collectively, the “Excluded Shares”)) shall automatically be converted

into the right to receive $3.40 in cash, without interest (the “Merger Consideration”).”

(c)

Section 4.1(c) of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Treatment

of Shares Held by Parent and Rollover Shares. Each Share issued and outstanding immediately prior to or at the Effective Time that

is owned by Parent as of immediately prior to or at the Effective Time (including all of the Rollover Shares contributed to Parent prior

to the Effective Time pursuant to the Rollover Agreement) shall not be converted into the right to receive the Merger Consideration pursuant

to Section 4.1(a) and shall instead remain outstanding and from and after the Effective Time shall represent one share of the

Surviving Corporation Common Stock.”

(d)

The third sentence of Section 4.2(g) of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“If,

after the Effective Time, a holder of a Dissenting Share fails to perfect, waives, effectively withdraws, or otherwise loses such holder’s

right to appraisal pursuant to Section 262 of the DGCL, or if a court of competent jurisdiction shall determine that such holder is not

entitled to the appraisal rights provided by Section 262 of the DGCL, then the right of such holder to be paid the fair value of such

Dissenting Share shall cease and such Dissenting Share shall thereupon be deemed to have been cancelled and converted as of the Effective

Time into, the right to receive the Merger Consideration, without any interest thereon, upon surrender of such Share in accordance with

Section 4.2(c) and shall not thereafter be deemed to be a Dissenting Share.”

(e)

Section 4.3(a)(iii) of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“In-the-Money

Company Options Held by Rollover Stockholders. Immediately prior to the Effective Time, each Company Option, whether vested or unvested,

that is (i) held by a Rollover Stockholder, and (ii) has an exercise price per Share that is less than the Merger Consideration (a “Rollover

Company Option”), shall, by virtue of the Merger and without further action on the part of Parent, Merger Sub, the Company

or any holder of any Share or Company Option, be cancelled and converted into the right to receive a number of Shares equal to the quotient

of (i) the applicable Option Spread for such Rollover Company Option, less applicable Taxes and authorized deductions, divided by (ii)

the Merger Consideration, rounded down to the nearest whole Share. Any Shares issuable pursuant to this Section 4.3(a)(iii) shall

be issued immediately prior to the Effective Time and shall be Rollover Shares subject to Section 4.1(c) and the Rollover Agreement.”

(f)

Section 4.3(b)(i) of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Treatment

of Company RSAs Held by Rollover Stockholders. Immediately prior to the Effective Time, each restricted stock award granted under

any Company Stock Plan (each, a “Company RSA” and each Share covered thereby, an “Unvested Share”)

and held by a Rollover Stockholder shall, by virtue of the Merger and without further action on the part of Parent, Merger Sub, the Company

or any holder of any Share or Unvested Share, be cancelled and converted into the right to receive a number of Shares equal to the quotient

of (i) the number of Unvested Shares covered thereby multiplied by the Merger Consideration, less applicable Taxes and authorized deductions,

divided by (ii) the Merger Consideration, rounded down to the nearest whole Share. Any Shares issuable pursuant to this Section 4.3(b)(i)

shall be issued immediately prior to the Effective Time and shall be Rollover Shares subject to Section 4.1(c) and the Rollover

Agreement.”

(g)

The definition of Dissenting Shares in Annex A of the Original Agreement is hereby deleted in its entirety and replaced with the following:

““Dissenting

Shares” means Shares issued and outstanding immediately prior to the Effective Time (other than such Shares that are to be

cancelled in accordance with Section 4.1(b) or treated in the manner provided in Section 4.1(c)) that are held by stockholders

of the Company who (i) did not vote in favor of this Agreement or the Merger (or consent thereto in writing), (ii) is entitled to demand

appraisal rights with respect to such Shares, and (iii) who has properly demanded and perfected such holder’s right to appraisal

with respect to such Shares in accordance with, complies in all respects with, and has not effectively withdrawn, failed to perfect,

or otherwise lost such holder’s right to appraisal with respect to such Shares, in each case, pursuant to Section 262 of the DGCL.”

(h)

Annex A of the Original Agreement is hereby amended by deleting the definition of “Rollover Agreement” in its entirety and

inserting the following definition in lieu thereof:

““Rollover

Agreement” means that certain Rollover Agreement, made and entered into as of August 27, 2024, by and among the Parent and

the Persons listed on the Schedule A attached thereto, an unexecuted copy of which is attached hereto as Exhibit D, as amended

by the Amendment No. 1 to Rollover Agreement, dated as of September 10, 2024.”

(i)

Annex A of the Original Agreement is hereby amended by inserting the following new definition in the appropriate alphabetical order:

““Surviving

Corporation Common Stock” means a share of common stock of the Surviving Corporation, par value $0.001 per share.”

(j)

The table of terms in Annex A of the Original Agreement is hereby amended by deleting the row for “Surviving Corporation Common

Stock.”

2.

Limited Effect. Except as expressly provided in this Amendment, all of the terms

and provisions of the Original Agreement shall remain in full force and effect and are hereby ratified and confirmed by the Parties.

On and after the Effective Date, each reference in the Original Agreement to “this Agreement,” “hereunder,” “hereof,”

“herein,” or words of like import shall mean and be a reference to the Original Agreement as amended by this Amendment.

3.

Miscellaneous.

(a)

This Amendment and any claim, action or proceeding (whether at law, in contract or in tort) that may directly or indirectly be based

upon, relate to or arise out of this Amendment shall be governed by, and construed and enforced in accordance with, the Laws of the State

of Delaware, without regard to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction)

that would cause the application of the Laws of any jurisdiction other than the State of Delaware.

(b)

This Amendment shall inure to the benefit of and be binding upon each of the parties to the Original Agreement, including the Parties,

and each of their respective permitted successors and permitted assigns.

(c)

This Amendment, together with the Original Agreement, constitutes the sole and entire agreement by the Parties with respect to the subject

matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect

to such subject matter.

(d)

This Amendment may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all

such counterparts shall together constitute the same agreement. Delivery of an executed counterpart of a signature page to this Amendment

by facsimile transmission or by email of a .pdf attachment shall be effective as delivery of a manually executed counterpart of this

Amendment.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

TECHPRINT

HOLDINGS, LLC

|

|

| |

|

| By: |

/s/

Kumarakulasingam Suriyakumar |

|

| Name: |

Kumarakulasingam

Suriyakumar |

|

| Title: |

Manager |

|

| |

|

|

| TECHPRINT

MERGER SUB, INC. |

|

| |

|

| By: |

/s/

Kumarakulasingam Suriyakumar |

|

| Name: |

Kumarakulasingam

Suriyakumar |

|

| Title: |

President |

|

| |

|

|

| ARC

DOCUMENT SOLUTIONS, INC. |

|

| |

|

| By: |

/s/

Tracey Luttrell |

|

| Name: |

Tracey

Luttrell |

|

| Title: |

Corporate

Counsel and Corporate Secretary |

|

[Signature

Page to Amendment No. 1 to Agreement and Plan of Merger]

Exhibit

7.02

AMENDMENT

NO. 1

TO

ROLLOVER

AGREEMENT

This

AMENDMENT NO. 1 TO ROLLOVER AGREEMENT (this “Amendment”), dated as of September 10, 2024 (the “Effective

Date”), is made and entered into by and among TechPrint Holdings, LLC, a Delaware limited liability company (“Parent”),

and the undersigned stockholders (the “Rollover Stockholders”) of ARC Document Solutions, Inc., a Delaware corporation

(the “Company”). Parent and the Rollover Stockholders are referred to herein as the “Parties” and

each, a “Party”.

RECITALS

WHEREAS,

Parent, TechPrint Merger Sub, Inc., a Delaware corporation and a wholly-owned Subsidiary of Parent, and the Company entered into that

certain Agreement and Plan of Merger, dated as of August 27, 2024 (the “Merger Agreement”; capitalized terms used

but not defined herein shall have the meanings ascribed to them in the Original Agreement);

WHEREAS,

in connection therewith, the Parties entered into that certain Rollover Agreement, dated as of August 27, 2024 (the “Original

Agreement”);

WHEREAS,

pursuant to Section 10 thereof, the Original Agreement may be amended by the Parties; and

WHEREAS,

the Parties now desire to amend the Original Agreement as set forth herein.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and other good and valuable consideration, the receipt and sufficiency of which are hereby

acknowledged, the Parties hereby agree as follows:

1.

Amendments to the Original Agreement. As of the Effective Date, the Original Agreement is hereby amended as follows:

(a)

The third WHEREAS clause in the Recitals of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“WHEREAS,

pursuant to Section 4.3(a)(iii) and Section 4.3(b)(i) of the Merger Agreement, such Company Options and Company RSAs shall be converted

into Company Shares issuable to the Rollover Stockholders;”

(b)

The fourth WHEREAS clause in the Recitals of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“WHEREAS,

in connection with the consummation of the transactions contemplated by the Merger Agreement, the Rollover Stockholders desire to contribute

the Company Shares (collectively, the “Rollover Shares”) to Parent in exchange for common units of Parent (the “Parent

Units”);”

(c)

Section 1 of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Contribution

of Rollover Shares. Subject to the conditions set forth herein, immediately prior to the Effective Time, and without further action

by the Rollover Stockholders or any other Person, all of each Rollover Stockholder’s right, title and interest in and to the Company

Shares shall be contributed, assigned, transferred and delivered to Parent. It is the intent of the parties hereto to treat (and shall

direct any applicable Affiliate to treat) for U.S. federal, state and local income tax purposes the contribution of Rollover Shares as

a tax free contribution made pursuant to Section 721 of the Code, and the parties hereto shall report, act, and file (and shall direct

any applicable Affiliate to report, act and file) all U.S. federal, state and local income tax returns consistent with such tax treatment.”

(d)

The second sentence of Section 2 of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Each

Rollover Stockholder hereby acknowledges and agrees that (a) delivery of such Parent Units shall constitute complete satisfaction of

all obligations towards or sums due such Rollover Stockholder by Parent and Parent with respect to the applicable Rollover Shares, and

(b) such Rollover Stockholder shall have no right to any Merger Consideration with respect to the Rollover Shares contributed to Parent

by such Rollover Stockholder.”

(e)

Section 3 of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Closing.

Subject to (i) the satisfaction (or waiver) of all of the conditions applicable to Parent’s obligation to close the transactions

contemplated by the Merger Agreement as set forth in Section 7.1 and Section 7.2 of the Merger Agreement (other than conditions that

by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions), (ii) the Debt Financing

Commitment having been funded or the Lenders having confirmed that the Debt Financing Commitment will be funded at Closing upon delivery

of a drawdown notice and notice from Parent that the Equity Financing Commitment will be funded at Closing, (iii) the substantially concurrent

receipt by Parent of the Equity Investment Commitment, (iv) Parent being required to effect the Closing pursuant to Section 1.2 of the

Merger Agreement and (v) the Company having irrevocably notified Parent in writing that the Company is ready, willing and able to consummate,

and will consummate, the Closing in accordance with the terms of the Merger Agreement and, if the Debt Financing Commitment and Equity

Investment Commitment are funded, the Company shall take such actions that are required of it by the Merger Agreement to consummate the

Closing, as of such date, pursuant to the terms of the Merger Agreement, the closing of the contribution and exchange contemplated under

Section 1 shall take place immediately prior to the Effective Time (the “Contribution Closing”).”

(f)

The Original Agreement is hereby amended by replacing the words “Contribution Closings, as applicable,” with “Contribution

Closing”. In each place where the Original Agreement uses the words “Contribution Closings” (but not “Contribution

Closings, as applicable,”), the Original Agreement is hereby amended by replacing “Contribution Closings” with “Contribution

Closing”.

(g)

Section 4 of the Original Agreement is hereby deleted in its entirety and replaced with the following:

“Deposit

of Rollover Shares. As promptly as reasonably practicable following the execution of this Agreement, the Rollover Stockholders and

any agent of the Rollover Stockholders holding certificates evidencing any Rollover Shares (including, without limitation, any broker

holding securities in “street name”) shall deliver or cause to be delivered to Parent as applicable, (a) all Certificates

representing Rollover Shares being contributed to Parent, duly endorsed for transfer or with executed stock powers for disposition in

accordance with the terms of this Agreement or (b) such documentation requested by the Company’s transfer agent in order to cause

the transfer of the Rollover Shares to Parent as contemplated by this Agreement (all such documents required under (a) or (b), the “Share

Documents”).”

2.

Limited Effect. Except as expressly provided in this Amendment, all of the terms

and provisions of the Original Agreement shall remain in full force and effect and are hereby ratified and confirmed by the Parties.

On and after the Effective Date, each reference in the Original Agreement to “this Agreement,” “hereunder,” “hereof,”

“herein,” or words of like import shall mean and be a reference to the Original Agreement as amended by this Amendment.

3.

Miscellaneous.

(a)

This Amendment and any claim, action or proceeding (whether at law, in contract or in tort) that may directly or indirectly be based

upon, relate to or arise out of this Agreement or any transaction contemplated hereby, or the negotiation, execution or performance hereunder

shall be governed by, and construed and enforced in accordance with, the Laws of the State of Delaware, without regard to any choice

or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of

the Laws of any jurisdiction other than the State of Delaware.

(b)

This Amendment shall inure to the benefit of and be binding upon each of the parties to the Original Agreement, including the Parties,

and each of their respective permitted successors and permitted assigns.

(c)

This Amendment, together with the Original Agreement, constitutes the sole and entire agreement by the Parties with respect to the subject

matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect

to such subject matter.

(d)

This Amendment may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all

such counterparts shall together constitute the same agreement. Delivery of an executed counterpart of a signature page to this Amendment

by facsimile transmission or by email of a .pdf attachment shall be effective as delivery of a manually executed counterpart of this

Amendment.

[Signature

PageS Follow]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

TECHPRINT HOLDINGS, LLC |

| |

|

|

| |

By: |

/s/ Kumarakulasingam

Suriyakumar |

| |

Name: |

Kumarakulasingam Suriyakumar |

| |

Title: |

Manager |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Kumarakulasingam

Suriyakumar |

| |

Kumarakulasingam Suriyakumar |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Dilantha

Wijesuriya |

| |

Dilantha Wijesuriya |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Jorge

Avalos |

| |

Jorge Avalos |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Rahul

Roy |

| |

Rahul Roy |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Sujeewa

Sean Pathiratne |

| |

Sujeewa Sean Pathiratne |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Kumarakulasingam

Suriyakumar |

| |

Kumarakulasingam Suriyakumar, as Trustee

of Suriyakumar Family Trust |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Shiyulli

Suriyakumar |

| |

Shiyulli Suriyakumar, as Trustee of Shiyulli

Suriyakumar 2013 Irrevocable Trust |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

IN

WITNESS WHEREOF, the Parties have executed this Amendment as of the Effective Date.

| |

ROLLOVER STOCKHOLDER: |

| |

|

| |

/s/ Seiyonne

Suriyakumar |

| |

Seiyonne Suriyakumar, as Trustee of Seiyonne

Suriyakumar 2013 Irrevocable Trust |

[Signature

Page to Amendment No. 1 to Rollover Agreement]

Exhibit

7.03

AMENDMENT

NO. 1

TO

VOTING

AGREEMENT

This

AMENDMENT NO. 1 TO VOTING AGREEMENT (this “Amendment”), dated as of September 10, 2024, amends that certain Voting

Agreement, dated as of August 27, 2024, by and among ARC Document Solutions, Inc. (the “Company”), TechPrint Holdings,

LLC, a Delaware limited liability company (the “Parent”), the stockholders listed on the signature pages thereto (collectively,

the “Stockholders” and each individually, a “Stockholder”) (the “Voting Agreement”).

Capitalized terms used and not defined herein shall have the meanings set forth in the Voting Agreement.

WHEREAS,

the Company required that Parent and the Stockholders enter into the Voting Agreement as a condition and inducement to the willingness

of the Company to enter into that certain Agreement and Plan of Merger, dated as of August 27, 2024 with Parent and TechPrint Merger

Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (the “Merger Agreement”);

WHEREAS,

pursuant to the Voting Agreement, Parent and each Stockholder agreed to vote or cause to be voted the Subject Shares shown in Schedule

A to the Voting Agreement (i) in favor of the adoption of the Merger Agreement and the approval of the transactions contemplated

thereby, including the Merger, and (ii) against any other action, agreement or transaction that has not been recommended by the Company

Board (acting on the recommendation of the Special Committee) or the Special Committee and that would reasonably be expected to (A) result

in a breach of any covenant, representation or warranty or any other obligation or agreement of the Company under the Merger Agreement,

(B) result in any of the conditions to the consummation of the Merger under the Merger Agreement not being fulfilled, or (C) impede,

frustrate, interfere with, delay, postpone or adversely affect the Merger and the other transactions contemplated by the Merger Agreement;

WHEREAS,

the number of Subject Shares shown in Schedule A to the Voting Agreement inadvertently excluded certain shares of restricted stock

held by each Stockholder (the “Restricted Stock”); and

WHEREAS,

the Company, Parent and the Stockholders originally intended to include such shares of Restricted Stock in Schedule A, and desire

to correct Schedule A to the Voting Agreement in order to clarify that all shares of Restricted Stock held by each Stockholder

shall be deemed to be Subject Shares for all purposes of the Voting Agreement;

*

* *

NOW,

THEREFORE, in consideration of the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the Company, Parent and each of the undersigned Stockholders, who constitute the Stockholders required

to amend the Voting Agreement, hereby agree as follows:

1.

Schedule A of the Voting Agreement is hereby replaced in its entirety by the following in lieu thereof:

“

SCHEDULE

A

| Name

of Stockholder | |

Number

of Shares |

| Kumarakulasingam

Suriyakumar | |

1,822,244 |

| Dilantha

Wijesuriya | |

825,653 |

| Jorge

Avalos | |

553,347 |

| Rahul

Roy | |

467,501 |

| Sujeewa

Sean Pathiratne | |

443,274 |

| Suriyakumar

Family Trust | |

1,732,171 |

| Shiyulli

Suriyakumar 2013 Irrevocable Trust | |

500,000 |

| Seiyonne

Suriyakumar 2013 Irrevocable Trust | |

500,000 |

”

2.

The first sentence of Section 5(c) of the Voting Agreement is hereby replaced in its entirety by the following in lieu thereof:

“Such

Stockholder is the record and beneficial owner of, as such ownership is determined in accordance with Section 13(d) of the Exchange Act,

or is a trust or estate that is the record holder of and whose beneficiaries are the beneficial owners of, and has good and marketable

title to, the Subject Shares set forth opposite such Stockholder’s name on Schedule A attached hereto and incorporated herein

by reference, free and clear of any and all security interests, liens, changes, encumbrances, equities, claims, options or limitations

of whatever nature and free of any other limitation or restriction (including any restriction on the right to vote, sell or otherwise

dispose of such Subject Shares), other than (i) such Stockholder’s obligation to contribute, transfer and assign all of such Stockholder’s

right, title and interest in the Subject Shares pursuant to the Rollover Agreement, (ii) any of the foregoing that would not prevent

or delay Parent’s or such Stockholder’s ability to perform Parent’s or such Stockholder’s obligations hereunder,

(iii) any of the foregoing in the Company Stock Plans, and (iv) any of the foregoing imposed by federal, state or foreign securities

Laws.”

3.

Incorporation of Voting Agreement. All the provisions of this Amendment shall be deemed to be incorporated in, and made a part

of, the Voting Agreement; and the Voting Agreement, as supplemented and amended by this Amendment, shall be read, taken and construed

as one and the same instrument, and except as expressly amended hereby, the terms and conditions of the Voting Agreement shall continue

in full force and effect. All references to “this Agreement” in the Voting Agreement or to the words “hereof,”

“hereunder” or “herein” or words of similar effect, or to any Schedule in the Voting Agreement, shall mean the

Voting Agreement or Schedule, as amended hereby.

4.

Governing Law. This Amendment and any claim, action or proceeding (whether at law, in contract or in tort) that may directly or

indirectly be based upon, relate to or arise out of this Agreement or any transaction contemplated hereby, or the negotiation, execution

or performance hereunder shall be governed by, and construed and enforced in accordance with, the Laws of the State of Delaware, without

regard to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause

the application of the Laws of any jurisdiction other than the State of Delaware.

5.

No Other Amendments. Except for the amendments expressly set forth in this Agreement, the Voting Agreement shall remain in full

force and effect in accordance with its existing terms.

6.

Counterpart Signature Pages. This Amendment may be executed in two or more consecutive counterparts (including by facsimile, of

“.pdf” transmission), each of which shall be deemed to be an original, with the same effect as if the signatures thereto

and hereto were upon the same instrument, and shall become effective when one or more counterparts have been signed by each of the parties

to this Amendment and delivered (electronically or otherwise) to the other parties to this Amendment.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

COMPANY: |

| |

|

|

| |

ARC DOCUMENT SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/ Tracey Luttrell |

| |

Name: |

Tracey Luttrell |

| |

Title: |

Corporate Counsel and Corporate Secretary |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

PARENT: |

| |

|

|

| |

TECHPRINT HOLDINGS, LLC |

| |

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam Suriyakumar |

| |

Title: |

Manager |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

KUMARAKULASINGAM SURIYAKUMAR |

| |

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam Suriyakumar |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

DILANTHA WIJESURIYA |

| |

|

|

| |

By: |

/s/ Dilantha Wijesuriya |

| |

Name: |

Dilantha Wijesuriya |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

JORGE AVALOS |

| |

|

|

| |

By: |

/s/ Jorge Avalos |

| |

Name: |

Jorge Avalos |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

RAHUL ROY |

| |

|

|

| |

By: |

/s/ Rahul Roy |

| |

Name: |

Rahul Roy |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

SUJEEWA SEAN PATHIRATNE |

| |

|

|

| |

By: |

/s/ Sujeewa Sean Pathiratne |

| |

Name: |

Sujeewa Sean Pathiratne |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

Name: |

Kumarakulasingam Suriyakumar, as Trustee

of Suriyakumar Family Trust |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

By: |

/s/ Shiyulli Suriyakumar |

| |

Name: |

Shiyulli Suriyakumar, as Trustee of Shiyulli

Suriyakumar 2013 Irrevocable Trust |

[Signature

Page to Amendment No. 1 to Voting Agreement]

IN

WITNESS WHEREOF, this Amendment has been executed by the parties hereto as of the day and year first above written.

| |

STOCKHOLDER: |

| |

|

|

| |

By: |

/s/ Seiyonne Suriyakumar |

| |

Name: |

Seiyonne Suriyakumar, as Trustee of Seiyonne

Suriyakumar 2013 Irrevocable Trust |

[Signature

Page to Amendment No. 1 to Voting Agreement]

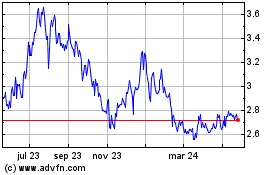

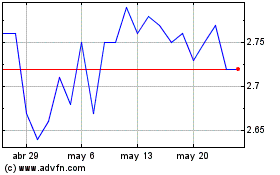

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024