UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 2)

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

ARC Document Solutions, Inc.

(Name of the Issuer)

ARC Document Solutions, Inc.

TechPrint Holdings, LLC

TechPrint Merger Sub, Inc.

Kumarakulasingam Suriyakumar

Dilantha Wijesuriya

Jorge Avalos

Rahul Roy

Sujeewa Sean Pathiratne

Shiyulli Suriyakumar 2013 Irrevocable Trust

Seiyonne Suriyakumar 2013 Irrevocable Trust

Suriyakumar Family Trust

(Names of Persons Filing Statement)

Common Stock, Par Value $0.001 per share

(Title of Class of Securities)

Common Stock: 00191G103

(CUSIP Number of Class of Securities)

|

ARC Document Solutions, Inc.

12657 Alcosta Blvd, Suite 200

San Ramon, CA 94583

Tel: (925) 949-5100

|

Kumarakulasingam Suriyakumar

Dilantha Wijesuriya

Jorge Avalos

Rahul Roy

c/o ARC Document Solutions, Inc.

12657 Alcosta Blvd, Suite 200

San Ramon, CA 94583

Tel: (925) 949-5100

TechPrint Holdings, LLC

TechPrint Merger Sub, Inc.

Shiyulli Suriyakumar 2013 Irrevocable Trust

Seiyonne Suriyakumar 2013 Irrevocable Trust

Suriyakumar Family Trust

c/o TechPrint Holdings, LLC

12657 Alcosta Blvd., Suite 200

San Ramon, California 94583

Tel: (925) 949-5100

|

Sujeewa Sean Pathiratne

5727 Poppy Hills Place

San Jose, CA 94583

Tel: (925) 949-5100

|

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

|

Glenn Luinenburg

Eric Hanson

Ryan S. Brewer

Wilmer Cutler Pickering Hale and Dorr LLP

2600 El Camino Real, Suite 400

Palo Alto, CA 94306

Tel: (650) 858-6000

|

Sean M. Jones

Coleman Wombwell

K&L Gates LLP

300 S. Tryon Street, Suite 1000

Charlotte, North Carolina 28202

Tel: (704) 331-7400

|

Terrence Allen, Esq.

Angela M. Dowd, Esq.

Janeane Ferrari, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

Tel: (212) 407-4000

|

| This statement is filed in connection with (check the appropriate box): |

| a. |

☒ |

The filing of solicitation materials or an information statement

subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. |

☐ |

The filing of a registration statement under the Securities Act of

1933. |

| c. |

☐ |

A tender offer. |

| d. |

☐ |

None of the above. |

Check the following box if the soliciting materials or information

statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the

results of the transaction: ☐

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on Schedule 13E-3. Any representation to the

contrary is a criminal offense.

INTRODUCTION

This Amendment No. 2 (“Amendment No. 2”) to the Rule 13e-3 Transaction

Statement on Schedule 13E-3, together with the exhibits hereto (as amended hereby, this “Schedule 13E-3” or “Transaction Statement”), is being filed with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Section

13(e) of the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively, the “Filing

Persons”): (i) ARC Document Solutions, Inc. (“ARC” or the “Company”), a Delaware corporation and the issuer of the common stock, par value $0.001 per share (the “ARC Common Stock”), that is subject to the Rule 13e-3

transaction, (ii) TechPrint Holdings, LLC, a Delaware limited liability company (“Parent”), (iii) TechPrint Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”), (iv) Kumarakulasingam

Suriyakumar, (v) Dilantha Wijesuriya, (vi) Jorge Avalos, (vii) Rahul Roy, (viii) Sujeewa Sean Pathiratne, (ix) Shiyulli Suriyakumar 2013 Irrevocable Trust, (x) Seiyonne Suriyakumar 2013 Irrevocable Trust, and (xi) Suriyakumar Family Trust (together

with Filing Persons (iv) through (x), the “Acquisition Group”).

On August 27, 2024, the Company, Parent and Merger Sub entered into an

Agreement and Plan of Merger (as subsequently amended on September 10, 2024) (as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”), pursuant to which, subject to the satisfaction or waiver of

certain conditions and on the terms set forth therein, pursuant to which Merger Sub will merge with and into ARC with ARC surviving the merger as the surviving corporation (the “Surviving Corporation”) and a wholly-owned subsidiary of Parent

(the “Merger”). Concurrently with the filing of this Amendment No. 2, the Company is filing with the SEC its definitive Proxy Statement (the “Proxy Statement”) under Regulation 14A of the Exchange Act, relating to a special meeting of

the stockholders of the Company (the “Special Meeting”) at which the stockholders of the Company will consider and vote upon a proposal to (i) approve and adopt the Merger Agreement and the transactions contemplated thereby, including the

Merger, (ii) approve, by nonbinding, advisory vote, certain compensation arrangements for ARC’s named executive officers in connection with the Merger and (iii) a proposal to adjourn the Special Meeting, if necessary or appropriate, including

adjournments to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt the Merger Agreement. The adoption of the Merger Agreement will require the affirmative vote of the holders of a majority of the

outstanding shares of ARC Common Stock entitled to vote, outstanding as of the close of business on the record date for the Special Meeting. A copy of the Proxy Statement is attached hereto as Exhibit (a)(2)(i) and incorporated herein by reference. A

copy of the agreement and plan of merger and the amendment thereto are attached hereto as Exhibits (d)(i) and (d)(ii), respectively, and are included as Annex A to the Proxy Statement and incorporated herein by reference.

Under the terms of the Merger Agreement, and subject to the conditions

thereof, at the effective time of the Merger (the “Effective Time”), among other things, each share of ARC Common Stock outstanding immediately prior to the Effective Time, other than as provided below, will be converted into the right to

receive $3.40 in cash (the “Merger Consideration”), without interest and less any applicable withholding taxes. The following shares of ARC Common Stock will not be converted into the right to receive the Merger Consideration in connection

with the Merger: (i) shares of ARC Common Stock held by Merger Sub or the Company or its subsidiaries as treasury stock or otherwise, (ii) shares ARC Common Stock owned by Parent immediately prior to the Effective Time of the Merger, (iii) shares of

ARC Common Stock held by members of the Acquisition Group to be contributed to Parent immediately prior to the Effective Time in exchange for common units of Parent pursuant to the rollover agreement, dated as of August 27, 2024 (as subsequently

amended on September 10, 2024), by and among Parent and the members of the Acquisition Group (such agreement, as amended, restated, supplemented or otherwise modified from time to time, the “Rollover Agreement” and such shares, the “Rollover

Shares”) and (iv) shares of ARC Common Stock that are issued and outstanding immediately prior to the Effective Time (other than Rollover Shares) and that have not been voted in favor of the adoption of the Merger Agreement or consented thereto

in writing, whose holders are entitled to demand appraisal rights with respect to such shares of ARC Common Stock, and whose holders have properly exercised and validly perfected appraisal rights with respect to such shares of ARC Common Stock in

accordance with, and who have complied in all respects with, and have not effectively withdrawn, failed to perfect, or otherwise lost such holder’s rights to appraisal with respect to such shares of ARC Common Stock, in each case, Section 262 of the

General Corporation Law of the State of Delaware (the “DGCL”), a copy of which is attached hereto as Exhibit (f) and is also included as Annex G to the Proxy Statement and incorporated herein by reference. A copy of the rollover agreement and

the amendment thereto are attached hereto as Exhibits (d)(iii) and (d)(iv), respectively, and are also included as Annex C to the Proxy Statement and incorporated herein by reference.

The cross-references below are being supplied pursuant to General

Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3. Pursuant to General Instruction F to Schedule 13E-3, the information contained in the

Proxy Statement, including all annexes and appendices thereto, is incorporated in its entirety herein by reference, and the responses to each item in this Schedule 13E-3 are qualified in their entirety by the information contained in the Proxy

Statement and the annexes and appendices thereto.

Capitalized terms used but not expressly defined in this Schedule 13E-3

shall have the respective meanings given to them in the Proxy Statement.

The information concerning ARC contained in, or incorporated by reference

into, this Schedule 13E-3 and the Proxy Statement was supplied by ARC. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference into this Schedule 13E-3 and the Proxy Statement was supplied by such

Filing Person. No Filing Person, including ARC, is responsible for the accuracy of any information supplied by any other Filing Person.

While each of the Filing Persons acknowledges that the Merger is a “going

private” transaction for purposes of Rule 13e-3 under the Exchange Act, the filing of this Transaction Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is “controlled” by

any Filing Person.

| Item 1. |

Summary Term Sheet |

The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE

SPECIAL MEETING”

| Item 2. |

Subject Company Information |

(a) Name and Address. The information set forth in the Proxy

Statement under the following caption is incorporated herein by reference:

“PARTIES TO THE MERGER”

(b) Securities. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE

SPECIAL MEETING”

“THE SPECIAL MEETING - Voting”

“THE SPECIAL MEETING - Record Date and Quorum”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Market

for ARC Common Stock and Dividends”

“OTHER IMPORTANT INFORMATION REGARDING

ARC - Security Ownership of Certain Beneficial Owners and Management”

(c) Trading Market and Price. The information set forth in the Proxy

Statement under the following caption is incorporated herein by reference:

“SUMMARY TERM SHEET – Other Important Information Regarding ARC”

“OTHER IMPORTANT INFORMATION REGARDING ARC- Market for ARC

Common Stock and Dividends”

(d) Dividends. The information set forth in the Proxy Statement

under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING ARC - Market for ARC

Common Stock and Dividends”

“THE MERGER AGREEMENT - Conduct of Business Pending the Merger”

(e) Prior Public Offerings. The information set forth in the Proxy

Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING ARC - Prior

Public Offerings”

(f) Prior Stock Purchases. The information set forth in the Proxy

Statement under the following caption is incorporated herein by reference:

“OTHER IMPORTANT INFORMATION REGARDING ARC - Stock

Repurchases”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Certain Transactions in

the Shares of ARC Common Stock”

| Item 3. |

Identity and Background of Filing Person |

(a)-(c) Name and Address; Business and Background of Entities; Business

and Background of Natural Persons. ARC is the subject company. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET – Parties to the Merger”

“PARTIES TO THE MERGER”

“OTHER IMPORTANT INFORMATION REGARDING ARC”

“OTHER IMPORTANT INFORMATION REGARDING THE PURCHASER

FILING PARTIES”

(d) Tender Offer. Not applicable.

| Item 4. |

Terms of the Transaction |

(a)(1) Material Terms. Tender Offers. Not Applicable.

(a)(2) Material Terms. Mergers or Similar Transactions. The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE

SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Material U.S. Federal Income Tax Consequences of

the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Accounting Treatment”

“THE MERGER AGREEMENT”

“THE SPECIAL MEETING - Vote Required”

Annex A – Merger Agreement

(c) Different Terms. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS – Limited Guarantee”

“SPECIAL FACTORS – Voting Agreement”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex E –Voting Agreement

Annex F – Limited Guarantee

(d) Appraisal Rights. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Appraisal Rights”

“THE MERGER AGREEMENT - Merger Consideration”

“THE SPECIAL MEETING - Appraisal Rights”

“THE MERGER (THE MERGER AGREEMENT PROPOSAL - PROPOSAL 1) - Appraisal

Rights”

Annex A – Merger Agreement

Annex G - Section 262 of the DGCL

(e) Provisions for Unaffiliated Security Holders. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“PROVISIONS FOR UNAFFILIATED STOCKHOLDERS”

(f) Eligibility for Listing or Trading. Not Applicable.

| Item 5. |

Past Contacts, Transactions, Negotiations and Agreements |

(a) Transactions. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS – Voting Agreement”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Certain Transactions in

the Shares of ARC Common Stock”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex D –Voting Agreement

(b) Significant Corporate Events. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Limited Guarantee”

“SPECIAL FACTORS – Voting Agreement”

“THE MERGER AGREEMENT”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex D –Voting Agreement

Annex F – Limited Guarantee

Annex H – Commitment Letter

(c) Negotiations or Contacts. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“THE MERGER AGREEMENT”

(e) Agreements Involving the Subject Company’s Securities. The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Intent of the Directors and Executive Officers to

Vote in Favor of the Merger”

“SPECIAL FACTORS - Intent of the Purchaser Filing Parties to Vote in

Favor of the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Limited Guarantee”

“SPECIAL FACTORS – Voting Agreement”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Certain Transactions in

the Shares of ARC Common Stock”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex D –Voting Agreement

Annex F – Limited Guarantee

| Item 6. |

Purposes of the Transaction and Plans or Proposals |

(b) Use of Securities Acquired. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Exchange and Payment Procedures”

“THE MERGER AGREEMENT”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

(c)(1)-(8) Plans. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Intent of the Directors and Executive Officers to

Vote in Favor of the Merger”

“SPECIAL FACTORS - Intent of the Purchaser Filing Parties to Vote in

Favor of the Merger”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Limited Guarantee”

“SPECIAL FACTORS – Voting Agreement”

“THE MERGER AGREEMENT”

“THE SPECIAL MEETING”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex E –Voting Agreement

Annex H –Commitment Letter

| Item 7. |

Purposes, Alternatives, Reasons and Effects |

(a) Purposes. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

(b) Alternatives. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Certain Effects on ARC if the Merger is Not

Completed”

(c) Reasons. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of the Special Committee’s Financial

Advisor”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

Annex B - Opinion of William Blair & Company, L.L.C.

(d) Effects. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Plans for ARC After the Merger”

“SPECIAL FACTORS - Certain Effects of the Merger”

“SPECIAL FACTORS - Certain Effects on ARC if the Merger is Not

Completed”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Material U.S. Federal Income Tax Consequences of

the Merger”

“SPECIAL FACTORS - Fees and Expenses”

“SPECIAL FACTORS - Accounting Treatment”

“SPECIAL FACTORS - Exchange and Payment Procedures”

“THE MERGER AGREEMENT”

“DELISTING AND DEREGISTRATION OF COMMON STOCK”

Annex A – Merger Agreement

| Item 8. |

Fairness of the Transaction |

(a), (b) Fairness; Factors Considered in Determining Fairness. The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of the Special Committee’s Financial

Advisor”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“THE MERGER AGREEMENT”

Annex B - Opinion of William Blair & Company, L.L.C.

(c) Approval of Security Holders. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“THE MERGER AGREEMENT - Conditions to the Closing of the Merger”

“THE SPECIAL MEETING - Record Date and Quorum”

“THE SPECIAL MEETING - Vote Required”

“THE SPECIAL MEETING - Voting”

“THE SPECIAL MEETING - Abstentions”

“THE SPECIAL MEETING - How to Vote”

“THE SPECIAL MEETING - Proxies and Revocation”

Annex A – Merger Agreement

(d) Unaffiliated Representative. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of the Special Committee’s Financial

Advisor”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

(e) Approval of Directors. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

(f) Other Offers. The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“THE MERGER AGREEMENT - Solicitation of Other Offers”

“THE MERGER AGREEMENT – Change of Recommendation”

Annex A – Merger Agreement

| Item 9. |

Reports, Opinions, Appraisals and Negotiations |

(a), (b) Report, Opinion or Appraisal; Preparer and Summary of the

Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Opinion of the Special Committee’s Financial

Advisor”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

“WHERE YOU CAN FIND MORE INFORMATION”

Annex B - Opinion of William Blair & Company, L.L.C.

(c) Availability of Documents. The reports, opinions or appraisals

referenced in this Item 9 will be made available for inspection and copying at the principal executive offices of ARC during its regular business hours by any interested equity holder of ARC Common Stock or by a representative who has been so

designated in writing.

| Item 10. |

Source and Amount of Funds or Other Consideration |

(a), (b) Source of Funds; Conditions. The information set forth in

the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Financing of the Merger”

“SPECIAL FACTORS - Limited Guarantee”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Exchange and Payment Procedures”

“THE MERGER AGREEMENT - Effect of the Merger”

“THE MERGER AGREEMENT - Closing and Effective Time”

“THE MERGER AGREEMENT - Conduct of Business Pending the Merger”

“THE MERGER AGREEMENT - Conditions to the Closing of the Merger”

Annex A – Merger Agreement

(c) Expenses. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Fees and Expenses”

“THE MERGER AGREEMENT - Termination of the Merger Agreement”

“THE MERGER AGREEMENT - Termination Fees”

“THE MERGER AGREEMENT - Fees and Expenses”

“THE SPECIAL MEETING - Solicitation of Proxies; Payment of

Solicitation Expenses”

Annex A – Merger Agreement

(d) Borrowed Funds.

“SPECIAL FACTORS - Financing of the Merger”

Annex H – Commitment Letter

| Item 11. |

Interest in Securities of the Subject Company |

(a) Securities Ownership. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS – Voting Agreement”

“THE SPECIAL MEETING - Record Date and Quorum”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Security Ownership of

Certain Beneficial Owners and Management”

Annex C – Rollover Agreement

Annex E –Voting Agreement

(b) Securities Transactions. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS – Voting Agreement”

“THE MERGER AGREEMENT”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Stock Repurchases”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Certain Transactions in

the Shares of ARC

Common Stock”

Annex A – Merger Agreement

Annex C – Rollover Agreement

Annex E –Voting Agreement

| Item 12. |

The Solicitation or Recommendation |

(d) Intent to Tender or Vote in a Going-Private Transaction. The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“SPECIAL FACTORS - Intent of the Directors and Executive Officers to

Vote in Favor of the Merger”

“SPECIAL FACTORS - Intent of the Purchaser Filing Parties to Vote in

Favor of the Merger”

“SPECIAL FACTORS - Voting Agreement”

“THE SPECIAL MEETING - Record Date and Quorum”

“THE SPECIAL MEETING - Voting Intentions of ARC’s Directors and

Executive Officers”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Directors and Executive

Officers of ARC”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Security Ownership of

Certain Beneficial Owners and Management”

Annex C - Rollover Agreement

Annex F – Voting Agreement

(e) Recommendation of Others. The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Notice Regarding Ratification Under Section 204

of the Delaware General Corporation Law”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Position of the Purchaser Filing Parties as to

the Fairness of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of the Purchaser Filing

Parties for the Merger”

| Item 13. |

Financial Statements |

(a) Financial Information. The audited consolidated financial

statements of the Company for the fiscal years ended December 31, 2023 and 2022 are incorporated herein by reference to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 29, 2024 (see “Item 8.

Financial Statements and Supplementary Data” beginning on page 35). The unaudited financial statements of the Company for the six months ended June 30, 2024 are incorporated herein by reference to the Company’s Quarterly Report on Form 10-Q for the

fiscal quarter ended June 30, 2024, filed on August 8, 2024 (see “Item 1. Condensed Consolidated Financial Statements” beginning on page 6).

The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Book

Value per Share”

“OTHER IMPORTANT INFORMATION REGARDING ARC - Selected Historical

Consolidated Financial Data”

“WHERE YOU CAN FIND MORE INFORMATION”

(b) Pro Forma Information. Not Applicable.

| Item 14. |

Persons/Assets, Retained, Employed, Compensated or Used |

(a) Solicitations or Recommendations. The information set forth in

the Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Purpose and Reasons of ARC for the Merger;

Recommendations of the ARC Board and the Special Committee; Fairness of the Merger”

“SPECIAL FACTORS - Fees and Expenses”

“THE SPECIAL MEETING - Solicitation of Proxies; Payment of

Solicitation Expenses”

(b) Employees and Corporate Assets. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“QUESTIONS AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING”

“SPECIAL FACTORS - Background of the Merger”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“THE SPECIAL MEETING”

“THE SPECIAL MEETING - Solicitation of Proxies; Payment of

Solicitation Expenses”

| Item 15. |

Additional Information |

(b) Golden Parachute Compensation. The information set forth in the

Proxy Statement under the following captions is incorporated herein by reference:

“SUMMARY TERM SHEET”

“SPECIAL FACTORS - Interests of Executive Officers and Directors of

ARC in the Merger”

“Merger-Related Compensation Proposal (The Merger-Related

Compensation Proposal—Proposal 3)”

(c) Other Material Information. The entirety of the Proxy Statement,

including all annexes and appendices thereto, is incorporated herein by reference.

The following exhibits are filed herewith:

| Exhibit No. |

|

Description |

| (a)(2)(i) |

|

Definitive Proxy Statement of ARC Document Solutions, Inc.

(included in the Schedule 14A filed on October 16, 2024, and incorporated herein by reference) (the “Definitive Proxy Statement”). |

| (a)(2)(ii) |

|

Form of Proxy Card (included in the Definitive Proxy

Statement and incorporated herein by reference). |

| (a)(2)(iii) |

|

Letter to Stockholders (included in the Definitive Proxy

Statement and incorporated herein by reference). |

| (a)(2)(iv) |

|

Notice of Special Meeting of Stockholders (included in the

Definitive Proxy Statement and incorporated herein by reference). |

| (a)(2)(v) |

|

Current Report on Form 8-K, filed August 28, 2024 (included

in the Definitive Proxy Statement and incorporated herein by reference). |

(a)(2)(vi)

|

|

Current Report on Form 8-K filed September 11, 2024 (included in the Definitive Proxy Statement and incorporated herein by reference).

|

(a)(2)(vii)

|

|

Current Report on Form 8-K filed October 15, 2024 (included in the Definitive Proxy Statement and

incorporated herein by reference).

|

| (a)(5)(i) |

|

Press Release, dated August 28, 2024 (incorporated by

reference to Exhibit 99.1 of the Company’s Form 8-K (filed August 28, 2024) (File No. 001-32407)). |

| (c)(i) |

|

Opinion of William Blair & Company, L.L.C., dated August

27, 2024 (included as Annex B to the Definitive Proxy Statement, and incorporated herein by reference). |

| (c)(ii)* |

|

Discussion Materials of William Blair & Company, L.L.C.

for the Special Committee, dated June 20, 2024. |

| (c)(iii)* |

|

Discussion Materials of William Blair & Company, L.L.C.

for the Special Committee, dated August 27, 2024. |

| (c)(iv)* |

|

Discussion Materials of AlixPartners, LLC for the Special

Committee, dated June 20, 2024. |

| (d)(i)** |

|

Agreement and Plan of Merger, dated August 27, 2024 by and among

ARC Document Solutions, Inc.,

TechPrint Holdings, LLC, and TechPrint Merger Sub, Inc. (included

as Annex A to the Definitive Proxy Statement, and incorporated herein by reference).

|

| (d)(ii) |

|

First Amendment, dated as of September 10, to the Agreement

and Plan of Merger by and among ARC Document Solutions, Inc., TechPrint Holdings, LLC, and TechPrint Merger Sub, Inc. (contained within Annex A to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(iii) |

|

Rollover Agreement, dated as of August 27, 2024, by and

among TechPrint Holdings, LLC, Kumarakulasingam Suriyakumar, Dilantha Wijesuriya, Jorge Avalos, Rahul Roy, Sujeewa Sean Pathiratne, Suriyakumar Family Trust, Shiyulli Suriyakumar 2013 Irrevocable Trust, and Seiyonne Suriyakumar 2013 Irrevocable

Trust (included as Annex C to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(iv) |

|

First Amendment to the Rollover Agreement, dated as of

September 10, by and among TechPrint Holdings, LLC, Kumarakulasingam Suriyakumar, Dilantha Wijesuriya, Jorge Avalos, Rahul Roy, Sujeewa Sean Pathiratne, Suriyakumar Family Trust, Shiyulli Suriyakumar 2013 Irrevocable Trust, and Seiyonne

Suriyakumar 2013 Irrevocable Trust (contained within Annex C to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(v) |

|

Equity Commitment Letter, dated August 27, 2024, dated

August 27, 2024, by and among TechPrint Holdings, LLC, Kumarakulasingam Suriyakumar and Sujeewa Sean Pathiratne (included as Annex D to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(vi)** |

|

Voting Agreement, dated as of August 27, 2024, by and among

TechPrint Holdings, LLC, Kumarakulasingam Suriyakumar, Dilantha Wijesuriya, Jorge Avalos, Rahul Roy, Sujeewa Sean Pathiratne, Suriyakumar Family Trust, Shiyulli Suriyakumar 2013 Irrevocable Trust, and Seiyonne Suriyakumar 2013 Irrevocable Trust

(included as Annex E to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(vii) |

|

First Amendment to the Voting Agreement, dated

as of September 10, by and among TechPrint Holdings, LLC, Kumarakulasingam Suriyakumar, Dilantha Wijesuriya, Jorge Avalos, Rahul Roy, Sujeewa Sean Pathiratne, Suriyakumar Family Trust, Shiyulli Suriyakumar 2013 Irrevocable Trust, and Seiyonne

Suriyakumar 2013 Irrevocable Trust (contained within Annex E to the Definitive Proxy Statement, and incorporated herein by reference). |

| (d)(viii)** |

|

Limited Guarantee, dated as of August 27, 2024, by and

between ARC Document Solutions, Inc. and Kumarakulasingam Suriyakumar (included as Annex F to the Definitive Proxy Statement, and incorporated herein by reference). |

(d)(ix)

|

|

Debt Commitment Letter, dated August 27, 2024, by and among TechPrint Holdings, LLC, TechPrint Merger Sub, Inc., U.S. Bank

National Association, BMO Bank N.A., Zions Bancorporation, N.A. dba California Bank & Trust and City National Bank, a national banking association (included as Annex H to the Definitive Proxy Statement and incorporated herein by reference).

|

| (f) |

|

Section 262 of the DGCL (included as Annex G to the

Definitive Proxy Statement, and incorporated herein by reference). |

| (g) |

|

Not Applicable. |

| 107* |

|

Filing Fee Table. |

|

**

|

Certain portions of this exhibit have been omitted pursuant to Item 1016 of Regulation M-A. The omitted information is (i) not material and

(ii) the type that the ARC Document Solutions, Inc. treats as private or confidential. Information that has been omitted has been noted in this document with a placeholder identified by the mark “[**]”.

|

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

ARC DOCUMENT SOLUTIONS, INC. |

| |

|

|

|

| |

By: |

/s/ Tracey Luttrell |

| |

|

Name: |

Tracey Luttrell |

| |

|

Title: |

Corporate Counsel & Corporate Secretary |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

TECHPRINT HOLDINGS, LLC |

| |

|

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

|

Name: |

Kumarakulasingam Suriyakumar |

| |

|

Title: |

Manager |

| |

|

|

|

| |

TECHPRINT MERGER SUB, INC. |

| |

|

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

|

Name: |

Kumarakulasingam Suriyakumar |

| |

|

Title: |

President |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

|

Name: |

Kumarakulasingam Suriyakumar |

| |

|

|

|

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

By: |

/s/ Dilantha Wijesuriya |

| |

|

Name: |

Dilantha Wijesuriya |

| |

|

|

|

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

By: |

/s/ Jorge Avalos |

| |

|

Name: |

Jorge Avalos |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

By: |

/s/ Rahul Roy |

| |

|

Name: |

Rahul Roy |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

By: |

/s/ Sujeewa Sean Pathiratne |

| |

|

Name: |

Sujeewa Sean Pathiratne |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

SURIYAKUMAR FAMILY TRUST |

| |

|

|

|

| |

By: |

/s/ Kumarakulasingam Suriyakumar |

| |

|

Name: |

Kumarakulasingam Suriyakumar |

| |

|

Title: |

Trustee |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

SHIYULLI SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

|

| |

By: |

/s/ Shiyulli Suriyakumar |

| |

|

Name: |

Shiyulli Suriyakumar |

| |

|

Title: |

Trustee |

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Date: October 16, 2024

| |

SEIYONNE SURIYAKUMAR 2013 IRREVOCABLE TRUST |

| |

|

|

|

| |

By: |

/s/ Seiyonne Suriyakumar |

| |

|

Name: |

Seiyonne Suriyakumar |

| |

|

Title: |

Trustee |

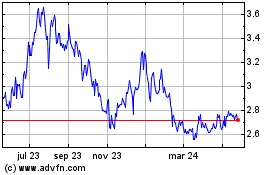

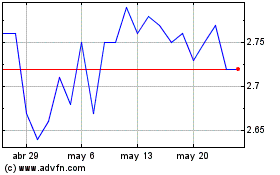

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

ARC Document Solutions (NYSE:ARC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024