Plans to Invest More Than $400 Million to

Maintain and Improve Existing Portfolio, Illustrating Commitment to

Delivering a Leading Resident Experience

Blackstone (NYSE: BX) and Apartment Income REIT Corp. (NYSE:

AIRC) (“AIR Communities” or the “Company”) today announced that

they have entered into a definitive agreement under which

Blackstone Real Estate Partners X (“Blackstone”) will acquire all

outstanding common shares of AIR Communities for $39.12 per share

in an all-cash transaction valued at approximately $10 billion,

including the assumption of debt.

The purchase price represents a premium of 25% to AIR

Communities’ closing share price on the NYSE on April 5, 2024, the

last trading day prior to the announcement of the transaction, and

a 25% premium to the volume weighted average share price on the

NYSE over the previous 30 days.

AIR Communities’ portfolio consists of 76 high-quality rental

housing communities concentrated primarily in coastal markets

including Miami, Los Angeles, Boston and Washington D.C. Blackstone

plans to invest more than $400 million to maintain and improve the

existing communities in the portfolio and may invest additional

capital to fund further growth.

“I am proud of the AIR team and its remarkable culture. The

transaction will strengthen the AIR mission to provide homes for

others, be a great place to work, act as responsible stewards of

AIR communities, and be a trusted partner to AIR investors. The

business the AIR team has built will be improved and expanded by

collaboration with Blackstone and a shared focus on serving

residents and investing wisely. The AIR team is grateful to

Blackstone for the opportunity and for its faith in what can be

accomplished working together,” said Terry Considine, President

& CEO of AIR Communities.

“AIR Communities represents the highest quality, large scale

apartment portfolio we have ever acquired, and is located in

markets where multifamily fundamentals are strong. We are very

impressed by the terrific operating team at AIR Communities and

look forward to working closely with them, while continuing to

deliver a fantastic resident experience,” said Nadeem Meghji,

Global Co-Head of Blackstone Real Estate.

Transaction Terms, Timing and Approvals

The transaction was unanimously approved by the AIR Communities

Board of Directors and is expected to close in the third quarter of

2024, subject to approval by AIR Communities’ stockholders and

other customary closing conditions. As a condition to the

transaction, AIR has suspended payment of its quarterly dividend,

effective immediately.

Subject to and upon completion of the transaction, AIR

Communities’ common stock will no longer be listed on the New York

Stock Exchange.

Advisors

BofA Securities, Barclays, Goldman Sachs & Co. LLC and Wells

Fargo are acting as Blackstone’s financial advisors, and Simpson

Thacher & Bartlett LLP is serving as Blackstone’s legal

counsel.

Citigroup Global Markets Inc. is acting as AIR Communities’

financial advisor, and Skadden, Arps, Slate, Meagher & Flom LLP

is serving as AIR Communities’ legal counsel.

About Apartment Income REIT Corp. (AIR Communities)

Apartment Income REIT Corp (NYSE: AIRC) is a publicly traded,

self-administered real estate investment trust (“REIT”). AIR’s

portfolio comprises 76 communities totaling 27,010 apartment homes

located in 10 states and the District of Columbia. AIR offers a

simple, predictable business model with focus on what we call the

AIR Edge, the cumulative result of our focus on resident selection,

satisfaction, and retention, as well as relentless innovation in

delivering best-in-class property management. The AIR Edge is a

durable operating advantage in driving organic growth, as well as

making possible the opportunity for excess returns for properties

new to AIR’s platform. For additional information, please visit

aircommunities.com.

About Blackstone Real Estate

Blackstone is a global leader in real estate investing.

Blackstone’s real estate business was founded in 1991 and has US

$337 billion of investor capital under management. Blackstone is

the largest owner of commercial real estate globally, owning and

operating assets across every major geography and sector, including

logistics, residential, office, hospitality and retail. Our

opportunistic funds seek to acquire undermanaged, well-located

assets across the world. Blackstone’s Core+ business invests in

substantially stabilized real estate assets globally, through both

institutional strategies and strategies tailored for income-focused

individual investors including Blackstone Real Estate Income Trust,

Inc. (BREIT), a U.S. non-listed REIT, and Blackstone’s European

yield-oriented strategy. Blackstone Real Estate also operates one

of the leading global real estate debt businesses, providing

comprehensive financing solutions across the capital structure and

risk spectrum, including management of Blackstone Mortgage Trust

(NYSE: BXMT).

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes certain disclosures which contain

“forward-looking statements” within the meaning of the federal

securities laws, including but not limited to those statements

related to the transaction, including financial estimates and

statements as to the expected timing, completion and effects of the

transaction. You can identify forward-looking statements because

they contain words such as “expect,” “believe,” “target,”

“project,” “goals,” “estimate,” “potential,” “predict,” “may,”

“will,” “might,” “could,” “forecast,” “outlook” and variations of

these terms or the negative of these terms and similar expressions.

Forward-looking statements, including statements regarding the

transaction, are based on the Company’s current expectations and

assumptions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that may differ materially from those

contemplated by the forward-looking statements, which are neither

statements of historical fact nor guarantees or assurances of

future performance.

Important factors, risks and uncertainties that could cause

actual results to differ materially from such plans, estimates or

expectations include but are not limited to: (i) the parties’

ability to complete the transaction on the anticipated terms and

timing, or at all, including the Company’s ability to obtain the

required stockholder approval, and the parties’ ability to satisfy

the other conditions to the completion of the transaction; (ii)

potential litigation relating to the transaction that could be

instituted against the Company or its directors, managers or

officers, including the effects of any outcomes related thereto;

(iii) the risk that disruptions from the transaction will harm the

Company’s business, including current plans and operations,

including during the pendency of the transaction; (iv) the ability

of the Company to retain and hire key personnel; (v) potential

adverse reactions or changes to business relationships resulting

from the announcement or completion of the transaction; (vi)

legislative, regulatory and economic developments; (vii) potential

business uncertainty, including changes to existing business

relationships, during the pendency of the transaction that could

affect the Company’s financial performance; (viii) certain

restrictions during the pendency of the transaction that may impact

the Company’s ability to pursue certain business opportunities or

strategic transactions; (ix) unpredictability and severity of

catastrophic events, including but not limited to acts of

terrorism, outbreaks of war or hostilities or the COVID-19

pandemic, as well as management’s response to any of the

aforementioned factors; (x) the possibility that the transaction

may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (xi) the occurrence of any

event, change or other circumstance that could give rise to the

termination of the transaction, including in circumstances

requiring the Company to pay a termination fee; (xii) those risks

and uncertainties set forth under the headings “Special Note

Regarding Forward Looking Statements” and “Risk Factors” in the

Company’s most recent Annual Report on Form 10-K, as such risk

factors may be amended, supplemented or superseded from time to

time by other reports filed by the Company with the Securities and

Exchange Commission (the “SEC”) from time to time, which are

available via the SEC’s website at www.sec.gov; and (xiii) those

risks that will be described in the proxy statement that will be

filed with the SEC and available from the sources indicated

below.

These risks, as well as other risks associated with the

transaction, will be more fully discussed in the proxy statement

that will be filed by the Company with the SEC in connection with

the transaction. There can be no assurance that the transaction

will be completed, or if it is completed, that it will close within

the anticipated time period. These factors should not be construed

as exhaustive and should be read in conjunction with the other

forward-looking statements. The forward-looking statements relate

only to events as of the date on which the statements are made. The

Company and Blackstone do not undertake any obligation to publicly

update or review any forward-looking statement except as required

by law, whether as a result of new information, future developments

or otherwise. If one or more of these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, our actual results may vary materially from what

we may have expressed or implied by these forward-looking

statements. We caution that you should not place undue reliance on

any of our forward-looking statements. You should specifically

consider the factors identified in this communication that could

cause actual results to differ. Furthermore, new risks and

uncertainties arise from time to time, and it is impossible for us

to predict those events or how they may affect the Company or

Blackstone.

Important Additional Information and Where to Find It

This communication is being made in connection with the

transaction. In connection with the transaction, the Company will

file a proxy statement on Schedule 14A and certain other documents

regarding the transaction with the SEC. Promptly after filing its

definitive proxy statement with the SEC, the definitive proxy

statement will be mailed to stockholders of the Company. This

communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION, COMPANY STOCKHOLDERS ARE URGED TO

READ THE PROXY STATEMENT THAT WILL BE FILED BY THE COMPANY WITH THE

SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION.

Company stockholders will be able to obtain, free of charge, copies

of such documents filed by the Company when filed with the SEC in

connection with the transaction at the SEC’s website

(http://www.sec.gov). In addition, the Company’s stockholders will

be able to obtain, free of charge, copies of such documents filed

by the Company at the Company’s website (www.aircommunities.com).

Alternatively, these documents, when available, can be obtained

free of charge from the Company upon written request to the Company

at 4582 South Ulster Street, Suite 1700, Denver, Colorado

80237.

Participants in the Solicitation

The Company and certain of its directors, executive officers and

other employees may be deemed to be participants in the

solicitation of proxies from stockholders of the Company in

connection with the transaction. Additional information regarding

the identity of the participants, and their respective direct and

indirect interests in the transaction, by security holdings or

otherwise, will be set forth in the proxy statement and other

relevant materials to be filed with the SEC in connection with the

transaction (if and when they become available). You may obtain

free copies of these documents using the sources indicated

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240408368769/en/

AIR Communities: Matthew O’Grady, Executive Vice

President, Capital Markets (303) 691-4566

matthew.ogrady@aircommunities.com

Blackstone: Jillian Kary Jillian.Kary@Blackstone.com

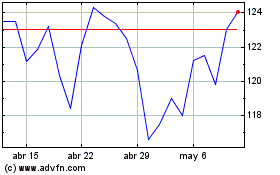

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025