Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

18 Septiembre 2024 - 11:43AM

Edgar (US Regulatory)

as

of

July

31,

2024

(Unaudited)

The

Central

and

Eastern

Europe

Fund,

Inc.

Shares

Value

($)

Poland

61.8%

Common

Stocks

Air

Freight

&

Logistics

0.5%

InPost

SA*

20,000

345,871

Banks

13.0%

Alior

Bank

SA

25,000

597,882

Bank

Polska

Kasa

Opieki

SA

130,000

5,257,028

Powszechna

Kasa

Oszczednosci

Bank

Polski

SA

225,000

3,344,510

9,199,420

Broadline

Retail

3.2%

Allegro.eu

SA

144A*

247,775

2,273,796

Capital

Markets

1.1%

Warsaw

Stock

Exchange

†

75,000

802,660

Commercial

Services

&

Supplies

1.0%

Mo-BRUK

SA

†

10,000

726,081

Construction

&

Engineering

1.9%

Budimex

SA

8,250

1,325,949

Consumer

Staples

Distribution

&

Retail

2.2%

Dino

Polska

SA

144A*

17,500

1,553,006

Diversified

Telecommunication

Services

2.0%

Orange

Polska

SA

700,000

1,401,588

Electric

Utilities

5.4%

Enea

SA*

250,000

694,567

PGE

Polska

Grupa

Energetyczna

SA*

1,100,000

2,024,455

Tauron

Polska

Energia

SA*

1,100,000

1,053,271

3,772,293

Entertainment

0.0%

CD

Projekt

SA

100

4,010

Household

Durables

0.5%

Dom

Development

SA

8,500

361,729

Insurance

8.2%

Powszechny

Zaklad

Ubezpieczen

SA

475,000

5,810,412

Interactive

Media

&

Services

0.4%

Wirtualna

Polska

Holding

SA

(Registered)

11,000

255,414

Metals

&

Mining

4.6%

Grupa

Kety

SA

3,250

673,925

KGHM

Polska

Miedz

SA

75,000

2,573,428

3,247,353

Shares

Value

($)

Oil,

Gas

&

Consumable

Fuels

9.7%

ORLEN

SA

422,500

6,888,460

Professional

Services

1.4%

Benefit

Systems

SA

1,100

734,905

Grupa

Pracuj

SA

20,000

293,962

1,028,867

Real

Estate

Management

&

Development

1.3%

Develia

SA

275,000

394,491

Murapol

SA

60,000

548,191

942,682

Textiles,

Apparel

&

Luxury

Goods

5.4%

LPP

SA

1,000

3,829,573

Total

Poland

(Cost

$31,038,874)

43,769,164

Hungary

18.0%

Common

Stocks

Banks

6.5%

OTP

Bank

Nyrt

90,000

4,606,484

Diversified

Telecommunication

Services

2.1%

Magyar

Telekom

Telecommunications

PLC

(ADR)

500,000

1,496,102

Oil,

Gas

&

Consumable

Fuels

4.4%

MOL

Hungarian

Oil

&

Gas

PLC

400,000

3,116,284

Pharmaceuticals

5.0%

Richter

Gedeon

Nyrt

125,000

3,561,821

Total

Hungary

(Cost

$8,517,333)

12,780,691

Russia

6.9%

Common

Stocks

Banks

0.0%

Sberbank

of

Russia

PJSC**

(a)

3,600,000

0

Broadline

Retail

1.6%

Ozon

Holdings

PLC

(ADR)*

(a)

60,000

1,128,400

Chemicals

0.0%

PhosAgro

PJSC

(GDR)

(Registered)*

(a)

90,000

0

Consumer

Staples

Distribution

&

Retail

1.6%

Fix

Price

Group

PLC

(GDR)

(Registered)*

(a)

125,000

118,750

Magnit

PJSC**

(a)

63,909

0

X5

Retail

Group

NV

(GDR)

(Registered)*

(a)

137,884

999,659

1,118,409

Shares

Value

($)

Interactive

Media

&

Services

1.0%

Yandex

NV

''A''*

(a)

188,000

687,486

Metals

&

Mining

0.0%

Alrosa

PJSC**

(a)

1,670,000

0

GMK

Norilskiy

Nickel

PAO

(ADR)*

(a)

50,000

0

Magnitogorsk

Iron

&

Steel

Works

PJSC

(GDR)

(Registered)*

(a)

74,569

0

Polyus

PJSC

(GDR)

(Registered)*

(a)

20,000

0

0

Oil,

Gas

&

Consumable

Fuels

2.4%

Gazprom

PJSC**

(a)

5,000,000

0

Lukoil

PJSC**

(a)

209,500

0

Novatek

PJSC

(GDR)

(Registered)*

(a)

37,500

1,218,750

Tatneft

PJSC

(ADR)*

†

(a)

100,000

478,400

1,697,150

Wireless

Telecommunication

Services

0.3%

Mobile

Telesystems

PJSC

(ADR)*

(a)

250,000

232,500

Total

Russia

(Cost

$58,955,122)

4,863,945

Czech

Republic

3.9%

Common

Stocks

Banks

1.5%

Komercni

Banka

AS

30,000

1,035,098

Moneta

Money

Bank

AS

144A

1,000

4,572

1,039,670

Electric

Utilities

2.4%

CEZ

AS

45,000

1,729,519

Total

Czech

Republic

(Cost

$2,687,237)

2,769,189

Moldova

3.4%

Common

Stocks

Beverages

3.4%

Purcari

Wineries

PLC

(Registered)

(Cost

$1,551,236)

700,000

2,403,877

Austria

2.4%

Common

Stocks

Banks

2.4%

Erste

Group

Bank

AG

32,500

1,691,046

Oil,

Gas

&

Consumable

Fuels

0.0%

OMV

AG

100

4,188

Total

Austria

(Cost

$985,731)

1,695,234

Shares

Value

($)

Portugal

0.7%

Common

Stocks

Consumer

Staples

Distribution

&

Retail

0.7%

Jeronimo

Martins

SGPS

SA

(Cost

$665,930)

30,000

524,326

Kazakhstan

0.3%

Common

Stocks

Metals

&

Mining

0.3%

Solidcore

Resources

PLC

(Cost

$1,244,170)*

75,000

196,500

France

0.0%

Common

Stocks

Oil,

Gas

&

Consumable

Fuels

0.0%

TotalEnergies

SE

(Cost

$4,732)

100

6,762

Securities

Lending

Collateral

1.2%

DWS

Government

&

Agency

Securities

Portfolio

''DWS

Government

Cash

Institutional

Shares'',

5.24%

(Cost

$833,837)

(b)

(c)

833,837

833,837

Cash

Equivalents

1.9%

DWS

Central

Cash

Management

Government

Fund,

5.37%

(Cost

$1,381,336)

(c)

1,381,336

1,381,336

%

of

Net

Assets

Value

($)

Total

Investment

Portfolio

(Cost

$107,865,538)

100.5

71,224,861

Other

Assets

and

Liabilities,

Net

(0.5)

(366,953)

Net

Assets

100.0

70,857,908

For

information

on

the

Fund’s

policies

regarding

the

valuation

of

investments

and

other

significant

accounting

policies,

please

refer

to

the

Fund’s

most

recent

semi-annual

or

annual

financial

statements.

A

summary

of

the

Fund’s

transactions

with

affiliated

investments

during

the

period

ended

July

31,

2024

are

as

follows:

Net

Change

Value

($)

at

10/31/2023

Purchases

Cost

($)

Sales

Proceeds

($)

Net

Real-

ized

Gain/

(Loss)

($)

in

Unreal-

ized

Appreci-

ation/

(Depreci-

ation)

($)

Income

($)

Capital

Gain

Distri-

butions

($)

Number

of

Shares

at

7/31/2024

Value

($)

at

7/31/2024

Securities

Lending

Collateral

1.2%

DWS

Government

&

Agency

Securities

Portfolio

''DWS

Government

Cash

Institutional

Shares'',

5.24%

(b)

(c)

1,788,397

–

954,560(d)

–

–

15,836

–

833,837

833,837

Cash

Equivalents

1.9%

DWS

Central

Cash

Management

Government

Fund,

5.37%

(c)

2,025,993

11,023,045

11,667,702

–

–

53,456

–

1,381,336

1,381,336

3,814,390

11,023,045

12,622,262

–

–

69,292

–

2,215,173

2,215,173

*

Non-income

producing

security.

**

Non-income

producing

security;

due

to

applicable

sanctions,

dividend

income

was

not

recorded.

†

All

or

a

portion

of

these

securities

were

on

loan.

The

value

of

all

securities

loaned

at

July

31,

2024

amounted

to

$677,351,

which

is

1.0%

of

net

assets.

(a)

Investment

was

valued

using

significant

unobservable

inputs.

(b)

Represents

cash

collateral

held

in

connection

with

securities

lending.

Income

earned

by

the

Fund

is

net

of

borrower

rebates.

(c)

Affiliated

fund

managed

by

DWS

Investment

Management

Americas,

Inc.

The

rate

shown

is

the

annualized

seven-day

yield

at

period

end.

(d)

Represents

the

net

increase

(purchases

cost)

or

decrease

(sales

proceeds)

in

the

amount

invested

in

cash

collateral

for

the

period

ended

July

31,

2024.

144A:

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

ADR:

American

Depositary

Receipt

GDR:

Global

Depositary

Receipt

PJSC:

Public

Joint

Stock

Company

For

purposes

of

its

industry

concentration

policy,

the

Fund

classifies

issuers

of

portfolio

securities

at

the

industry

sub-

group

level.

Certain

of

the

categories

in

the

above

Schedule

of

Investments

consist

of

multiple

industry

sub-groups

or

industries.

The

United

States,

the

European

Union,

the

United

Kingdom

and

other

countries

have

imposed

sanctions

on

Russia,

Russian

companies,

and

Russian

individuals

in

response

to

actions

taken

by

Russia

in

recent

years,

including

its

February

2022

invasion

of

Ukraine

and

subsequent

activities.

In

turn

Russia

has

imposed

sanctions

on

Western

individuals,

businesses

and

products,

and

the

Russian

central

bank

has

taken

actions

that

have

effectively

frozen

investments

by

Western

entities,

including

the

Fund,

in

Russian

companies.

These

s

anctions

have

adversely

affected

not

only

the

Russian

economy

but

also

the

economies

of

many

countries

in

Europe,

including

countries

in

Central

and

Eastern

Europe,

and

the

continuation

of

sanctions,

or

the

imposition

of

new

sanctions,

may

have

further

adverse

effects

on

the

Russian

and

European

economies.

As

a

result

of

Russia’s

invasion

of

Ukraine

and

the

resulting

dislocations,

Wes

tern

sanctions

and

Russia’s

retaliatory

measures,

the

value

and

liquidity

of

the

Fund’s

portfolio

assets

have

been

severely

adversely

affected,

and

its

Russian

investments

(some

of

which

are

in

companies

that

are

subject

to

sanctions)

have

been

fair

valued

at

zero

since

March

14,

2022

.

It

is

not

known

if

the

situation

will

improve

,

although

the

Fund

has

observed

occasional

privately

negotiated

transactions

in

depositary

receipts

of

non-sanctioned

Russian

issuers

taking

place

(at

prices

that

are

deeply

discounted

from

those

taking

place

through

the

facilities

of

the

Moscow

Stock

Exchange).

In

May

2024,

the

Fund

was

successful

in

selling

depositary

receipts

of

one

non-sanctioned

Russian

issuer

in

such

a

privately

negotiated

transaction

resulting

in

positive

impact

to

the

Fund's

net

asset

value.

War,

terrorism,

sanctions,

economic

uncertainty,

trade

disputes,

public

health

crises,

natural

disasters,

climate

change

and

related

geopolitical

events

have

led

and,

in

the

future,

may

lead

to

significant

disruptions

in

U.S.

and

world

economies

and

markets,

which

may

lead

to

increased

market

volatility

and

may

have

significant

adverse

effects

on

the

Fund

and

its

investments.

In

the

case

of

the

Fund,

Russia’s

invasion

of

Ukraine

has

materially

adversely

affected,

and

may

continue

to

materially

adversely

affect,

the

value

and

liquidity

of

the

Fund’s

portfolio.

Fair

Value

Measurements

Various

inputs

are

used

in

determining

the

value

of

the

Fund’s

investments.

These

inputs

are

summarized

in

three

broad

levels.

Level

1

includes

quoted

prices

in

active

markets

for

identical

securities.

Level

2

includes

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

prepayment

speeds

and

credit

risk).

Level

3

includes

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

level

assigned

to

the

securities

valuations

may

not

be

an

indication

of

the

risk

associated

with

investing

in

those

securities.

The

following

is

a

summary

of

the

inputs

used

as

of

July

31,

2024

in

valuing

the

Fund’s

investments.

(e)

See

Schedule

of

Investments

for

additional

detailed

categorizations

.

During

the

period

ended

July

31,

2024,

the

amount

of

transfers

between

Level

3

and

Level

1

was

$210,938.

The

investments

were

transferred

from

Level

3

to

Level

1

due

to

increase

in

market

activity.

Transfers

between

price

levels

are

recognized

at

the

beginning

of

the

reporting

period.

OBTAIN

AN

OPEN-END

FUND

PROSPECTUS

To

obtain

a

summary

prospectus,

if

available,

or

prospectus,

download

one

from

fundsus.dws.com,

talk

to

your

financial

representative

or

call

(800)

728-3337.

We

advise

you

to

carefully

consider

the

product's

objectives,

risks,

charges

and

expenses

before

investing.

The

summary

prospectus

and

prospectus

contain

this

and

other

important

information

about

the

investment

product.

Please

read

the

prospectus

carefully

before

you

invest.

CLOSED-END

FUNDS

The

shares

of

most

closed-end

funds,

including

the

Fund,

are

not

continuously

offered.

Once

issued,

shares

of

closed-end

funds

are

bought

and

sold

in

the

open

market.

Shares

of

closed-end

funds

frequently

trade

at

a

discount

to

net

asset

value.

The

price

of

the

fund’s

shares

is

determined

by

a

number

of

factors,

several

of

which

are

beyond

the

control

of

the

fund.

Therefore,

the

fund

cannot

predict

whether

its

shares

will

trade

at,

below

or

above

net

asset

value.

The

brand

DWS

represents

DWS

Group

GmbH

&

Co.

KGaA

and

any

of

its

subsidiaries

such

as

DWS

Distributors,

Inc.,

which

offers

investment

products,

or

DWS

Investment

Management

Americas

Inc.

and

RREEF

America

L.L.C.,

which

offer

advisory

services.

NO

BANK

GUARANTEE

|

NOT

FDIC

INSURED

|

MAY

LOSE

VALUE

CEE-PH3

R-080548-2

(1/25)

Assets

Level

1

Level

2

Level

3

Total

Common

Stocks

(e)

Poland

$

43,769,164

$

—

$

—

$

43,769,164

Hungary

12,780,691

—

—

12,780,691

Russia

—

—

4,863,945

4,863,945

Czech

Republic

2,769,189

—

—

2,769,189

Moldova

2,403,877

—

—

2,403,877

Austria

1,695,234

—

—

1,695,234

Portugal

524,326

—

—

524,326

Kazakhstan

196,500

—

—

196,500

France

6,762

—

—

6,762

Short-Term

Instruments

(e)

2,215,173

—

—

2,215,173

Total

$

66,360,916

$

—

$

4,863,945

$

71,224,861

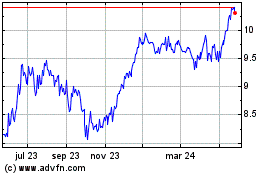

Central and Eastern Europe (NYSE:CEE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

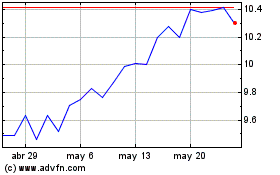

Central and Eastern Europe (NYSE:CEE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024