Verde AgriTech Ltd (TSX: “

NPK”)

(OTCMKTS: “

VNPKF”) (“

Verde” or

the “

Company”) is pleased to announce that it has

filed a request with the National Land Transport Agency

(“

ANTT”, from Agência Nacional de Transportes

Terrestres) for authorization to build a railway branch line (the

“

Railway”) to transport up to 50 million tonnes

per year (“

Mtpy”) of Verde’s multinutrient

potassium products, BAKS® and K Forte®, sold internationally as

Super Greensand®, (the “

Product”).

The Railway will connect Verde’s facilities in São Gotardo to

Ibiá, both municipalities in Minas Gerais state, where there is a

railway node, part of the Ferrovia Centro Atlântica

(“FCA”). FCA is the largest railroad network in

Brazil, interconnecting seven states and the Federal District. The

FCA railways are the main freight route between the Southeast,

Northeast and Midwest regions in Brazil.1

“The Railway will be a major milestone on our way to mitigate

Brazil’s dependency on imported potash. By connecting Verde’s

potash mines, Brazil's largest known deposit, to its main consumer

centers, the Railway will give farmers access to an even more

substantial volume of Product,” commented Cristiano Veloso, Verde’s

founder, and CEO.

In 2021 Brazil’s consumption of potash (in K2O) was 7.92

million,2 which is equivalent to 79.20 million tonnes of Verde’s

Product. Currently, over 96% of Brazil's potash is supplied by

imports, mostly in the form of KCl, sold by the Canadian and

Belarus-Russian duopoly. Verde has a combined measured and

indicated mineral resource of 1.47 billion tonnes at 9.28% K2O and

an inferred mineral resource of 1.85 billion tonnes at 8.60% K2O

(using a 7.5% K2O cut-off grade).3 This amounts to 295.70 million

tonnes of potash in K2O.

Verde's Plant 1 operates with a capacity of 0.6Mtpy and Plant 2

operates with a capacity of 1.2Mtpy, totalling 1.8Mtpy. With Plant

2’s nameplate capacity of 2.4Mtpy to be achieved after its ramp up

is concluded, the Company’s overall production capacity will be 3

Mtpy. Construction of Plant 3 is expected for 2024, with an

expected capacity of 10Mtpy.

Based on the studies for the Pre-Feasibility Study filed by the

Company in 2022 (the “PFS”), Verde has determined

the viability of using road haulage for distribution logistics of

up to 23Mtpy of Product. A rail spur will only be necessary for

logistics of production exceeding such amount.

The Railway Authorization Program (“Pro

Trilhos”), approved in August 2021 by the Brazilian

Federal Government,4 allows the private sector to build and operate

railroads, branches, yards and railroad terminals, with the

objective of increasing the attractiveness of the private sector to

make investments in railroads, whether “greenfields” (new ventures

– railroads built from scratch) or “brownfields” (development that

will use existing railroads, at least in part of the desired

length).

Next Steps

The decision by ANTT and the Brazilian Ministry of

Infrastructure is expected in the coming months. If the

Authorization is granted, a contract between ANTT and Verde will be

subsequently signed, authorizing the exploration of the Railway in

a private regime. After that, the Company shall start the

environmental and engineering studies for this project.

Capital Expenditure

The PFS estimates a CAPEX of US$283.02 million5

for the construction of a railway from São Gotardo to Ibiá to

transport up to 50Mtpy of Product. The total CAPEX estimated in the

PFS for the 50Mtpy Scenario is US$ 553.99 million, which includes

the railway branch line, processing costs, road improvement,

licensing, technical studies and projects, land purchase,

equipment, personnel mobilization and demobilization, and a 15%

contingency amount.

As stated in the press release published by the

Company on May 16, 2022,6 the investment in the railway branch

construction is expected to be assumed by the rail operator. Verde

is studying the possibility of potential partnerships for technical

support in the Railway implementation and logistics operation.

The table below shows the summary of the

financial-economic analysis for the 50Mtpy Scenario:

|

50Mtpy Scenario |

|

Description |

Unit |

Value |

|

Proven and probable reserves |

million tonnes |

1,297.66 |

|

K2O grade |

% |

9.19 |

|

Capex |

US$ million |

553.99 |

|

Operating cost |

US$/tonne of Product |

8.06 |

|

General and Administrative Expenses |

US$/tonne of Product |

2.01 |

|

Sustaining capital |

US$/tonne of Product |

0.50 |

|

|

|

Product composition |

Unit |

K2O |

K2O + S |

K2O + S +

Micronutrients |

|

Product Sale Price |

US$/tonne of Product |

74.05 |

84.79 |

92.05 |

|

NPV after-tax |

US$ billion |

9.34 |

11.50 |

13.54 |

|

NPV discount rate |

% |

8.00 |

8.00 |

8.00 |

|

IRR after-tax |

% |

167.86 |

196.19 |

227.08 |

|

Cumulative Cash Flow |

US$ billion |

22.74 |

28.04 |

32.98 |

About Verde AgriTech

Verde is an agricultural technology company that produces potash

fertilizers. Our purpose is to improve the health of all people and

the planet. Rooting our solutions in nature, we make agriculture

healthier, more productive, and profitable.

Verde is a fully integrated company, from the mining and

processing its main feedstock from its 100% owned mineral

properties, to the Product sales processes, which also include

direct technical advice for farmers, and distribution.

Verde’s focus on research and development has resulted in one

patent and eight patents pending. Among its proprietary

technologies are Cambridge Tech, 3D Alliance, MicroS Technology, N

Keeper, and Bio Revolution.7 Currently, the Company is fully

licensed to produce up to 2.8 million tonnes per year of its

multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®.8 By the end of 2022, it plans

to become Brazil's largest potash producer by capacity.9 Verde has

a combined measured and indicated mineral resource of 1.47 billion

tonnes at 9.28% K2O and an inferred mineral resource of 1.85

billion tonnes at 8.60% K2O (using a 7.5% K2O cut-off grade).10

This amounts to 295.70 million tonnes of potash in K2O. For

context, in 2021 Brazil’s total consumption of potash in K2O was

7.92 million.11

Brazil ranks second in global potash demand and is its single

largest importer, currently depending on external sources for over

96% of its potash needs. In 2021, potash accounted for

approximately 2% of all Brazilian imports by dollar value.

Corporate Presentation

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/9eftew2grqtk6wfr

Investors Newsletter

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

https://bit.ly/InvestorNewsletter_October-2022_

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of Mineral Resources and Mineral

Reserves;

- the PFS representing a viable development option for the

Project;

- estimates of the capital costs of constructing mine facilities

and bringing a mine into production, of sustaining capital and the

duration of financing payback periods;

- the estimated amount of future production, both produced and

sold;

- timing of disclosure for the PFS and recommendations from the

Special Committee;

- the Company’s competitive position in Brazil and demand for

potash; and,

- estimates of operating costs and total costs, net cash flow,

net present value and economic returns from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

- the presence of and continuity of resources and reserves at the

Project at estimated grades;

- the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations;

- the capacities and durability of various machinery and

equipment;

- the availability of personnel, machinery and equipment at

estimated prices and within the estimated delivery times;

- currency exchange rates;

- Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed;

- appropriate discount rates applied to the cash flows in the

economic analysis;

- tax rates and royalty rates applicable to the proposed mining

operation;

- the availability of acceptable financing under assumed

structure and costs;

- anticipated mining losses and dilution;

- reasonable contingency requirements;

- success in realizing proposed operations;

- receipt of permits and other regulatory approvals on acceptable

terms; and

- the fulfilment of environmental assessment commitments and

arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

_______________________________________

1 Source: https://www.fcatransforma.com.br/ 2 Source: Union of

the Agricultural Fertilizers and Correctives Industry in the State

of São Paulo ("SIACESP", from Sindicato da Indústria de

Fertilizantes e Corretivos Agropecuários no Estado de São Paulo).3

As per the National Instrument 43-101 Standards of Disclosure for

Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR in

2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

4 Source:

https://www.gov.br/infraestrutura/pt-br/assuntos/transporte-terrestre_antigo/programa-de-autorizacoes-ferroviarias,

regulated by Law 14.273, (December 23, 2021) and ANTT

Resolution 5.987 (September 01, 2022).5 For further information,

please see page 264 of the PFS:

https://investor.verde.ag/wp-content/uploads/2022/05/NI-43-101-Pre-Feasibility-Technical-Report-for-the-Cerrado-Verde-Project.pdf

6 See the press release at:

https://investor.verde.ag/wp-content/uploads/2022/05/Verde-AgriTech-Press-Release-Pre-Feasibility-Results-May-16-2022.pdf

7 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9 8 See

the release at:

https://investor.verde.ag/2-5-million-tonnes-per-year-potash-mining-concession-granted-to-verde/

9 See the release at:

https://investor.verde.ag/verde-to-reach-3-million-tonnes-potash-production-capacity-in-2022/

10 As per the National Instrument 43-101 Standards of Disclosure

for Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR

in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

11 Union of the Agricultural Fertilizers and Correctives Industry,

in the State of São Paulo (“SIACESP”, from Sindicato da

Indústria de Fertilizantes e Corretivos Agropecuários, no Estado de

São Paulo).

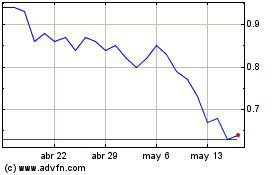

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Verde Agritech (TSX:NPK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024