UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2009

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 000-53350

AXIS TECHNOLOGIES GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

26-1326434

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

2055 S. Folsom

Lincoln, Nebraska 68522

(Address of principal executive offices)

(866) 458-9880

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of Each Class

|

|

Name of Exchange on Which Registered

|

|

N/A

|

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

|

Title of Each Class

|

|

Common Stock, par value $0.001 per share

|

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes

¨

No

x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨

No

x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

¨

No

x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

¨

Accelerated filer

¨

Non-accelerated filer

¨

Smaller reporting company

x

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

¨

No

x

At June 30, 2009, the aggregate market value of shares held by non-affiliates of the Registrant (based upon 22,345,195 shares on June 30, 2009) was $4,022,135.

At June 10, 2010, there were 74,980,181 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE

OF CONTENTS

|

PART I

|

|

Page

|

|

|

|

|

|

|

|

Item 1.

|

|

|

|

4

|

|

|

|

|

|

|

|

Item 1A.

|

|

|

|

12

|

|

|

|

|

|

|

|

Item 2.

|

|

|

|

16

|

|

|

|

|

|

|

|

Item 3.

|

|

|

|

16

|

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

|

|

Item 5.

|

|

|

|

16

|

|

|

|

|

|

|

|

Item 7.

|

|

|

|

18

|

|

|

|

|

|

|

|

Item 8.

|

|

|

|

24

|

|

|

|

|

|

|

|

Item 9.

|

|

|

|

24

|

|

|

|

|

|

|

|

Item 9AT.

|

|

|

|

24

|

|

|

|

|

|

|

|

Item 9B.

|

|

|

|

25

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

|

|

Item 10.

|

|

|

|

25

|

|

|

|

|

|

|

|

Item 11.

|

|

|

|

27

|

|

|

|

|

|

|

|

Item 12.

|

|

|

|

29

|

|

|

|

|

|

|

|

Item 13.

|

|

|

|

30

|

|

|

|

|

|

|

|

Item 14.

|

|

|

|

31

|

|

|

|

|

|

|

|

Item 15.

|

|

|

|

32

|

PART

I

Axis Technologies Group, Inc. (the “Company” and “Axis”) was incorporated in Delaware on September 30, 1997. Through the Company’s wholly owned operating subsidiary, Axis Technologies, Inc., a Delaware corporation, the Company is in the business of the development and marketing of daylight harvesting fluorescent lighting ballasts that use natural lighting to reduce electricity consumption. The Company’s market for advertising and selling the product currently lies within North America.

The Company was originally organized in September 1996 as California limited liability company under the name Challenge 2000 International, LLC. In September 1997, the Company reorganized into a Delaware corporation and changed its name to C2i Solutions, Inc. From the Company’s inception in September 1996 to the first quarter of 1999, the Company’s business involved providing services to address the Year 2000 or “Y2K” computer software programming issues, including transitioning legacy program applications. At the end of the first quarter of 1999, the Company changed its primary business focus from Y2K issues to providing companies with e-business/e-commerce solutions. In connection with this strategic realignment, the Company completed its Y2K contracts, closed its four regional offices and eliminated approximately 14 employee positions. During this period the Company also began focusing on potential merger and acquisition targets. On December 22, 1999, the Company merged with its wholly owned subsidiary, GlobalDigitalCommerce.com, Inc., a Delaware corporation, and in connection therewith, changed its name from C2i Solutions, Inc. to GlobalDigitalCommerce.com, Inc. The Company was also previously subject to the reporting requirements of the Exchange Act until it filed a Form 15 and withdrew as a reporting company in March 2001.

Subsequent to its withdrawal as a public company, the Company amended its Certificate of Incorporation to effect a name change to Dreamfield Holding Inc. in October 2002. On May 18, 2004, the Company amended its Certificate of Incorporation again to change its name to Riverside Entertainment, Inc. On October 25, 2006, the Company acquired all of the issued and outstanding shares of Axis Technologies, Inc. pursuant to a share exchange transaction, whereby Axis Technologies, Inc. became a wholly owned subsidiary of the Company. Axis Technologies, Inc. had a total of six shareholders, each of which exchanged all of their ownership interest in the subsidiary for shares in the Company. In exchange for their shares, the owners of the subsidiary shares received a combined total of 45,000,000 newly issued restricted shares of the Company which resulted in a change of control of the Company. As a result of the transaction, the existing management of Axis Technologies, Inc. became the new management of the Company.

The Company currently develops, tests, and patents a unique technology to create energy efficient products that meet federal energy code standards and encourages “green” initiatives for high-profile companies. The Company’s primary products are self-contained electronic, dimming and daylight harvesting, fluorescent ballasts. A ballast is an electrical component used with a fluorescent bulb to conduct electricity at each end of the tube. It supplies the initial electricity to the bulb that creates light, and then it regulates the amount of electricity flowing through the bulb so that it emits the right amount of light.

Extensive testing was conducted to ensure product reliability, and energy-saving properties. The Company has obtained and owns the patent rights for our ballasts’ unique control system, and has trademarked our slogan “The Future of Fluorescent Lighting”. Underwriters Laboratory (“UL”), the lighting industry’s certification authority, has approved our products for use in the United States and Canada.

The Company’s target market is small to large commercial users of fluorescent lighting fixtures, including office buildings, wholesale and retail buildings, hospitals, schools and government buildings. We have arrangements with sales representatives, electrical distributors, electrical contractors, retrofitters, ESCO’s (Energy Service Companies), and OEM’s (Original Equipment Manufacturers) to market, distribute and install the Company’s products. Through these arrangements, sales to contractors, distributors, ESCO’s and OEM’s are made through purchase orders submitted by them to the Company. However, we have not entered into any written agreements regarding on-going or future sales involving any of these parties.

Market for Electronic Dimming Ballasts

Historically, there have been two types of fluorescent lamp ballasts: magnetic and electronic. Generally, electronic ballasts were more expensive to purchase than the magnetic ballasts; however, electronic ballasts use less electricity. In September 2000, the U.S. Department of Energy (“DOE”) published the Fluorescent Lamp Ballast Energy Conservation Standards (10 CFR, Part 430), which established new minimum ballast efficacy factor (“BEF”) standards that would go into effect in 2005. Ballasts that did not pass the standards would be phased out of production and sale in the United States, this included many types of magnetic ballasts that were being manufactured. Subsequently, the federal government revisited ballast efficiency in the Energy Policy of Act of 2005 (the “2005 Act”). Provisions in the 2005 Act extend the coverage of BEF standards, which will result in the phased elimination and sale of most magnetic ballasts in new fixtures, starting in 2009 and replacement ballasts in 2010.

Based on a Current Industrial Report issued in June 2006 by the U.S. Department of Commerce, a total of approximately $784 million fluorescent ballasts were shipped in 2005. Of that amount, approximately $595 million were electronic ballasts and $189 million were magnetic ballasts. The Department of Commerce discontinued its report on fluorescent lamp shipments after publication of the June 2006 report. However, because of the phase out of magnetic ballasts, as described above, we believe that, to date, nearly the entire magnetic ballast market has been replaced by electronic ballasts. Further we believe the overall market for fluorescent ballasts has not contracted since 2005. As such, we believe the market for electronic ballasts is currently in excess of approximately $700 million in annual sales. Based on market data and our industry experience, we anticipate that this market will continue with moderate growth for the next ten to fifteen years, of which there can be no assurances. Although the overall economic outlook for the U.S. is presently not optimistic, we do not believe that the sales of our products will correlate with the overall economic conditions because of the present need to establish more efficient use of energy and reduce energy costs. However, due to switching costs of our customers and the higher price of our products, there can be no assurance that our products will be accepted by the market.

T8 Ballasts

Our current and primary product is the patented T8 Axis Daylight Harvesting Dimming Ballast. This ballast uses simple technology that transforms the standard ballast, into a dynamic energy saving system that can reduce lighting energy costs by up to 88% over a magnetic ballast utilizing T12 lamps and up to 42% over traditional electronic ballasts. A report titled “Demonstration of Efficient Lighting Conversion of the Lincoln Electric System Administration Building” written by Lincoln Electric System engineers, dated October 2004, compared energy usage of T12 magnetic ballast versus the Company’s T8 ballast with the light sensing and dimming feature. The report showed energy savings ranging from 69% to 88% in different areas of the building. The New Jersey Department of Transportation also conducted a report titled “Daylight Harvesting & Dimming Ballast Study” that compared the energy usage of standard electronic ballasts with the Company’s ballasts that have the light sensing and dimming feature. This report concluded that replacing Sylvania Model QT4X32/120LP electronic ballasts with Axis Technologies Model AX232B electronic ballasts resulted in energy savings of approximately 42%.

Our T8 ballast utilizes an individual photo sensor to automatically adjust the amount of electrical current flowing to the light fixture and then dims or increases lighting in conjunction with the amount of available sunlight. Based on our knowledge, this ballast is the only ballast on the market that has automatic dimming controls integrated into each ballast. We believe this feature reduces the costs of acquisition and installation over that of competing dimming systems, which require that first, a dimming ballast must be acquired along with a separate control system, and a separate photocell; then all components must be “hard-wired” together and “commissioned” or “balanced” in order to operate properly. The Company believes that this extra equipment and labor for competing systems can increase the cost of acquisition and installation over that of the T8 ballast system.

T5HO Ballasts

The Company is in the process of developing and introducing a line of dimming and daylight harvesting ballasts with the same control system as its present T8 ballasts that would utilize 54 watt, High Output (“T5HO”) lamps. These lamps are smaller in diameter and put out more light per lamp than T8 lamps. They are used mainly in “high-bay” fixtures which are normally installed in warehouses, gymnasiums, larger retail stores, etc. Skylights are frequently installed in these applications, and a dimming ballast as provided by Axis would be an economical choice to greatly reduce the lighting energy needed to illuminate these spaces.

We anticipate this ballast will be submitted to Underwriters Laboratories (“UL”) for testing and approval in late 2010. All electronic products must be submitted to, and approved by, a testing agency such as UL before they can be sold in the US and/or Canada. UL tests for safety-related issues only and not for any operational claims made by the manufacturer. UL requires that from four to six complete samples be submitted for their proprietary testing. A typical timeline for a product going through the UL approval process may take 90 days. Once approval is obtained from UL, the product can be sold.

Status of New Products

Load Shedding Addressable Ballast:

Axis has continued development work on a new line of addressable, load shedding ballasts over the last year. These ballasts would allow communications between the fixtures installed in the building and the building management system, which would allow certain rooms or fixtures to be controlled. The communications used to control the ballasts will significantly reduce the installation time and costs. Provisional Patents for this new ballast line were submitted on May 4, 2010. Some delays have been encountered in the development of these ballasts due to component parts delivery; however, we expect that these ballasts will be ready for testing and submission to UL by the fourth quarter 2010. We are limited in expanding disclosure on the capabilities of this ballast line due to our filing of the aforementioned Provisional Patents.

Most utility companies charge their customers a surcharge or “peak demand” charge during those times of day when the load on the power plants are at the highest. Usually this means the power companies must start up higher cost generators, and/or buy power from the electrical grid at higher rates. Our load shedding ballast would allow the power companies the ability to reduce the lighting load for their customers during those peak demand periods by sending a signal to their subscriber customers. This would provide a benefit for both the utility company and their customers. Moving forward, we plan to work with utility companies to complete the development of the load shedding ballasts in order to provide for the installation of the ballasts in their customer facilities, of which there can be no assurances. We are designing the load shedding ballast to the needs of utility “Advanced Metering Infrastructure” (AMI) communication requirements. AMI systems are comprised of state-of-the-art electronic/digital hardware and software, which combine interval data measurement with continuously available remote communications, enabling measurement of detailed, time-based information and frequent collection and transmittal of such information to various parties, including customers and utilities. AMI systems require communication and coordination with the components of a lighting system, and as such, the load shedding ballast we provide must integrate the AMI software to function properly in the AMI system.

Because both the load shedding Ballast and T5HO Ballast are simpler, more cost effective, and directly serve the market needs, we believe these qualities create a competitive advantage for us and allow us to gain a larger acceptance in the market.

Competition

The energy saving electronic component market is very competitive. There are other companies that manufacture dimming ballasts, such as Advance, Sylvania, GE and others. These companies have larger financial resources, including larger operating, staffing and advertising budgets. These companies are also better-known than us. We believe that most of these ballasts from competitive companies, however, primarily require that a separate control system be installed, that separate photosensors be installed, and that all components must be “hard-wired” together, then “commissioned” (adjusted) in order to work properly. We estimate that these systems cost about three times that of our system because of the extra components to purchase and labor to install. Also, because of their complexity, they have proved cumbersome to maintain.

The other type of general competition for our ballasts is standard electronic ballasts. Even though the Axis ballast system is cost-efficient and has demonstrated to reduce up to 42% of the lighting energy costs over our competitor’s standard electronic ballasts, as illustrated in the report conducted by the New Jersey Department of Transportation, as described above, the end consumer is many times reluctant to pay the switching costs to install the Axis dimming system.

With regard to our daylight harvesting products, to our knowledge, there are currently no direct competitors to this technology. However, we do experience indirect competition from other lower cost ballasts, which have a lower installation cost and which do not utilize the daylight harvesting technique, as an alternative solution. To minimize the effects of competition, we are working with energy agencies to promote the usage and acceptance of our products. We are also continuously upgrading and improving the performance and reliability of our ballasts. We believe that our products’ lower acquisition costs, lower installation costs and improved energy savings will differentiate our ballasts from the other ballasts in the market and increase our products’ acceptance in the market.

Principal Suppliers and Manufacturers

Early in 2009, we started a relationship with DuroPower, Inc. to manufacture our line of dimming/daylight harvesting ballasts. DuroPower Inc. is a leading manufacturer and supplier of advanced electronic ballasts for the fluorescent lighting industry. With corporate offices, engineering, marketing, and warehousing in the Los Angeles, California area and state of the art manufacturing facilities in China, DuroPower offers its customers total solutions with high-performance products, rapid delivery, competitive prices and dedicated technical support.

DuroPower has 20 years experience as a contract manufacturer providing ballasts to leading lighting companies. It developed a worldclass ISO-certified, 60,000 square foot manufacturing facility to produce top quality, high-volume products. All products produced by DuroPower undergo rigorous performance testing before shipment, including bench and elevated temperature testing and operation with live lighting loads. All of DuroPower’s ballasts are UL and UL of Canada listed and are warranted for five years. The Axis ballasts manufactured by DuroPower use a “slimline” design which give lighting designers the flexibility to implement creative designs for their fixtures.

Customers

For our fiscal year ended December 31, 2009, one customer accounted for 41% of sales and two customers accounted for 62% of outstanding accounts receivable. At December 31, 2008, one customer accounted for 48% of sales and 45% of outstanding accounts receivable. We do not believe that the loss of any significant customer would have a material adverse effect on the Company, but we can make no assurances to that effect.

We are in the process of talking with several utilities who have indicated an interest in utilizing our products to further broaden our customer base. Additionally, we have established relationships, typically on a standard purchase order basis, with large wholesale distributors such as Grainger, Graybar, Consolidated Electrical Distributors (CED), Crescent, Wesco, Rexel, FSG, Winlectric; and smaller distributors across the country such as Jewel, Munro, Walter’s Wholesale, Shepherd, Gilman, Kriz-Davis, American Light, Loeb, Platt, Motors & Controls who market and distribute our ballasts to third parties, usually building owners. It should be noted that we do not have any formal agreements in place with any of these distributors for on-going or future sales. Rather, these distributors submit purchase orders to us on an “as needed” basis (which represents the extent of such relationships). In the list above, we have named most of the major national electrical distributors, and a few of the smaller regional electrical distributors with which we have done business within the last year (fiscal year 2009). Nevertheless, there are numerous other distributors and OEM fixture manufacturers nationwide that we have done business with within the last year but were not mentioned. However, moving forward, we make no assurances of any future sales to any of these named or unnamed distributors. Our ballasts are marketed and sold through these distributors to, among others, electrical contractors and building owners. To date, there has been no material change to the constituency of our significant customers.

Building owners can retrofit their existing light fixtures with the Axis ballast. A ballast is a necessary electronic component that regulates voltage to the lamps in a fluorescent fixture. Normal ballasts send a fixed voltage to the lamps which mean the lamps deliver the same light output whenever the fixture is turned on. When incoming daylight is present, the aggregate light level is increased. The Axis dimming ballast reacts to this incoming daylight and automatically dims the light output of the fixture, and saves energy as a result. Any standard fluorescent fixture can be retrofitted to the Axis dimming ballast by removing the old ballast and replacing it with the Axis ballast. Our T8 ballasts are commonly sized to other T8 ballasts in the industry. Actual sizes are available on our website at axistechnologyinc.com, on the available specification sheet, which website includes other information that we do not wish to be incorporated by reference into this report. Ballasts are mounted to the fixture, and are attached to a power source and to the fluorescent lamps. Our ballast can be sold individually for retrofit of existing fixtures, eliminating the need to replace the fixture, as well as in fixtures supplied by manufacturers for new installation. Axis does not typically sell direct to building owners, but sells to electrical distributors, energy service companies, and fixture manufacturers, who then sell to the building owners.

We have relationships with over 30 fluorescent fixture manufacturers who have factory-installed our ballasts in their fixtures for re-sale to their customers. It should be noted, however, that we do not have any formal agreements in place with any of these manufacturers for on-going or future sales. Rather, these manufactures submit purchase orders to us on an “as needed” basis (which represents the extent of such relationships). Many of these original equipment manufacturers have made a catalog entry featuring their own “dimming/daylight harvesting” fixture which utilizes our ballasts.

Governmental Approvals and the Effect of Regulations on our Business

There are many states that have passed legislation that requires lighting controls at a minimum, and in some cases (California for example), there are requirements that new construction and major lighting retrofits incorporate daylight harvesting. These regulations are specific to lighting, and there are many further regulations in place from cities and states, that are requiring government buildings to save a certain amount of all forms of energy by specified dates. We believe that our dimming ballast system can help greatly in achieving these energy-reduction goals. Most states in the United States adopt an energy standard. These standards are primarily based on three main energy efficiency codes: American Society of Heating, Refrigerating, and Air-Conditioning Engineers, the International Electric Code, and California Title 24 Building Standards. The latest versions of these codes include requirements for daylight harvesting and day lighting controls. While the three code standards had existed autonomously in previous years, they are working together to create a consistency of standards, across all three agencies, for lighting energy efficiency.

Newer and stricter energy efficiency codes mandated by the U.S. Federal government should encourage the use of our products. The Energy Policy Act of 2005 has mandated minimum energy reductions. President Bush signed approval on Executive Order 13243 issued in January of 2007. The executive order requires a 30% energy reduction in Federal buildings, from 2003 energy levels, by 2015. These standards apply to all buildings owned, and leased, by the Federal government. We believe that due to these new regulations, the size of the electronic ballast market should expand significantly. While these new regulations do not expose us to additional liabilities, the Axis ballast can help these Federal buildings adhere to and comply with these requirements. With exception to standard business licenses and the certification of our products by the UL, we are not required to obtain any additional governmental approvals. We can obtain our standard business licenses with minimal cost and can renew them with relative ease.

License Agreement

On January 1, 2008, we entered into a co-exclusive license agreement (the “License Agreement”) with The Regents of the University of California, a California Corporation (“Regents”), whereby Regents licensed the Company to use a series of patents developed by Regents. Together, the patents are characterized as the Simplified Daylight Harvesting Technology (“SDHT”). Only one other company, Watt Stopper, Inc., has a license from the Regents to use the SDHT patents; however, Regents may grant up to four total licenses for the SDHT patents, as described below. While the Watt Stopper, Inc. is not prohibited from competing with us, it uses the license for a different application and purpose and does not currently manufacture ballasts. There are no assurances Regents will not grant up to two additional licenses for the SDHT patents. The material terms of the License Agreement are as follows:

|

-

|

We are granted a co-exclusive license to make, have made, use, offer for sale, import, sell, and have sold the Simplified Daylight Harvesting Technology which has been developed by Regents;

|

|

-

|

Regents may not grant more than a total of four co-exclusive license agreements for the SDHT patents, without the approval of all co-exclusive licensees;

|

|

-

|

The Company must pay Regents a $5,000 License Fee, which fee has been paid to date;

|

|

-

|

Until the first sale of the SDHT products and services, we are to pay to the Regents a license maintenance fee of $3,000 on each of the one-year, two-year, and three-year anniversaries of the license and $5,000 on each subsequent one-year anniversary of the license thereafter (the Company is currently paid through December 31, 2009);

|

|

-

|

Additionally, royalties calculated as a percentage of net sales are to be paid to the Regents which may vary from 0.85% to 1.70% based upon the components that are sold;

|

|

-

|

Earned royalties are to be paid quarterly to the Regents;

|

|

-

|

Beginning in the first calendar year in which the sale of the SDHT products and services occur (none as of December 31, 2009), we are to pay the Regents a minimum annual royalty in accordance to the following payment schedule:

|

|

|

o

|

Five Thousand Dollars ($5,000) for the first calendar year;

|

|

|

o

|

Six Thousand Dollars ($6,000) for the second calendar year;

|

|

|

o

|

Eight Thousand Dollars ($8,000) for the third calendar year;

|

|

|

o

|

Ten Thousand Dollars ($10,000) for the fourth calendar year;

|

|

|

o

|

Ten Thousand Dollars ($10,000) for each subsequent calendar year thereafter for the life of the license.

|

|

-

|

The License Agreement remains in effect for the life of the last-to-expire patent or last-to-be-abandoned patent application licensed under this Agreement, whichever is later (the Company is currently unsure of the exact date that each patent expires, as it had no involvement in filing the patent applications);

|

|

-

|

The License Agreement is terminable by Regents if (1) the Company should violate or fail to perform any term of the License Agreement, and then fail to repair such default within 90 days of notice from Regents, or (2) at Regents discretion, if the Company files a claim asserting that any portion of Regents’ patent rights is invalid or unenforceable;

|

|

-

|

The License Agreement is terminable at-will by the Company, in whole or as to any portion of the patent rights, by giving 90 days notice in writing to Regents.

|

Our current daylight harvesting system does not utilize the SDHT technology. Royalty payments would begin when, and if, we begin selling ballasts equipped with the SDHT technology. The Company is currently evaluating the possibility of integrating the SDHT technology into its ballasts. There are no assurances, however, that the Company will move forward with designing and implementing this integration or choose to use the SDHT technology in its ballast at all.

Axis Joint Venture Agreement

On April 22, 2010, the Company, IRC - Interstate Realty Corporation (“IRC”), and DHAB, LLC (“DHAB”) entered into an Axis Joint Venture Agreement (the “JV Agreement”), thereby forming a Tennessee joint venture/general partnership between the Company and IRC. The joint venture is named the Axis Joint Venture (the “Joint Venture”). The primary purpose of the Joint Venture is to facilitate and make funds available for the Company to acquire inventory and sell such inventory to customers on a temporary basis until the contemplated equity transaction, as further described below, is completed in its entirety. This joint venture structure is being set up only to secure IRC’s interest for their willingness to advance funds to Axis for inventory purchases. Specifically, IRC will advance funds up to $778,000 to purchase inventory from manufacturers, which inventory will be delivered to customers of the Company in connection with two separate purchase orders for 12,000 units of inventory, each. Payments made by customers for the units will be deposited in a bank account from which IRC will be promptly repaid for all sums advanced by IRC for the purchase of the inventory from manufacturers and for related reasonable costs and expenses incurred by IRC. IRC will also receive a fee of $50,000 as consideration for providing or arranging for the inventory purchases. IRC will hold a security interest in the bank account, thereby securing repayment by the Company of the amounts IRC advances and is owed, pursuant to the Deposit Account Security Agreement entered into by the Company and IRC. Repayment of the amounts advanced by IRC is also secured by a first lien on all of the Company’s personal property, including its inventory, pursuant to a Security Agreement entered into by IRC and the Company.

Pursuant to the JV Agreement, the Company issued DHAB an aggregate of 163,192,720 shares (the “DHAB Stock”) of its common stock in return for a Promissory Note from DHAB in the principal amount of $6,000,000 and the execution by DHAB of a Stock Pledge and Security Agreement (the “DHAB Security Agreement”). The Promissory Note bears no interest and is due on July 1, 2010. If an event of default occurs under the Promissory Note, the Company’s sole remedy is to exercise its rights under the DHAB Security Agreement (“to cancel the shares”). Pursuant to the DHAB Security Agreement, DHAB pledged to the Company a continuing security interest in the DHAB Stock as collateral for DHAB’s $6,000,000 obligation to the Company under the Promissory Note. All certificates representing the DHAB Stock are to be delivered to and retained by the Company until payment of the $6,000,000 is received. As DHAB pays such obligation to the Company (either in the form of monies or other consideration performed by DHAB), the Company will release the equivalent number of shares of the DHAB Stock on a prorated basis as is represented by the sums so paid on a $0.04 per share basis. DHAB will not have any voting rights pertaining to the DHAB Stock, other than to shares that the Company has released as security. The JV Agreement provides that the Company will not issue or agree to issue any additional shares of its common stock prior to July 20, 2010, and IRC intends to invest in DHAB and to be a member thereof.

In connection with the JV Agreement, on April 22, 2010, the Company and its wholly-owned subsidiary, Axis Technologies, Inc., entered into an Amendment Agreement with Gemini Strategies, LLC and Gemini Master Fund, Ltd. (collectively with Gemini Strategies, LLC and individually, “Gemini”). The Amendment Agreement provides for the extension of the maturity date of the Amended and Restated 10% Senior Secured Convertible Note, restated as of December 30, 2009, with a principal amount as of such date of $1,884,097.22 (the “Gemini Note”). The maturity date of the Gemini Note is extended to July 1, 2010, provided that upon the Company receiving funds in connection with the $6,000,000 Promissory Note with DHAB, the Gemini Note is to be repaid with the proceeds from such funds. Ten percent of all proceeds received from the sale of units of the inventory to customers is also to be paid to Gemini as partial repayment of the Gemini Note. The Amendment Agreement further provides for the consent by Gemini to the transactions contemplated by the JV Agreement (which consent was received), and subordination of Gemini’s existing lien on the Company’s inventory and other collateral.

OTHER MATTERS

Employees

Including our executive officers, the Company currently has three full-time employees and no part-time employees. We also engage consultants periodically in connection with various aspects of our business. We believe our relationship with our employees is good. Currently, we do not have any full-time employees devoted only to research and development.

Research and Development

During the last two full fiscal years, we have been involved in the process of developing and introducing a line of dimming and daylight harvesting ballasts with the same control system as the present T8 ballasts which utilizes 54 watt High Output lamps (as described in more detail above under the section titled “T5HO Ballasts”). We have also commenced development work on a new line of wireless addressable, load shedding ballasts (as described in more detail under the section titled “Status of New Products”). Additionally, we have contracted to license Regents’ Simplified Daylight Harvesting photosensor technology. Moving forward, we may work with them in the integration of the technology, internal product testing, and public program testing for technology demonstration, of which there can be no assurances. In addition, we have active discussions in methods to accelerate the deployment of the daylight harvesting technology into the lighting industry through private industry and utility rebate programs. Future research and development programs will integrate more government and energy industry sponsorship through private or governmental sponsored grants.

Expenses for research and development over the last two years have been minimal, as our existing products were developed prior to that period and we have had limited operating funds.

Intellectual Property

As previously mentioned, we have commenced development work on a new line of wireless addressable, load shedding ballasts. Provisional Patents for this new ballast line were submitted on May 4, 2010. We are limited in expanding our disclosure on the capabilities of this ballast line due to our filing of the aforementioned Provisional Patents.

In November 2005, we were issued a patent (Patent #6,969,955) for a term of 20 years from the date of issuance that covers North America (expires November 2025) to protect the ATI ballast and its unique control system, which utilizes a 7-position dipswitch to provide pre-set fixed output from 100% to 40% in approximately 10% increments; and an integral photo sensor which further dims the fixture to as much as an 80% reduction depending on available daylight. The ATI ballast is an apparatus and method for providing dimming control of an electronic ballast circuit that includes an electronic ballast circuit that is electrically connected to a plurality of input voltage terminals that can receive alternating current, and the electronic ballast circuit is electrically connected to the plurality of fluorescent lamp terminals. The technology for our patent primarily involves the dimming control settings of the tuning dip-switch function, the dip switch and photosensor housings, and the integration of controls with the ballast circuit board. Alternatively, the intellectual property relating to the license with the CLTC is for a programming algorithm, used for the control and function of the photosensor. The CLTC intellectual property involves software to further control lighting through a building management system. For example, the CLTC software might use input from a photocell mounted outside the building. The Axis ballast system looks at interior light conditions.

In September 2005, the Company trademarked our slogan “The Future of Fluorescent Lighting” (under trademark # 78437293).

Environmental Matters

We currently do not manufacture any product or conduct any activity that is subject to environmental laws. All manufacturing is undertaken by a third party. Nevertheless, it is possible that our activities could fall within the ambit of environmental regulation in the future.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below before deciding to purchase shares of our common stock. If any of the events, contingencies, circumstances or conditions described in the risks below actually occurs, our business, financial condition or results of operations could be seriously harmed. The trading price of our common stock could, in turn, decline, and you could lose all or part of your investment.

RISK FACTORS CONCERNING OUR BUSINESS AND OPERATIONS:

WE HAVE A LIMITED OPERATING HISTORY, WHICH MAY MAKE IT DIFFICULT FOR INVESTORS TO PREDICT OUR FUTURE PERFORMANCE BASED ON OUR CURRENT OPERATIONS.

We have a limited operating history upon which investors may base an evaluation of our potential future performance. As a result, there can be no assurance that we will be able to develop consistent revenue sources, or that our operations will be profitable. Our prospects must be considered in light of the risks, expense and difficulties frequently encountered by companies in an early stage of development.

We must, among other things, determine appropriate risks, rewards and level of investment in each project, respond to economic and market variables outside of our control, respond to competitive developments and continue to attract, retain and motivate qualified employees. There can be no assurance that we will be successful in meeting these challenges and addressing such risks and the failure to do so could have a materially adverse effect on our business, results of operations and financial condition.

WE HAVE EXPERIENCED SUBSTANTIAL OPERATING LOSSES AND MAY INCUR ADDITIONAL OPERATION LOSSES IN THE FUTURE.

During the twelve month period ended December 31, 2009, we have incurred a net loss of $2,272,239, and have not generated significant revenues to date. We may continue to incur losses until we are able to generate sufficient revenues and cash flows from our marketing and distribution of ballasts in the commercial lighting market discussed herein. If we are unable to generate sufficient revenues and cash flows to meet our costs of operations, we could be forced to curtail or cease our business operations without obtaining additional financing.

WE COULD CEASE TO OPERATE AS A GOING CONCERN.

We have had and could have in the future losses, deficits and deficiencies in liquidity, which could impair our ability to continue as a going concern.

In Note #2 to our consolidated financial statements, our independent auditors have indicated that certain factors raise substantial doubt about our ability to continue as a going concern. During our periods of operation, we have suffered recurring losses from operations and have been dependent on existing stockholders and new investors to provide the cash resources to sustain our operations. At December 31, 2009, we had a negative working capital position of $2,459,405, an accumulated deficit of $6,164,479, and a stockholder’s deficit of $2,410,890. For the year ended December 31, 2009, we had a net loss of $2,272,239.

Our long-term viability as a going concern is dependent on certain key factors, as follows:

|

--

|

Our ability to continue to obtain sources of outside financing that will supplement current revenue and allow us to continue to develop and market our products.

|

|

--

|

Our ability to increase profitability and sustain a cash flow level that will ensure support for continuing operations as well as to continue to develop and market our products.

|

WE MAY NEED ADDITIONAL FINANCING WHICH WE MAY NOT BE ABLE TO OBTAIN ON ACCEPTABLE TERMS. IF WE ARE UNABLE TO RAISE ADDITIONAL CAPITAL, AS NEEDED, THE FUTURE GROWTH OF OUR BUSINESS AND OPERATIONS WOULD BE SEVERELY LIMITED.

A limiting factor on our growth, including its ability to penetrate new markets, attract new customers, and deliver products and services in the commercial lighting market, is our limited capitalization compared to other companies in the industry. We will require additional funding in the future to achieve all of our proposed objectives. We anticipate our joint venture agreement with DHAB, LLC will provide us with the resources needed for the short-term. However, the Company is uncertain such financing and related equity placement will be available to the Company if at all.

If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our common stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

THE TERMS OF OUR FUNDING WITH GEMINI MAY LIMIT OUR ABILITY TO OBTAIN FUNDING ON ACCEPTABLE TERMS.

The existing terms under the April 2008 financing with Gemini Master Fund LTD (“Gemini”), the terms of which were amended in December 2009 and in April 2010 (as described in more detail below under “Liquidity and Capital Resources”), make it less likely that the Company will be able to obtain future financing or financing on acceptable terms. In connection with the Gemini financing, the Company entered into a Securities Purchase Agreement and various related agreements with Gemini Master Fund, Ltd. (“Gemini”), including certain security documents. These security documents include a Security Agreement and an Intellectual Property Security Agreement. The Security Agreement grants to Gemini a first priority security interest in and to, a lien upon and a right of set-off against all of the Company’s assets (subject to subordination of the security interest on the Company’s inventory and other collateral in connection with the Axis Joint Venture Agreement described above), and the Intellectual Property Security Agreement grants to Gemini a first priority security interest in all of the Company’s intellectual property. As such, any future obligations that the Company may enter into to obtain additional financing may only be secured by a security interest in the Company’s assets that is junior to the outstanding security interests, and such potential investors may be less willing to provide funding under such terms, or at all.

Additionally, the terms of the Securities Purchase Agreement may limit the Company’s ability to obtain future funding through the sale of equity securities. Specifically, the Securities Purchase Agreement provides that until such time as Gemini no longer holds any of the securities or underlying securities purchased, the Company cannot issue shares of common stock, securities convertible into common stock, or debt obligations involving a variable rate transaction (meaning there is a conversion, exercise or exchange price that is contingent on trading prices or other factors) or a transaction where a purchaser of securities is granted the right to received additional securities in the future on terms better than those presently being granted to the purchaser. Further, until such time as Gemini no longer holds any of the securities or underlying securities purchased, if the Company issues common stock or securities convertible into common stock on terms that Gemini deems to be more favorable than the terms received by Gemini, Gemini may require the Company to amend the Securities Purchase Agreement and related documents to give Gemini the benefit of the more favorable terms. As such, the Company is materially limited in its ability to effect future equity funding transactions.

WE DEPEND ON KEY EMPLOYEES AND PERSONNEL TO OPERATE OUR BUSINESS, WHICH COULD ADVERSELY AFFECT OUR ABILITY TO OPERATE IF WE ARE UNABLE TO RETAIN OR REPLACE THESE PERSONS.

Our future success is largely dependent upon its existing management team, including Kipton P. Hirschbach, our Chief Executive Officer, and Jim Erickson, our President. The loss of either of these officers or directors through injury, death or termination of employment could result in the investment of significant time and resources for recruiting and replacement. We do not have employment agreements with our executive officers and do not maintain any key man insurance on their lives for our benefit. Additionally, the loss of the services of our executive officers could have a serious and adverse effect on our business, financial condition and results of operations. There is also no assurance that as we grow, the existing team can successfully manage our growth or that we can attract the new talent that will be necessary to run the Company at a high level. Our success will also depend upon our ability to recruit and retain additional qualified senior management personnel. Competition is intense for highly skilled personnel in our industry and, accordingly, no assurance can be given that we will be able to hire or retain sufficient personnel.

WE FACE COMPETITION FROM SEVERAL SOURCES, WHICH MAY MAKE IT MORE DIFFICULT TO INTRODUCE NEW PRODUCTS INTO THE COMMERCIAL LIGHTING MARKET.

The market segments in which the Company competes are rapidly evolving and intensely competitive, and have many competitors in different industries, including both lighting and energy industries. These competitors include market-specific retailers and specialty retailers. Many of the Company’s current and potential competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we have. They may be able to operate with a lower cost structure, and may be able to adopt more aggressive pricing policies. Competitors in both the retail lighting and energy industries also may be able to devote more resources to technology development and marketing than the Company

WE MAY ISSUE ADDITIONAL SHARES OF COMMON STOCK IN THE FUTURE, WHICH COULD CAUSE DILUTION TO ALL SHAREHOLDERS.

We may seek to raise additional equity capital in the future. Any issuance of additional shares of our common stock will dilute the percentage ownership interest of all shareholders and may dilute the book value per share of our common stock.

WE RELY ON THIRD PARTY INDUSTRY VENDORS FOR MANUFACTURING SERVICES AND PROCESSING FACILITIES.

At this time, we primarily depend on DuroPower, Inc., headquartered in Los Angeles, California for merchandise, manufacturing and equipment produced and sold by us. Should we cease to do business with our sole manufacturer or should DuroPower cease to do business and is unable to provide their services to us, our business may be disrupted because a suitable replacement may be difficult to retain. While we believe that DuroPower’s facilities have the capacity to meet our current production needs and our current demands, we cannot be certain that these facilities will continue to meet our needs or future demands. In addition, these facilities are subject to certain risks of damage, including fire that would disrupt production of our products. To the extent we are forced to find alternate facilities, it would likely involve delays in manufacturing and potentially significant costs.

WE DEPEND ON A LIMITED NUMBER OF CUSTOMERS FOR A SIGNIFICANT PERCENTAGE OF OUR REVENUES, AND ANY LOSS, CANCELLATION, REDUCTION OR DELAY IN PURCHASES BY THESE CUSTOMERS COULD HARM OUR BUSINESS.

A limited number of customers have, historically, consistently accounted for a significant portion of our revenues. For the fiscal year ended December 31, 2009, one customer accounted for 41% of sales and two customers accounted for 62% of outstanding accounts receivable. At December 31, 2008, one customer accounted for 48% of sales and 45% of outstanding accounts receivable. Revenues from our major customer may decline or fluctuate significantly in the future. We are attempting to expand our customer base by entering into working agreements with large wholesale distributors and manufacturers. Accordingly, our success will depend on our ability to develop and manage relationships with our distributors and utility companies who market and utilize our ballasts, and we expect that the majority of our revenues will continue to depend on sales of our products to a limited number of customers for the foreseeable future. We may not be able to offset any decline in revenues from our existing major customer with revenues from new customers or other existing customers. Because of our reliance on a limited number of customers, any decrease in revenues from, or loss of, one or more of these customers without a corresponding increase in revenues from other customers would harm our business, operating results and financial condition. In addition, any negative developments in the business of our existing significant customers could result in significantly decreased sales to these customers, which could seriously harm our business, operating results and financial condition.

RISK FACTORS CONCERNING INVESTMENT IN OUR COMPANY:

THERE IS ONLY A LIMITED PUBLIC MARKET FOR OUR SHARES, AND IF AN ACTIVE MARKET DOES NOT DEVELOP, INVESTORS MAY HAVE DIFFICULTY SELLING THEIR SHARES.

There is a limited public market for our common stock. We cannot predict the extent to which investor interest in the Company will lead to the development of an active trading market or how liquid that trading market might become. If a trading market does not develop or is not sustained, it may be difficult for investors to sell shares of our common stock at a price that is attractive. As a result, an investment in our common stock may be illiquid and investors may not be able to liquidate their investment readily or at all when he/she desires to sell.

OUR COMMON STOCK IS DEEMED TO BE A "PENNY STOCK," WHICH MAY MAKE IT MORE DIFFICULT FOR INVESTORS TO SELL THEIR SHARES DUE TO SUITABILITY REQUIREMENTS.

The SEC has adopted regulations that define a “penny stock”, generally, to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock has been less than $5.00 per share. This designation requires any broker or dealer selling our securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of stockholders to sell their shares. In addition, since our common stock is currently quoted on the Pink Sheets, stockholders may find it difficult to obtain accurate quotations of our common stock, may experience a lack of buyers to purchase our shares or a lack of market makers to support the stock price.

FUTURE SALES BY OUR STOCKHOLDERS MAY ADVERSELY AFFECT OUR STOCK PRICE AND OUR ABILITY TO RAISE FUNDS IN NEW STOCK OFFERINGS.

Sales of our common stock in the public market could lower our market price for our common stock. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that management deems acceptable or at all.

THERE IS LIMITED LIQUIDITY IN OUR SHARES.

Historically, the volume of trading in our common stock has been low. A more active public market for our common stock may not develop or, even if it does in fact develop, may not be sustainable. The market price of our common stock may fluctuate significantly in response to factors, some of which are beyond our control. These factors include:

|

|

·

|

the announcement of new products or product enhancements by us or our competitors;

|

|

|

·

|

developments concerning intellectual property rights and regulatory approvals;

|

|

|

·

|

quarterly variations in our results of operations or the results of operations of our competitors;

|

|

|

·

|

developments in our industry; and

|

|

|

·

|

general market conditions and other factors, including factors unrelated to our own operating performance.

|

Recently, the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of shares of our common stock, which could cause a decline in the value of our shares. Price volatility may be worse if the trading volume of our common stock is low.

THE CONCENTRATED OWNERSHIP OF OUR CAPITAL STOCK MAY BE AT ODDS WITH YOUR INTERESTS, AND HAVE THE EFFECT OF DELAYING OR PREVENTING A CHANGE IN CONTROL OF OUR COMPANY.

Our common stock ownership is highly concentrated. Our directors, officers, key personnel and their affiliates as a group beneficially own or control the vote of approximately 65% of our outstanding capital stock, and control the Company. They will be able to continue to exercise significant influence over all matters affecting the Company, including the election of directors, formation and execution of business strategy and approval of mergers, acquisitions and other significant corporate transactions, which may have an adverse effect on the stock price. They may have conflicts of interest and interests that are not aligned with yours in all respects. As a result of the concentrated ownership of our stock, a relatively small number of shareholders, acting together, will be able to control all matters requiring shareholder approval. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our company. It may affect the market price of our common stock.

The Company currently has one (1) office located in Lincoln, Nebraska. The address is as follows:

2055 South Folsom

Lincoln, NE 68522

On March 1, 2003, the Company leased the office warehouse location, comprised of approximately 2,800 square feet of space which is held under a 36 month lease at a rate of approximately $1,300 per month (with payments started in March 2003). The Company currently leases this office warehouse location on a month-to-month basis at a current rate of $1,302 per month. The Company uses 1,000 square feet as their corporate office and 1,800 square feet as warehouse with additional square footage as needed. The Company believes that these properties are adequate for its corporate office and operational needs at this time.

|

ITEM

3.

|

LEGAL PROCEEDINGS

|

The Company is not currently a party to any material legal proceedings.

PART

II

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

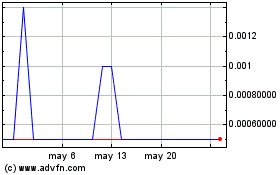

Our common stock is currently quoted on the Pink Sheets Electronic Interdealer Quotation and Trading System under the symbol “AXTG.”

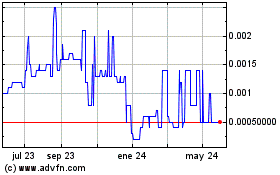

For the periods indicated, the following table sets forth the high and low closing prices per share of common stock, as reported by www.pinksheets.com. These prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

Quarter

|

|

High

|

|

|

Low

|

|

|

1

st

Quarter 2008

|

|

$

|

0.53

|

|

|

$

|

0.28

|

|

|

2

nd

Quarter 2008

|

|

$

|

0.76

|

|

|

$

|

0.31

|

|

|

3

rd

Quarter 2008

|

|

$

|

0.65

|

|

|

$

|

0.45

|

|

|

4

th

Quarter 2008

|

|

$

|

0.47

|

|

|

$

|

0.18

|

|

|

1

st

Quarter 2009

|

|

$

|

0.38

|

|

|

$

|

0.19

|

|

|

2

nd

Quarter 2009

|

|

$

|

0.27

|

|

|

$

|

0.14

|

|

|

3

rd

Quarter 2009

|

|

$

|

0.24

|

|

|

$

|

0.13

|

|

|

4

th

Quarter 2009

|

|

$

|

0.16

|

|

|

$

|

0.09

|

|

Record Holders

As of December 31, 2009 we had approximately

70

holders of record of our common stock. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

No prediction can be made as to the effect, if any, that future sales of shares of our common stock or the availability of our common stock for future sale will have on the market price of our common stock prevailing from time-to-time. The additional registration of our common stock and the sale of substantial amounts of our common stock in the public market could adversely affect the prevailing market price of our common stock.

Transfer Agent

The transfer agent and registrar for our common stock is:

Holladay Stock Transfer, Inc.

2939 N. 67th Place

Scottsdale, AZ 85251

Dividend Policy

The holders of the common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of legally available funds. We have not issued any dividends on our common stock to date, and do not intend to issue any dividends on our common stock in the near future. We currently intend to retain earnings, if any, to further the growth and development of the Company.

Therefore, prospective investors who anticipate the need for immediate income by way of cash dividends from their investment should not purchase our shares of common stock.

Recent Sales of Unregistered Securities

1. On May 1, 2009, the Company issued 250,000 shares at an estimated fair value of $0.19 per share valued in total at $47,500 as compensation for marketing services performed. This issuance was completed in accordance with Section 4(2) of the Act in an offering without any public offering, advertising or general solicitation. These shares are restricted securities and include an appropriate restrictive legend.

2. On May 1 and June 1, 2009, the Company issued 964,506 on each date in lieu of cash payments due to Gemini Master Fund, Ltd. The total shares of 1,929,012 were issued to pay $231,482 of debt payments due. The shares were issued at a variable conversion price per the debt agreement and, thus, a beneficial conversion charge of $135,030 was recorded to interest expense. This issuance was completed in accordance with Section 4(2) of the Act in an offering without any public offering, advertising or general solicitation. These shares are restricted securities and include an appropriate restrictive legend.

|

ITEM

7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

Forward Looking Statements and Information

This document contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management and information currently available to management. The use of words such as "believes," "expects," "anticipates," "intends," "plans," "estimates," "should," "likely" or similar expressions, indicates a forward-looking statement.

Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future results may differ materially from those expressed in the forward-looking statements. Many of the factors that will determine these results are beyond our ability to control or predict. Stockholders are cautioned not to put undue reliance on any forward-looking statements, which speak only to the date made

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events, or performance and underlying assumptions and other statements, which are other than statements of historical facts. These statements are subject to uncertainties and risks including, but not limited to, product and service demands and acceptance, changes in technology, economic conditions, the impact of competition and pricing, and government regulation and approvals. The Company cautions that assumptions, expectations, projections, intentions, or beliefs about future events may, and often do, vary from actual results and the differences can be material. Some of the key factors which could cause actual results to vary from those the Company expects include changes in product prices, the timing of planned capital expenditures, availability of acquisitions, operational factors, the condition of the capital markets generally, as well as our ability to access them, and uncertainties regarding environmental regulations or litigation and other legal or regulatory developments affecting our business.

Our expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis, including without limitation, our examination of historical operating trends, data contained in our records and other data available from third parties. There can be no assurance, however, that our expectations, beliefs or projections will result, be achieved, or be accomplished. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no duty to update these forward-looking statements.

Results of Operation

Year Ended December 31, 2009:

Consolidated net sales for the years ended December 31, 2009 and 2008 totaled $429,243 and $686,528, respectively, for an decrease of $257,285. We believe the decrease is due to us having very limited operating funds to adequately procure product inventory and market and sell those products. We also believe the decrease is due to customers waiting to purchase in hopes of acquiring Federal Stimulus money to invest in products like those of the Company. We believe customers are beginning to invest in 2010 based on our shipments in 2010 year to date through June 21, 2010 and with back purchase orders received for over $1,600,000 to be filled yet in 2010. Cost of goods sold for the years ended December 31, 2009 and 2008 was $329,730 and $566,694, respectively, a decrease of $236,964. The decrease is primarily due to our decrease in sales volume although, we have increased our product pricing during 2009. After deducting costs of goods sold, including warehouse salaries and allocated overhead, we finished the year ended December 31, 2009 with $99,513 in gross profit, compared to a gross profit of $119,834 for the year ended December 31, 2008, a decrease of $20,321. Gross profit as a percentage of sales for the year ended December 31, 2009 was 23.2%, compared to 17.4% for the year ended December 31, 2008, a 5.8% increase in gross profit as a percentage of sales. This increase in gross profit as a percentage of sales is primarily attributable to an increase in sales unit price that was in excess of a decrease in sales volume to cover fixed overhead costs in 2009.

For the year ended December 31, 2009, operating expenses totaled $797,359 compared to $924,608 for the year ended December 31, 2008, a decrease of $127,249. The operating expenses were lower due to a decrease in personnel costs as the Company has been monitoring expenses and having reduced professional fees associated with accounting and related regulatory needs in 2009.

For the year ended December 31, 2009, interest expense was $1,574,421 compared to $843,543 for the year ended December 31, 2008, an increase of $730,878. This increase was the result of the Company issuing a convertible note payable in April 2008 that had significant transaction costs and debt discounts related to an original issue discount, warrants issued and a beneficial conversion feature that is being accreted over the term of the debt to interest expense. There was a full year of these costs in 2009 compared to 2008. In addition, we incurred default charges totaling $384,723 for the year ended December 31, 2009. Also, when the default occurred on July 1, 2009, the note interest rate increased to 24% from 10%. Additional details of this note are listed in Notes 5 and 6 to the consolidated financial statements of the Company and below in “Liquidity and Capital Resources.”

For the year ended December 31, 2009, the net loss was $2,272,239 compared to a net loss of $1,644,296 for the year ended December 31, 2008, an increase of $627,943. This increase in net loss is attributable to the significant increase in interest expense, partially offset by the increase in gross profit as a percentage of sales and a decrease in operating expenses, as described above.

Assets, Liabilities and Employees; Research and Development

As of December 31, 2009, the Company has total current assets of $362,887, which includes $11,488 of cash, $32,136 of accounts receivable, $226,412 of inventory, $89,878 of inventory deposits and $2,973 of prepaid expenses. As of December 31, 2009, the Company also has $18,667 of property and equipment, less accumulated depreciation of $15,191, and total other assets of $45,039, consisting primarily of debt financing costs.

As of December 31, 2009, the Company has total liabilities, consisting entirely of current liabilities, of $2,822,292, including $162,209 of accounts payable, $120,915 of accrued expenses, $107,167 of note payable, $1,746,459 of convertible note payable and $685,542 of accrued salary due to officers/stockholders.

As of December 31, 2009, the Company has a working capital deficit of $2,459,405.

At December 31, 2009, our ballast inventory represented 55.0% of our assets. Inventory is manufactured in China by our manufacturer (whose corporate offices are located in the Los Angeles, California area) and is shipped to our warehouse in Lincoln, Nebraska. The time from ordering the product to receipt of the product can exceed 90 days. We are currently working to reduce this turnaround time to 60 days. We try to maintain our inventory at levels that are deemed reasonable based upon projected sales, but the recent liquidity problems has prevented us from having the desired amount of inventory to effectively operate our business.

At this time, we do not anticipate purchasing or selling any significant equipment or other assets in the near term. Neither do we anticipate any imminent or significant changes in the number of our employees. We may, however, increase the number of independent sales representatives in the event that we expand into other markets or our current market significantly increases.

We expect that we will invest time, effort, and expense in the continued development and refinement of our current and next generation ballasts, through our relationship with CLTC and the power companies.

Liquidity and Capital Resources; Anticipated Financing Needs

For the year ended December 31, 2009, we incurred net operating losses aggregating $697,846 which was the result of funding, marketing and advertising, business development and other activities as discussed above.

Net cash of $257,405 was used in operating activities during the year ended December 31, 2009, compared to $820,582 in cash used for the year ended December 31, 2008. Net cash used in operating activities for the year ended December 31, 2009 is primarily attributable to $2,272,239 of net loss which was partially offset by non-cash items such as $65,065 of amortization of original issue discount, $148,819 of amortization of debt issuance costs, $720,615 of non-cash interest expense related to issuance of warrants and beneficial conversion feature, and $384,723 of default interest charges added to notes payable. Additionally, we had significant changes in various operating assets and liabilities that helped offset the loss. The primary items were: 1) decrease in inventory of $79,773, 2) increase in accrued expenses of $220,829 and 3) increase in accrued salary to officers/stockholders of $199,905.

Net cash used in investing activities for the year ended December 31, 2009 totaled $479, compared to $1,095 used for the year ended December 31, 2008.

Net cash of $257,167 was provided by financing activities during the year ended December 31, 2009, compared to $819,354 in cash provided for the year ended December 31, 2008. Cash flows from financing activities for the year ended December 31, 2009 included principal payments on notes payable of $43,833, offset by cash proceeds from short-tem debt issuance of $300,000.

On April 25, 2008, the Company issued a convertible debt instrument generating net cash proceeds of $1,218,000 for working capital purposes and to pay off the Company’s bank note which was due on June 10, 2008. The convertible note payable (the “Note”) is a 10% Senior Secured Convertible Promissory Note in the principal amount of $1,388,889. The face amount of the Note of $1,388,889 was reduced by an original issue discount of $138,889 and other issuance costs of $32,000 to arrive at net proceeds of $1,218,000. The Note has been amended to provide a maturity date of July 1, 2010 and is secured by all assets of the Company. The Note originally accrued interest at a rate of 10% per annum, due to the default, the interest rate changed to 24% for the period from July 1, 2009 to December 30, 2009. The Note was originally convertible at the option of the holder at any time into shares of the Company's common stock at an initial conversion price of $0.26 per share. After the note was amended on December 30, 2009, the conversion price was changed to $0.10 and was not convertible until after February 1, 2010. Additionally, the interest rate reverted back to 10%.

Under the terms of the note and as additional consideration for the loan, the Company issued a five-year warrant to purchase up to 5,341,880 shares of its common stock at an exercise price of $0.26 per share which was deemed to have a fair value of $861,778. The Company calculated the intrinsic value of the beneficial conversion feature embedded in the note. As the amount of the beneficial conversion feature exceeded the fair value allocated to the note, the amount of the beneficial conversion feature to be recorded was limited to the proceeds allocated to the note. Accordingly, the beneficial conversion feature was calculated to be $388,222 and was recorded as an additional discount on the note.

Non-cash interest expense related to this note for the year ended December 31, 2009 included $934,499 attributable to the amortization of the original issue discount, beneficial conversion feature, debt issuance costs and warrant discounts. In 2009, there was also default interest charges of $347,223 recorded against the Note. As of December 31, 2009, the total note balance owed was $1,884,097 which included the March 25, 2009 bridge note noted below.

On March 25, 2009, the Company entered into a debt instrument security agreement with Gemini Master Fund, Ltd. (“Gemini”), pursuant to which the Company issued a 10% Senior Secured Note in the principal amount of $150,000 (the “Note”) for working capital funds. The note has a mandatory default amount where the principal of the obligation increases 25% and the stated interest rate increases to 24% if the note is in default. The note was deemed in default in July 2009 and a default interest charge of $37,500 was recorded. The note balance increased to $187,500. The note was refinanced on December 30, 2009 by adding the obligation plus accrued interest of $20,250 with the convertible note payable as discussed above.

On May 20, 2009, the Company issued a promissory note with Mid-America Funding Company generating net cash proceeds of $150,000 for working capital purposes. In connection with the note payable, the Company issued 1,000,000 shares of its common stock to be held in escrow as collateral for the loan. Additionally, the Company assigned a customer purchase order totaling $247,500 to the issuer as additional collateral on the note. The note bears interest at a monthly rate of 2% of the outstanding balance. The note is past due and demand can be made for payment in full. The note has a balance of $107,167 at December 31, 2009.