Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

24 Enero 2025 - 3:36PM

Edgar (US Regulatory)

Exhibit

1

FORM OF 10b5-1 TRADING PLAN

terms

and conditions

THIS

TRADING PLAN is adopted by Customer and Fidelity Brokerage Services LLC, a Delaware limited liability

company (‘Broker’), is agreeing to administer this trading plan as a broker in compliance with Rule 10b5-1 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

[Applicable

to Administrative Transfers of Plans only; void if not completed] WHEREAS, Customer (a)

entered into a Rule 10b5-1 trading plan dated N/A, a copy of which is attached (the “Initial

Trading Plan”), (b) desires by this document to effect solely a change in the identity of the broker identified and

instructed to carry out the trading instructions under the Initial Trading Plan, (c) is completing this document solely to meet the requirements

of the new broker with respect to administering the trading plan, (d) intends to make no changes to the trading instructions under the

Initial Trading Plan, (e) intends that this document merely effects the change in the identity of the broker, including completing the

new broker’s form of agreement, and makes no material change to the Initial Trading Plan, and (f) intends and believes that this

document does not constitute a material modification of the Initial Trading Plan or the adoption of a new trading plan under Rule 10b5-1;

and

WHEREAS,

Customer wishes to provide instructions to Broker as to how, when, and whether to conduct purchases or sales of securities of the Issuer

in compliance with Rule 10b5-1 under the Exchange Act as set forth in the foregoing Trading Schedule (the “Shares”);

and

WHEREAS,

the Shares may include Shares that Customer has previously acquired under outstanding employee stock options of the Issuer (“Options”)

and/or Shares (“Company Stock Plan Shares”) issued

or to be issued to Customer based on Customer’s participation in one or more of Issuer’s employee stock plans (each a Company

Stock Plan”), which is either (i) subject to a Recordkeeping and Administrative Services Agreement (“SPS

Agreement”) between the Issuer and Fidelity Stock Plan Services, LLC (“SPS”);

or (ii) with respect to all other Company Stock Plans, attached hereto as Exhibit 1; and

NOW,

THEREFORE, in consideration of the foregoing and the respective covenants and agreements hereinafter

contained, the parties hereby agree as follows:

| a. | Term:

This trading plan has been completed and entered into by the Customer (individually and, if applicable, as a duly authorized representative

of any other entity under the direction of such individual and named in the “Customer’s Name” box in Part “I

– Customer Information” above) on the date set forth on the signature page hereto below the Customer’s signature (the

“Plan Adoption Date”) and shall continue until terminated

in accordance with Section 1(b) below. Please note that if the

Trading Schedule provides for an Option Exercise Date or Order Entry Date earlier than the expiration of the applicable cooling-off period

under Rule 10b5-1(c) (the “Cooling-Off Period”), the

transactions specified to occur on those dates are subject to cancellation as provided in Section 8(c). If Broker cannot effect any sale

of Shares for any of the reasons set forth in Section 8(a), then Broker will execute the sale on the next possible business day. |

| i. | This Trading Plan will terminate

on the earlier of: |

| A. | ___01/24/2025 ___________ [specify

date, generally not to exceed one (1) year from the Plan Adoption Date]; |

| B. | execution of all trades or

expiration of all of the orders relating to such trades as specified below; |

| C. | the date Broker receives notice

of liquidation, dissolution, bankruptcy, insolvency, or death of Customer; |

| D. | when Broker receives notice

from the Customer or Customer’s agent of Customer’s termination of the Trading Plan; |

| E. | where Broker determines, in

its sole discretion, that the Trading Plan has been terminated, including, without limitation, where Broker determines there has been

a modification or change to Trading Plan that constitutes the termination of the Trading Plan |

| F. | the date Broker notifies Customer

of Broker’s termination of this Trading Plan due to Customer’s breach of any of the terms of this Trading Plan or in the

event that Customer trades Shares outside of this Trading Plan; or |

| G. | where Broker exercises any

other termination right it may have under this Trading Plan. |

| ii. | Any termination of this Trading

Plan by Customer must be: delivered to Broker in writing and signed and dated by Customer; and the Customer shall promptly provide a

copy of such written notice of termination to the Issuer and, where applicable, to any Third-Party Agent(s) (as such term is defined

herein). |

| 2. | INTENT

TO COMPLY WITH RULE 10b5-1 |

It is the intent

of the parties that this Trading Plan satisfies the affirmative defense conditions of Rule 10b5-1(c) and complies with the requirements

of Rule 10b5-1.

| a. | If the shares are “restricted

securities” and/or Customer may be deemed an “affiliate” of Issuer, as such terms are defined in Rule 144 promulgated

under the Securities Act of 1933 (“Rule 144”), then within five (5) days of the first date on which sales, if any, can be

made under this Trading Plan, and within five (5) days of each three-month anniversary of such first date (providing that on such anniversary

any sales of Shares remain pending under this Trading Plan), Customer shall execute and deliver to Broker a certification disclosing

trades made by Customer and its related parties for purposes of Rule 144 (i.e.--immediate family and others that Customer is acting in

concert with or whose sales are required under Rule 144 to be aggregated with Customer) within the three (3) months preceding such first

date or three-month anniversary date, as the case may be, for purposes of determining compliance of sales to be made under this Trading

Plan with Rule 144. If there were no such trades within such three (3) month period, no certification is required. In the event that

Shares Customer is selling are restricted securities as defined in paragraph (a)(3) of Rule 144, Customer warrants that the Shares have

been beneficially owned for a period of at least six (6) months as of the date of any contemplated sale hereunder as computed in accordance

with paragraph (d) of Rule 144. |

| b. | In respect of any sales of

Shares under this Trading Plan, if such Shares are “restricted securities” and/or Customer may be deemed an “affiliate”

of Issuer, as such terms are defined in Rule 144, then Broker will complete on behalf of Customer and file with appropriate authorities

any required Forms 144 of Customer provided Customer has completed and submitted a power of attorney in good order permitting Broker

to file on Customer’s behalf (unless Customer or Customer’s agents shall have independently filed the required Form 144 on

or before any trade date) and, provided that Customer has complied with its covenant set forth in Section 3(a) above, with respect to

each such filing. |

| i. | Customer understands and agrees

that each such Form 144 shall provide |

| A. | that the sales are being made

pursuant to a Rule 10b5-1 Trading Plan, |

| B. | the date on which such Trading

Plan was adopted and |

| C. | that Customer’s knowledge

speaks as of the date such Trading Plan was adopted. |

| ii. | Customer shall cooperate with

Broker to execute and file any modifications to an effective Form 144 in order to comply with the foregoing. |

| c. | If Customer indicates in Section

I of this Trading Plan that Issuer will file Form 4 statements on Customer’s behalf consistent with Issuer’s designation

of Customer as a “Section 16 reporting person,” then Broker will use reasonable efforts to transmit to Issuer’s Authorized

Representative, in writing, the details of any trade executed under this Trading Plan within one business day of the trade execution

(in each case, a “Broker Trade Notification”). |

| 4. | IMPLEMENTATION

OF TRADING PLAN |

| a. | Customer agrees to promptly

deliver Shares now or hereafter coming into Customer’s possession that are subject to sale under this Trading Plan, including,

if applicable, Company Stock Plan Shares, for so long as sales are to be conducted under this Trading Plan, all of which Shares shall

be deposited into the Customer Account in the name of Broker or its duly appointed designee. Broker shall withdraw Shares from the Customer

Account in order to effect sales of Shares under this Trading Plan. Broker agrees to notify Customer promptly if at any time during the

term of this Trading Plan the number of Shares in the applicable Customer Account is less than the number of Shares remaining to be sold

pursuant to this Trading Plan, unless such shortfall will be eliminated in the ordinary course by the exercise of Options or delivery

of Shares pursuant to a Company Stock Plan in accordance with this Trading Plan. To the extent that any Shares remain in the Customer

Account upon termination of this Trading Plan, Broker agrees, upon Issuer’s request, to return such Shares promptly to Issuer’s

transfer agent for re-legending to the extent that such Shares would then be subject to transfer restrictions in the hands of Customer. |

| b. | Company

Stock Plan Exercises: |

| i. | If this Trading Plan covers

exercises of Options or other exercises under a Company Stock Plan (a “Company Stock Plan Exercise”), then Customer agrees

to make appropriate arrangements with Issuer and its transfer agent and the Company Stock Plan administrator to permit Broker to furnish

notice to Issuer of the Company Stock Plan Exercise and to have underlying Shares delivered to Broker as necessary to effect sales under

this Trading Plan. Shares received pursuant to a Company Stock Plan Exercise shall be delivered to the Customer Account. |

| ii. | In the event Issuer is not

an SPS Customer, Customer agrees to complete, execute, and deliver to Broker from time to time Broker’s customary forms (e.g.,

Employee Stock Option Notice of Intent and Agreement for the Exercise of Options), at such times and in such numbers as Broker shall

request, to complete any Company Stock Plan Exercises pursuant to this Trading Plan. |

| iii. | Customer hereby authorizes: |

| A. | Broker to serve as Customer’s

agent and attorney-in-fact to cause said Shares to be issued upon payment (or eligible margin credit, if applicable) of amounts due to

Issuer under the Company Stock Plan (including any exercise price and tax withholding), and in the event Issuer is not an SPS Customer,

receipt from Customer of the properly endorsed Employee Stock Option Notice of Intent and Agreement; and |

| B. | Broker, Issuer, and/or Company

Stock Plan administrator to exchange information regarding the acquisition and disposition of said Shares, including, without limitation,

any required notification of the sale of Shares acquired under a Company Stock Plan and verification by Issuer of tax withholding. |

| iv. | On each day that sales are

to be made under this Trading Plan (or, in the event that Customer owns a portion of Shares directly and not pursuant to a Company Stock

Plan Exercise, on any day that the number of Shares in the Customer Account is less than the number of Shares to be sold on such day),

Broker shall initiate a Company Stock Plan Exercise on behalf of Customer to obtain a sufficient number of Shares to effect such sales

in the manner specified on the Trading Schedule. Broker shall in no event initiate any Company Stock Plan Exercise if at the time of

exercise the exercise price is equal to or higher than the market price of the Shares. In connection with any Company Stock Plan Exercise,

Broker shall remit to Issuer any required exercise price together with any tax withholding that Issuer and or Company Stock Plan administrator

informs Broker is required in connection with the Company Stock Plan Exercise, which amounts shall be deducted from the proceeds of sale

of the Shares. |

| i. | If this Trading Plan covers

Company Stock Plan Shares, Customer shall provide written notice to Broker at any time when Issuer amends or terminates the related Company

Stock Plan, together with a written copy of any such amendment(s), as soon as practicable but in any event no later than two (2) business

days after Customer receives notice thereof from Issuer. |

| ii. | If Customer changes or terminates

any contribution elections during a contribution election period where Customer is instructing Broker on the Trading Schedule to sell

all or a percentage of the Company Stock Plan Shares that Customer expects to receive pursuant to such contribution election (as opposed

to specifying on the Trading Schedule an actual number of shares that Broker should sell), Customer shall provide written notice to Broker

and to Issuer’s Authorized Representative of such contribution election change or termination as soon as practicable but in any

event no later than two (2) business days after Customer effects any such change, which written notice must be accompanied by Customer’s

representation that: |

| A. | Customer was not in possession

of any material nonpublic information concerning Issuer or its securities when Customer effected such change, and |

| B. | such change was made in good

faith and not as a part of a plan or scheme to evade compliance with federal securities laws. |

| 5. | REPRESENTATIONS,

WARRANTIES, AND COVENANTS OF CUSTOMER |

| a. | Customer hereby certifies,

and covenants to Broker as of the Plan Adoption Date: |

| i. | The Plan Adoption Date does

not fall within any blackout period of Issuer; |

| ii. | Customer in entering into this

Trading Plan is in compliance with Issuer’s insider trading policies; |

| iii. | Customer is not aware of any

material, nonpublic information concerning Issuer or its securities; |

| iv. | If Customer is an institution,

Customer has implemented reasonable policies and procedures to ensure that the individuals authorized to enter into this Trading Plan

on its behalf are not aware, as of the Plan Adoption Date, of any material, nonpublic information concerning Issuer or its securities

and, to the knowledge of Customer, no such individual is aware of any such information; |

| v. | Customer is adopting this Trading

Plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1; |

| vi. | Customer is not a party to

any other trading plan designed to comply with Rule 10b5-1(c) other than as permitted under Rule 10b5-1(c); |

| vii. | Customer has obtained the approval

or acknowledgment of Issuer’s Authorized Representative to enter into this Trading Plan; and |

| viii. | The execution, delivery, and

performance by Customer of this Trading Plan does not, directly or indirectly (with or without notice or lapse of time), contravene,

conflict with, or result in a violation of any of the terms or requirements of any legal or contractual requirement or order to which

Customer may be subject, nor does this Trading Plan require any consent, waiver, authorization or approval of any person or entity other

than Customer, Issuer and Broker. Customer shall immediately notify Broker if Customer becomes subject to a legal, regulatory or contractual

restriction or undertaking that would prevent or prohibit Broker from carrying out its obligations under this Trading Plan. |

| b. | Without limiting Section 5(a),

Customer hereby certifies, and covenants to Broker as of the Plan Adoption Date through and including the date on which this Trading

Plan terminates: |

| i. | Customer has all requisite

power and authority to adopt this Trading Plan and to carry out the obligations hereunder. The execution and delivery of this Trading

Plan and the performance of the obligations of Customer hereunder have been duly authorized and approved by all necessary action on the

part of Customer, and no other proceedings on the part of Customer are necessary to authorize and approve this Trading Plan and the transactions

contemplated hereby. This Trading Plan has been duly executed by Customer and constitutes its valid and binding obligation, enforceable

against Customer in accordance with its terms. |

| ii. | Customer has acted in good

faith with respect to this Trading Plan. |

| iii. | Customer has not entered into

any other trading plan designed to comply with Rule 10b5-1(c) other than as permitted under Rule 10b5-1(c). |

| iv. | All information provided by

Customer under this Agreement, and any other information provided by Customer upon Broker’s request in connection with this Trading

Plan, is complete and accurate in all material respects. |

| v. | Customer has not, directly

or indirectly, communicated any material nonpublic information relating to the Issuer or its securities to any employee of Broker or

its affiliates. |

| vi. | Customer has not exercised

any influence over how, when, or whether to effect purchases or sales pursuant to the Trading Plan. |

| vii. | Customer will immediately notify

Broker if Company ceases to be in compliance with the current public information reporting requirements set forth in Rule 144(c)(1) at

any time; and |

| viii. | Customer agrees to notify Broker

promptly if Customer obtains knowledge at any time that any of the representations or warranties in this Section 5(b) are untrue or inaccurate

in any respect. Each representation in this Section 5(b) is being made as of the Plan Adoption Date and shall be deemed to have been

made again as of any date on which Shares are being sold by Broker under this Trading Plan. |

| If this Trading Plan results

from an administrative transfer of a preexisting plan from another broker, Customer’s representations in Section 5 are deemed to

have been made as of the date of the Initial Trading Plan. |

Customer will

not enter into any new, or change any existing, corresponding or hedging transaction or position with respect to the Shares subject to

this Trading Plan for as long as this Trading Plan is in effect.

| a. | Customer shall notify Broker

in the event customer has entered into separate contracts or agreements with other agents to execute trades on Customer’s behalf

that, together with this Trading plan and any other such contract or agreement, are intended to meet the requirements of, and be treated

as, a single plan for purposes of Rule 10b5–1(c) (each, a “Third-Party Plan”). Customer shall provide Broker with contact

information for each such agent and provide Broker with a copy of each contract or agreement between or among Customer and such agent

related such Third-Party Plan(s). In the event Broker determines that this Trading Plan, together with any Third-Party Plan, does not

comply with the requirements of Rule 10b5–1(c), Broker may immediately cease to act as Broker under this Trading Plan and notify

each agent responsible for effecting transactions under a Third-Party Plan (such agents, the “Third-Party Agents”) of such

action. |

| b. | Customer shall promptly notify

Broker in the event there is any modification to any Third-Party Plan, including, without limitation, the substitution of the agent responsible

for effecting transactions under such Third-Party Plan, any modification or change to the amount, price, or timing of the purchase or

sale of the securities under the Third-Party Plan or the modification or change to the written formula or algorithm, or computer program,

used to determine the amount, price, or timing of the purchase or sale of the securities under the Third-Party Plan. Customer acknowledges

that Broker, in its sole discretion, may determine that such modification represents the termination of this Trading Plan and the adoption

of a new plan for purposes of Rule 10b5–1(c), requiring a new agreement and cooling-off period. |

| c. | Customer acknowledges that

Broker may notify each Third-Party Agent in the event of any modification or change to this Trading Plan, including, without limitation,

any change or modification to the amount, price, or timing of the purchase or sale of the securities under this Trading Plan or the modification

or change to the written formula or algorithm, or computer program, used to determine the amount, price, or timing of the purchase or

sale of the securities under this Trading Plan. Broker shall have no liability to Customer for any actions of a third-party, including

any Third-Party Agent, taken in connection or as a result of such notification. |

| 8. | MARKET

DISRUPTION AND TRADING RESTRICTIONS |

| a. | Customer understands that Broker

may not be able to effect a transaction under this Trading Plan due to: |

| i. | any of the events described

in the “Limits to our Responsibility” section of the Customer Agreement; |

| ii. | a legal, regulatory, or contractual

restriction or suspension applicable to Customer, Customer’s affiliates, Broker, or Broker’s affiliates (including the volume

limitations of Rule 144); |

| iii. | failure of Broker to receive

Shares, including Company Stock Plan Shares, or delay in Broker’s receipt of such Shares for deposit into Customer Account, if

applicable, whether or not such failure or delay is consistent with the terms of the Company Stock Plan, or any other agreement to which

Broker is not a controlling party; |

| iv. | if this Trading Plan includes

a Company Stock Plan Exercise, and on the Trading Schedule Customer places a market order with respect to Shares subject to a Company

Stock Plan Exercise, failure of the market price for such Shares to exceed the exercise price of such Company Stock Plan Exercise on

the exercise date; |

| v. | a suspension, expiration, termination,

or unavailability of any applicable registration statement related to Issuer; or |

| vi. | a trading suspension under

Section 8(b) of this Trading Plan. |

| b. | Broker shall suspend trading

under this Trading Plan, in whole or in part as appropriate, as soon as practicable but in no event later than two (2) business days

after receipt of written notice from Issuer’s Authorized Representative that the Issuer has imposed trading restrictions on the

Customer (a “Trading Suspension Notice”). Broker shall

lift any such trading suspension and shall resume effecting trades in accordance with this Trading Plan as soon as practicable but in

no event later than two (2) business days after receipt of written notice from Issuer’s Authorized Representative that such Issuer

Restrictions have terminated (a “ Trading Suspension Release”). Without limiting Broker’s rights under Section 1(b)(i)(E),

Broker shall follow Customer’s instructions as set forth in Section 8(a) of this Trading Plan with respect to any unexecuted trades

that would have been executed in accordance with the terms of the Trading Schedule but for the Trading Suspension Notice. |

| c. | If Broker becomes aware that

an Option Exercise Date or Order Entry Date specified in this Trading Plan is prior to the end of the Cooling Off Period, the transactions

specified to occur on those dates shall be cancelled unless Broker has received a Trading Suspension Notice. |

| 9. | LEGAL

COMPLIANCE; AGENT DUTIES |

| a. | Customer agrees that Customer

is solely responsible for determining whether this Trading Plan meets the requirements of Rule 10b5-1(c) and any other applicable federal

or state laws or rules. |

| b. | Customer shall provide Broker

such information as Broker, in its reasonable discretion, may request to confirm this Trading Plan meets the requirements of Rule 10b5-1(c)

and any other applicable federal or state laws or rules. Customer agrees that Broker shall have no obligation to effect any transaction

under this Trading Plan in the event Broker does not receive such information. |

| c. | Without limiting Section 9(b),

Customer shall provide Broker such information that Broker, in its reasonable discretion, may request to confirm the Plan Adoption Date,

including information sufficient to confirm whether Customer is a director or officer (as defined in § 240.16a–1(f) of the

Issuer. |

| d. | Customer agrees to comply with

all applicable laws in connection with the performance of this Trading Plan, including, without limitation, Sections 13 and 16 of the

Exchange Act and the respective rules and regulations promulgated thereunder. |

| e. | Customer agrees that Broker

is acting solely as agent for Customer and shall not by reason thereof assume any fiduciary or advisory relationship with Customer. Nothing

in this Trading Plan shall be construed as to impose upon Broker any obligation to exercise discretion over how, when, or whether to

effect trades in the Shares. |

| f. | Customer is responsible for

consulting with his or her own advisers as to the legal, tax, business, financial, and related aspects of, and has not relied on Broker

or any person affiliated with Broker in connection with Customer’s adoption and implementation of, this Trading Plan. |

| g. | Customer agrees that Customer

is solely responsible to determine whether this Trading Plan, or any actions taken pursuant to or in connection with this Trading Plan

(including without limitation termination of this Trading Plan), meets the requirements of any agreements between Issuer and Customer

and any of Issuer policies or other requirements applicable to Customer. Issuer policies or other requirements, copies of which may be

attached to this Trading Plan for informational purposes only, are not made a part of this Trading Plan. |

| h. | Without limiting Section 5,

Customer shall not, directly or indirectly, communicate any material nonpublic information relating to the Issuer or its securities to

any employee of Broker or its affiliates. |

| i. | Without limiting Section 5,

Customer agrees that Customer shall not exercise any subsequent influence over how, when, or whether to effect purchases or sales pursuant

to the Trading Plan. |

| a. | Severability.

In the event that any provision of this Trading Plan is declared by any court or other judicial or administrative body to be null, void,

or unenforceable, said provision shall survive to the extent it is not so declared, and all of the other provisions of this Trading Plan

shall remain in full force and effect. |

| b. | Amendments.

Without limiting Broker’s rights under Section 1(b)(i)(E), this Trading Plan may be amended or modified only in writing and signed

and dated by Customer and Broker and acknowledged by Issuer and, in the event of such an amendment or modification, Customer shall be

deemed to have restated and reaffirmed, as of the date of such amendment, each representation and warranty set forth in Section 5 of

this Trading Plan. |

| i. | All notices, requests, demands,

and other communications under this Trading Plan shall be in writing and shall be deemed to have been duly given: |

| A. | on the date of service if served

personally on the party to whom notice is to be given; |

| B. | on the date when receipt by

addressee is confirmed in writing, if sent via facsimile transmission to the facsimile number given below; or |

| C. | on the first business day with

respect to which a reputable air courier guarantees delivery. |

| ii. | Notice shall be delivered to

any party as follows: |

| A. | If to Customer: See Customer

Information in Part I above. |

Attn:

Phone:

Fax:

Email:

Fidelity

Brokerage Services LLC

Attn: 10b5-1

Group

2 Contra Way

T2L

Merrimack,

NH 03054

| iii. | Any party may change its address

for the purpose of this Section 10 by giving the other parties written notice of its new address in the manner set forth above. |

| d. | Customer

Agreement and Conflict of Terms. In the event of any inconsistencies between the Customer

Agreement and the Trading Plan, the provisions of the Customer Agreement, as amended and in effect, shall control. Customer acknowledges

that he has read the Customer Agreement, including its arbitration provision. Customer further acknowledges that a copy of the Customer

Agreement, as amended and in effect, is available at any time upon request or at www.Fidelity.com. |

| e. | Confidentiality.

This Trading Plan, together with the Trading Schedule and other personal information of the Customer, is subject to the confidentiality

and privacy provisions of the Customer Agreement, including Broker’s Privacy Policy. |

| f. | Entire

Trading Plan. This Trading Plan, together with the Trading Schedule and any exhibits hereto

or thereto, and the Customer Agreement contain the entire understanding between the parties with respect to the transactions contemplated

hereby and supersedes and replaces all prior and contemporaneous agreements and understandings, oral or written, with regard to such

transactions. |

| g. | Counterparts.

This Trading Plan may be executed in one or more counterparts, each of which shall be deemed an original and all of which shall constitute

a single document. |

Customer agrees

to all of the terms and conditions set forth in this Trading Plan, as may be amended from time to time and all applicable exhibits hereto

(collectively, the “Agreement “).

| |

|

|

|

|

|

| CUSTOMER: |

|

Accepted by Fidelity Brokerage Services LLC: |

| |

|

|

| BY: |

|

|

BY: |

|

|

| |

Kaufman 2012 Descendants Trust |

|

|

| |

|

|

|

| Name: |

TTEE: David Smith |

|

Name: |

| |

Kaufman 2012 Descendants Trust |

|

|

| |

|

|

|

| Title: |

|

Title: |

| |

|

|

| Date: |

|

Date: |

Once completed,

you may mail this document to Fidelity Brokerage Services LLC, Attn: 10b5-1

Group, 2 Contra Way T2L, Merrimack, NH 03054 if you are not completing this electronically. Please

call 800-544-6161 for any assistance that you may require with the completion of this 10b5-1 Trading Plan.

ISSUER

ACKNOWLEDGEMENT

ISSUER:

AGILYSYS INC

TO:

Fidelity Brokerage Services LLC

As a duly authorized

representative of the Issuer, I hereby represent that I have reviewed the attached 10b5-1 Trading Plan of ___

Kaufman

2012 Descendants Trust TTEE: David Smith

Kaufman

2012 Descendants Trust dated _________________, confirm that it is consistent with the Issuer’s

insider trading policies, and approve the designation of the Issuer’s Authorized Representative or successor above.

Acknowledged:

ISSUER:

AGILYSYS INC

BY: ____________________

Name: Kyle

Badger

Title: SVP,

General Counsel & Secretary

Date: ___________________

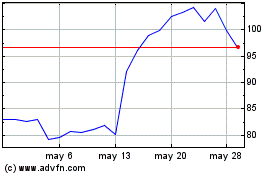

Agilysys (NASDAQ:AGYS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Agilysys (NASDAQ:AGYS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025