false

--12-31

0001860657

0001860657

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): August 19, 2024

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant

as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor

Boston, MA |

|

02108 |

| (Address of principal executive offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone

number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Series

A Convertible Redeemable Preferred Stock Offering

On August

19, 2024 (the “Closing Date”), Allarity Therapeutics, Inc., a Delaware corporation (the “Company” or “Allarity”),

entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain purchasers (the “Purchasers”),

pursuant to which the Company issued and sold, in a private placement (the “Offering”), 35,000 shares of the Company’s

Series A Convertible Redeemable Preferred Stock, par value $0.0001 per share (the “Preferred Stock”), at a net purchase price

of $90 per share, for gross proceeds of approximately $3.15 million in the aggregate for the Offering, before the deduction of discounts,

fees and offering expenses.

On the

Closing Date, the Company filed a certificate of designation (the “Certificate of Designation”) with the Secretary of the

State of Delaware designating the rights, preferences and limitations of the Preferred Stock. Under the Certificate of Designation, for

purposes of determining the presence of a quorum at any meeting of the stockholders of the Company at which the Preferred Stock are entitled

to vote and the voting power of the Preferred Stock, each holder of the Preferred Stock shall be entitled to a number of votes equal to

shares of the Company’s common stock, $0.0001 per share (the “Common Stock”) into which such Preferred Stock are then

convertible, disregarding, for such purposes, any limitations on conversion. The Preferred Stock shall be entitled to vote on each matter

submitted to a vote of the stockholders generally and shall vote together with the Common Stock and any other class or series of capital

stock entitled to vote thereon as a single class and on an as converted to the Common Stock basis.

The Company

plans to hold an annual meeting of stockholders to consider an amendment (the “Amendment”) to the Company’s Certificate

of Incorporation, as amended, to effect a reverse stock split of the outstanding Common Stock by a ratio to be determined by the Board

of Directors of the Company within a range specified in the proposal put to the stockholders for approval of the Amendment (the “Reverse

Stock Split”). The Purchasers have agreed in the Purchase Agreement not to convert the Preferred Stock, and not to transfer or otherwise

dispose of the Preferred Stock until the Reverse Stock Split, and to vote the Preferred Stock purchased in the Offering in favor of the

Amendment.

The holders

of the Preferred Stock are entitled to dividends, on an as-if converted basis, equal to dividends actually paid, if any, on the Common

Stock. The Preferred Stock is convertible, at the option of the holders and, in certain circumstances, by the Company, into the Common

Stock, as determined by dividing the net purchase price of $90 per share by the conversion price of $0.17, at the option of the holders.

The conversion price can be adjusted pursuant to the Certificates of Designation for stock dividends and stock splits, subsequent rights

offering, pro rata distributions of dividends or the occurrence of a fundamental transaction. The holders of the Preferred Stock have

the right to require the Company to redeem their shares of preferred stock for cash at 100% of the stated value of such shares commencing

after the earlier of the receipt of stockholder approval of the Amendment and 60 days after the Closing Date and until 90 days after the

Closing Date. The Company has the option to redeem the Preferred Stock for cash at 100% of the stated value commencing after the 90th day

following the Closing Date, subject to the holders’ rights to convert the shares prior to such redemption.

The proceeds

of the Offering are currently held in an escrow account, along with the additional amount that would be necessary to fund the 100% redemption

price until the expiration of the redemption period for the Preferred Stock, as applicable, subject to the earlier payment to redeeming

holders. Upon expiration of the redemption period, any proceeds remaining in the escrow account will be disbursed to the Company.

On the

Closing Date, the Company and the Purchasers also entered into a Registration Rights Agreement (the “Registration Rights Agreement”),

pursuant to which the Company agreed to file a registration statement with the Securities and Exchange Commission (the “SEC”),

to register for resale the Common Stock issuable upon the conversion of the Preferred Stock. The Company agreed to file the registration

statement with the SEC as early as 10 days following the date of the annual meeting of stockholders.

In

connection with the Offering, the Company agreed to pay Ascendiant Capital Markets, LLC, the Company’s placement agent, an aggregate

cash fee equal to $189,000.

The Purchase

Agreement contains customary representations, warranties and agreements by the Company and the Purchasers, and customary conditions to

closing. The representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of such agreement

and as of specific dates, were solely for the benefit of the parties to the agreements and are subject to limitations agreed upon by the

contracting parties. Accordingly, the Purchase Agreement is incorporated herein by reference only to provide investors with information

regarding the terms of the Purchase Agreement and not to provide investors with any other factual information regarding the Company or

its business and should be read in conjunction with the disclosures in the Company’s periodic reports and other filings with the

SEC.

The

foregoing summaries of the Purchase Agreement, the Registration Rights Agreement and Certificate of Designation do not purport to be complete

and are subject to, and qualified in their entirety by, forms of such documents attached as Exhibits 10.1, 10.2 and 3.1, respectively,

to this Current Report on Form 8-K, which are incorporated herein by reference.

License

Agreement with Eisai Inc. for Stenoparib

As previously

disclosed, the Company holds the exclusive worldwide rights to all preventative, therapeutic and/or diagnostic uses related to cancer

in humans and by amendment to the agreement on December 11, 2020, viral infections in humans (including, but not limited to, coronaviruses)

for Stenoparib from Eisai, Inc. (“Eisai”) pursuant to a license agreement (the “Eisai License Agreement”). On

August 19, 2024, the Company and Eisai entered into a sixth amendment (the “Sixth Amendment”) to the Eisai License Agreement,

among other things, to further extend the deadline for the Company’s Successful Completion (as defined below) of a further Phase

2 Clinical Trial and change the due date of the Extension Payment (as described below).

“Successful

Completion” means with respect to the Phase 2 Clinical Trial currently in design and to be executed by the Company and/or its affiliates

or sublicensees hereunder pursuant to the clinical development plan, reaching either 20% overall response rate (ORR, by RECIST v1.1) or

any of the primary or secondary endpoints of the trial mutually agreed by the parties. For the avoidance of doubt, irrespective of whether

there is any additional endpoint mutually agreed by the parties, if the Phase 2 Clinical Trial meets 20% ORR, it will be considered a

Successful Completion.

If the

Company and Eisai have not achieved the Successful Completion prior to April 1, 2028, Eisai may terminate the Eisai License Agreement

in its entirety, in its sole discretion on at least 120 days prior written notice.

In consideration

of this extension, and the Company not achieving the minimum patient enrollment, by July 1, 2022, as set out in the second amendment to

the Eisai License Agreement, the Company agreed to pay a one-time payment to Eisai of $1,250,000 (the “Extension Payment”)

as follows: (i) $400,000, (ii) $425,000 within 10 days from August 19, 2024 and (iii) $425,000 upon completion of a 10 million dollar

capital raising, but in no event later than September 1, 2024. To date, the Company has paid the full Extension Payment to Eisai, and

no payments are currently outstanding.

The foregoing

summary of the Sixth Amendment does not purport to be complete and is subject to, and qualified in its entirety by the Sixth Amendment,

attached as Exhibit 10.3 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 3.03 Material Modification to Rights of

Security Holders.

See the description set forth

under “Item 1.01. Entry into a Material Definitive Agreement – Series A Convertible Redeemable Preferred Stock Offering,”

which is incorporated into this Item 3.03 by reference.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On the Closing Date, the Company’s

Board of Directors designated the Preferred Stock in connection with the Offering. See the description set forth under “Item 1.01.

Entry into a Material Definitive Agreement – Series A Convertible Redeemable Preferred Stock Offering,” for a more complete

description of the rights and preferences of the Preferred Stock.

Item 8.01 Other Events.

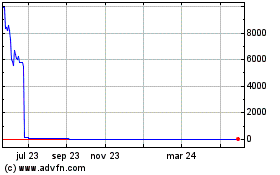

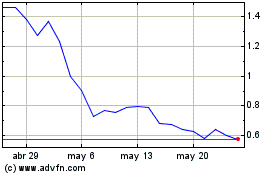

On August 15, 2024, The Nasdaq

Hearings Panel approved the Company’s request to maintain its listing on The Nasdaq Stock Market. This approval is contingent

upon the Company obtaining shareholder approval for a reverse split by September 6, 2024. The reverse split must be at a ratio sufficient

to meet the bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2).

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on our behalf by the

undersigned hereunto duly authorized.

| |

Allarity Therapeutics, Inc. |

|

|

|

| Date: August 21, 2024 |

By: |

/s/ Thomas H. Jensen |

| |

|

Thomas H. Jensen |

| |

|

Chief Executive Officer |

4

Exhibit 3.1

Allarity

THERAPEUTICS, INC.

CERTIFICATE OF DESIGNATION OF PREFERENCES, RIGHTS

AND LIMITATIONS OF

SERIES a

CONVERTIBLE REDEEMABLE PREFERRED STOCK

PURSUANT

TO SECTION 151 OF THE

delaware

GENERAL CORPORATION LAW

The undersigned, Thomas H.

Jensen, does hereby certify that:

| |

1. |

He is the Chief Executive Officer of Allarity Therapeutics, Inc., a Delaware corporation (the “Corporation”).

|

| |

2. |

The Corporation is authorized to issue 500,000 shares of preferred stock, $0.0001 par value per share, 20,000 of which have been issued as Series A Convertible Preferred Stock, $0.0001 par value per share, of which no shares remain outstanding, 200,000 of which have been issued as Series B Preferred Stock, $0.0001 par value per share, all of which have been redeemed, and 50,000 of which have been issued as Series C Preferred Stock, $0.0001 par value per share, of which no shares remain outstanding.

|

| |

3. |

The following resolutions were duly adopted by

the board of directors of the Corporation (the “Board of Directors”):

|

WHEREAS, the Certificate

of Incorporation of the Corporation, as amended to date (the “Certificate of Incorporation”), provides for a class of its

authorized stock known as preferred stock, consisting of 500,000 shares, $0.0001 par value per share, issuable from time to time in one

or more series;

WHEREAS, the Board of Directors

is authorized by resolution to provide for the issuance of preferred stock in one or more series, and to establish from time to time the

number of shares to be included in each such series, and to fix the designation, powers, privileges, preferences and relative participating,

optional or other rights, if any, of the shares of each such series and the qualifications, limitations or restrictions thereof; and

WHEREAS, it is the desire

of the Board of Directors, pursuant to its authority as described above, to fix the rights, preferences, restrictions and other matters

relating to a series of the preferred stock, which shall consist of 40,000 shares of the preferred stock which the Corporation has the

authority to issue.

NOW, THEREFORE, BE IT RESOLVED,

that the Board of Directors does hereby provide for the issuance of a series of preferred stock to be designated “Series A Convertible

Redeemable Preferred Stock” and does hereby fix and determine the designation, powers, privileges, preferences and relative participating,

optional or other rights, if any, of the shares of each such series and the qualifications, limitations or restrictions thereof as follows:

Section 1. Definitions.

For the purposes hereof, the following terms shall have the following meanings:

“Affiliate”

means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control

with a Person, as such terms are used in and construed under Rule 405 of the Securities Act.

“Alternate

Consideration” shall have the meaning set forth in Section 7(d).

“Amendment”

means the amendment to the Corporation’s Certificate of Incorporation to, after the date hereof, effect the Reverse Stock Split.

“Authorized

Stockholder Approval” means approval of the Amendment by the affirmative vote of holders of a majority of the votes cast affirmatively

or negatively (excluding abstentions).

“Beneficial

Ownership Limitation” shall have the meaning set forth in Section 6(d).

“Business

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day

on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Buy-In”

shall have the meaning set forth in Section 6(c)(iv).

“Change

of Control Transaction” means the occurrence after the date hereof of any of (a) an acquisition by an individual or legal entity

or “group” (as described in Rule 13d-5(b)(1) promulgated under the Exchange Act) of effective control (whether through legal

or beneficial ownership of capital stock of the Corporation, by contract or otherwise) of in excess of 33% of the voting securities of

the Corporation (other than by means of the issuance, sale, conversion or exercise of Series A Preferred Stock, (b) the Corporation merges

into or consolidates with any other Person, or any Person merges into or consolidates with the Corporation and, after giving effect to

such transaction, the stockholders of the Corporation immediately prior to such transaction own less than 66% of the aggregate voting

power of the Corporation or the successor entity of such transaction, (c) the Corporation (and all of its Subsidiaries, taken as a whole)

sells or transfers all or substantially all of its assets to another Person and the stockholders of the Corporation immediately prior

to such transaction own less than 66% of the aggregate voting power of the acquiring entity immediately after the transaction, (d) a replacement

at one time or within a one year period of more than one-half of the members of the Board of Directors which is not approved by a majority

of those individuals who are members of the Board of Directors on the Original Issue Date (or by those individuals who are serving as

members of the Board of Directors on any date whose nomination to the Board of Directors was approved by a majority of the members of

the Board of Directors who are members on the Original Issue Date), or (e) the execution by the Corporation of an agreement to which the

Corporation is a party or by which it is bound, providing for any of the events set forth in clauses (a) through (d) above.

“Closing”

means the closing of the purchase and sale of the Series A Preferred Stock pursuant to Section 2.1 of the Purchase Agreement.

“Closing

Date” means the Trading Day on which all of the Transaction Documents have been executed and delivered by the applicable parties

thereto and all conditions precedent to (i) each Holder’s obligations to pay the Subscription Amount and (ii) the Corporation’s

obligations to deliver the Series A Preferred Stock have been satisfied or waived.

“Commission”

means the United States Securities and Exchange Commission.

“Common

Stock” means the Corporation’s common stock, $0.0001 par value per share, and stock of any other class of securities into

which such securities may hereafter be reclassified, converted or changed.

“Common

Stock Equivalents” means any securities of the Corporation or the Subsidiaries which would entitle the holder thereof to acquire

at any time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that

is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion

Amount” means the Stated Value at issue.

“Conversion

Date” shall have the meaning set forth in Section 6(a).

“Conversion

Price” shall have the meaning set forth in Section 6(b).

“Conversion

Shares” means, collectively, the shares of Common Stock issuable upon conversion of the shares of Series A Preferred Stock in

accordance with the terms hereof.

“Escrow

Agreement” means the escrow agreement to be entered into concurrently with the Purchase Agreement, by and among the Corporation,

Equinity Trust Company, LLC, a New York limited liability trust company, and the other party thereto.

“Equity

Conditions” means, during the period in question, (a) the Corporation shall have paid all liquidated damages and other amounts

owing to the applicable Holder in respect of the Series A Preferred Stock, (b)(i) there is an effective registration statement pursuant

to which either (A) the Corporation may issue Conversion Shares or (B) the Holders are permitted to utilize the prospectus thereunder

to resell all of the shares of Common Stock issuable pursuant to the Transaction Documents (and the Corporation believes, in good faith,

that such effectiveness will continue uninterrupted for the foreseeable future), (ii) all of the Conversion Shares issuable pursuant to

the Transaction Documents (and shares issuable in lieu of cash payments of dividends) may be resold pursuant to Rule 144 without volume

or manner-of-sale restrictions or current public information requirements as determined by the counsel to the Corporation as set forth

in a written opinion letter to such effect, addressed and reasonably acceptable to the Transfer Agent and the affected Holder, or (iii)

all of the Conversion Shares may be issued to the Holder pursuant to Section 3(a)(9) of the Securities Act and immediately resold without

restriction, (c) the Common Stock is trading on a Trading Market and all of the shares of Common Stock issuable upon conversion of the

Series A Preferred Stock are listed or quoted for trading on such Trading Market (and the Corporation believes, in good faith, that trading

of the Common Stock on a Trading Market will continue uninterrupted for the foreseeable future), (d) there is a sufficient number of authorized,

but unissued and otherwise unreserved, shares of Common Stock for the issuance of all of the shares then issuable pursuant to the Transaction

Documents, (e) Authorized Stockholder Approval shall have been received and be effective, (f) the issuance of the shares in question to

the applicable Holder would not violate the limitations set forth in Section 6(d) herein, (g) the shares of Common Stock have traded on

the applicable Trading Market during a consecutive ten (10) day period at an average market price per share greater than $2 (as adjusted

for stock splits) and the average daily trading volume during such period is equal to or greater than $2,000,000, (h) there has been no

public announcement of a pending or proposed Fundamental Transaction or Change of Control Transaction that has not been consummated, (i)

the applicable Holder is not in possession of any information provided by the Corporation, any of its Subsidiaries, or any of their officers,

directors, employees, agents or Affiliates, that constitutes, or may constitute, material non-public information and (j) the Corporation

shall have duly honored all conversions scheduled to occur or occurring by virtue of one or more Notices of Conversion of the applicable

Holder on or prior to the dates so requested or required, if any.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Forced

Conversion Date” shall have the meaning set forth in Section 8(b).

“Forced

Conversion Notice” shall have the meaning set forth in Section 8(b).

“Forced

Conversion Notice Date” shall have the meaning set forth in Section 8(b).

“Fundamental

Transaction” shall have the meaning set forth in Section 7(d).

“GAAP”

means United States generally accepted accounting principles.

“Holder”

shall have the meaning given such term in Section 2.

“Liquidation”

shall have the meaning set forth in Section 5.

“Mandatory

Conversion” shall have the meaning set forth in Section 8(a).

“Mandatory

Conversion Date” shall have the meaning set forth in Section 8(a).

“Net Per

Share Purchase Price” equals, with respect to each share of Series A Stock, $90 per share, subject, in each case, to adjustment

for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Common Stock that occur

after the date of this Agreement.

“Notice

of Conversion” shall have the meaning set forth in Section 6(a).

“Original

Issue Date” means the date of the first issuance of any shares of the Series A Preferred Stock regardless of the number of transfers

of any particular shares of Series A Preferred Stock and regardless of the number of certificates which may be issued to evidence such

Series A Preferred Stock.

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company,

joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Purchase

Agreement” means the Securities Purchase Agreement, dated as of August 19, 2024, among the Corporation and the original Holders,

as amended, modified or supplemented from time to time in accordance with its terms.

“Reverse

Stock Split” means the reverse stock split of the Corporation’s Common Stock that is effected by the Corporation’s

filing of the Amendment with and acceptance by the Secretary of State of the State of Delaware.

“Reverse

Stock Split Date” means the date on which the Amendment to effectuate the Reverse Stock Split is filed and accepted by the Secretary

of State of the State of Delaware.

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Series

A Preferred Stock” shall have the meaning set forth in Section 2.

“Share

Delivery Date” shall have the meaning set forth in Section 6(c).

“Stated

Value” shall have the meaning set forth in Section 2.

“Subscription

Amount” shall mean, as to each Holder, the aggregate amount to be paid for the Series A Preferred Stock purchased pursuant to

the Purchase Agreement as specified below such Holder’s name on the signature page of the Purchase Agreement and next to the heading

“Subscription Amount,” in United States dollars and in immediately available funds.

“Subsidiary”

means any subsidiary of the Corporation as set forth on Schedule 3.1(a) of the Purchase Agreement and shall, where applicable,

also include any direct or indirect subsidiary of the Corporation formed or acquired after the date of the Purchase Agreement.

“Successor

Entity” shall have the meaning set forth in Section 7(d).

“Trading

Day” means a day on which the principal Trading Market is open for business.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, or the New York

Stock Exchange (or any successors to any of the foregoing).

“Transaction

Documents” means this Certificate of Designation, the Purchase Agreement, the Registration Rights Agreement, the Escrow Agreement,

all exhibits and schedules thereto and hereto and any other documents or agreements executed in connection with the transactions contemplated

pursuant to the Purchase Agreement, in each case as amended, modified or supplemented from time to time in accordance with its terms.

“Transfer

Agent” means Computershare Trust Company, N.A., the current transfer agent of the Company, with a mailing address of P.O. Box

43001, Providence, RI 02940-3001, and any successor transfer agent of the Corporation.

Section 2. Designation,

Amount and Par Value. The series of preferred stock shall be designated as “Series A Convertible Redeemable Preferred Stock”

(the “Series A Preferred Stock”) and the number of shares of such series shall be 40,000 (which shall not be subject

to increase without the written consent of the holders of a majority of the then outstanding shares of the Series A Preferred Stock (each,

a “Holder” and collectively, the “Holders”)). Each share of Series A Preferred Stock shall have

a par value of $0.0001 per share and a stated value equal to $100 (the “Stated Value”).

Section 3. Dividends.

Except for stock dividends or distributions for which adjustments are to be made pursuant to Section 7, Holders shall be entitled to receive,

and the Corporation shall pay, dividends on shares of Series A Preferred Stock equal (on an as-if-converted-to-Common-Stock basis, disregarding

for such purpose any conversion limitations hereunder) to and in the same form as dividends actually paid on shares of the Common Stock

when, as and if such dividends are paid on shares of the Common Stock. No other dividends shall be paid on shares of Series A Preferred

Stock. The Corporation shall not pay any dividends on the Common Stock unless the Corporation simultaneously complies with this provision.

Section 4. Voting

Rights.

a) For purposes of determining

the presence of a quorum at any meeting of the stockholders of the Corporation at which the shares of Series A Preferred Stock are entitled

to vote and the voting power of the shares of Series A Preferred Stock, each holder of outstanding shares of Series A Preferred Stock

shall be entitled to a number of votes equal to the number of shares of Common Stock into which such shares of Series A Preferred Stock

are then convertible, disregarding, for such purposes, any limitations on conversion set forth herein.

b) Except as otherwise required

by the Delaware General Corporation Law or the Certificate of Incorporation (including this Certificate of Designation), each share of

Series A Preferred Stock shall be entitled to vote on each matter submitted to a vote of the stockholders generally and shall vote together

with the Common Stock and any other class or series of capital stock entitled to vote thereon as a single class and on an as converted

to Common Stock basis. Notwithstanding the foregoing, in addition, as long as any shares of Series A Preferred Stock are outstanding,

the Corporation shall not, without the affirmative vote of the Holders of a majority of the then outstanding shares of the Series A Preferred

Stock, voting as a separate class, (a) alter or change the powers, preferences or rights of the Series A Preferred Stock so as to affect

them adversely, (b) amend the Certificate of Incorporation or other charter documents in a manner adverse to the Holders, (c) increase

the number of authorized shares of Series A Preferred Stock, (d) pledge, encumber, or place a lien on any assets in an account subject

to the Escrow Agreement or (e) enter into any agreement with respect to any of the foregoing.

Section 5. Liquidation.

Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”),

prior and in preference to the Common Stock, the Holders shall be entitled to receive out of the assets available for distribution to

stockholders an amount in cash equal to 100% of the Stated Value and no more. The preference set forth in this Section 5 with respect

to distributions to the Series A Preferred Stock upon a Liquidation shall apply mutatis mutandis to any distributions to be made

upon the consummation of a Fundamental Transaction or Change of Control Transaction. The Corporation shall mail written notice of any

such Liquidation, Fundamental Transaction or Change of Control Transaction not less than 45 days prior to the payment date stated therein,

to each Holder.

Section 6. Conversion.

a) Conversions

at Option of Holder. Subject to Section 6(d), each share of Series A Preferred Stock shall be convertible, at any time and from time

to time only after the Reverse Stock Split Date, at the option of the Holder thereof, into that number of shares of Common Stock determined

by dividing the Net Per Share Purchase Price of such share of Series A Preferred Stock by the Conversion Price. Holders shall effect conversions

by delivering to the Corporation a conversion notice in the form attached hereto as Annex A (a “Notice of Conversion”).

Each Notice of Conversion shall specify the number of shares of Series A Preferred Stock to be converted, the number of shares of Series

A Preferred Stock owned prior to the conversion at issue, the number of shares of Series A Preferred Stock owned subsequent to the conversion

at issue and the date on which such conversion is to be effected, which date may not be prior to the date the applicable Holder delivers

such Notice of Conversion to the Corporation (such date, the “Conversion Date”). If no Conversion Date is specified

in a Notice of Conversion, the Conversion Date shall be as of the close of business on the Business Day that such Notice of Conversion

is delivered to the Corporation, or if such day is not a Business day or if the Notice of Conversion is delivered after regular business

hours, the next Business Day. No ink-original Notice of Conversion shall be required, nor shall any medallion guarantee (or other type

of guarantee or notarization) of any Notice of Conversion form be required. The calculations and entries set forth in the Notice of Conversion

shall control in the absence of manifest or mathematical error. From and after the Conversion Date, until presented for transfer or exchange,

certificates that previously represented shares of Series A Preferred Stock shall represent, in lieu of the number of shares of Series

A Preferred Stock previously represented by such certificate, the number of shares of Series A Preferred Stock, if any, previously represented

by such certificate that were not converted pursuant to the Notice of Conversion, plus the number of shares of Conversion Shares into

which the shares of Series A Preferred Stock previously represented by such certificate were converted. To effect conversions of shares

of Series A Preferred Stock, a Holder shall not be required to surrender the certificate(s), if any, representing the shares of Series

A Preferred Stock to the Corporation unless all of the shares of Series A Preferred Stock represented thereby are so converted, in which

case such Holder shall deliver the certificate representing such shares of Series A Preferred Stock promptly following the Conversion

Date at issue. Shares of Series A Preferred Stock converted into Common Stock shall be canceled and shall not be reissued.

b) Conversion

Price. The conversion price for the Series A Preferred Stock shall equal $0.17, subject to adjustment herein (the “Conversion

Price”). In no event shall the Conversion Price be less than the Minimum Price defined in Nasdaq Listing Rule 5635(d).

c) Mechanics

of Conversion

| |

i. |

Delivery of Conversion Shares Upon Conversion. Not later than the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined below) after each Conversion Date (the “Share Delivery Date”), the Corporation shall deliver, or cause to be delivered, to the converting Holder the number of Conversion Shares being acquired upon the conversion of the Series A Preferred Stock, which Conversion Shares shall be free of restrictive legends and trading restrictions. The Corporation shall use its reasonable best efforts to deliver the Conversion Shares required to be delivered by the Corporation under this Section 6 electronically through the Depository Trust Company or another established clearing corporation performing similar functions. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Corporation’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Conversion. |

| |

|

|

| |

ii. |

Failure to Deliver Conversion Shares. If, in the case of any Notice of Conversion, such Conversion Shares are not delivered to or as directed by the applicable Holder by the Share Delivery Date, the Holder shall be entitled to elect by written notice to the Corporation at any time on or before its receipt of such Conversion Shares, to rescind such Conversion, in which event the Corporation shall promptly return to the Holder any original Preferred Stock certificate delivered to the Corporation and the Holder shall promptly return to the Corporation the Conversion Shares issued to such Holder pursuant to the rescinded Notice of Conversion. |

| |

iii. |

Obligation Absolute; Partial Liquidated Damages. Subject to Section 6(d), the Corporation’s obligation to issue and deliver the Conversion Shares upon conversion of Series A Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law by such Holder or any other Person, and irrespective of any other circumstance, which might otherwise limit such obligation of the Corporation to such Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the Corporation of any such action that the Corporation may have against such Holder. In the event a Holder shall elect to convert any or all of the Stated Value of its Series A Preferred Stock, the Corporation may not refuse conversion based on any claim that such Holder or anyone associated or affiliated with such Holder has been engaged in any violation of law, agreement or for any other reason, other than pursuant to Section 6(d), unless an injunction from a court, on notice to Holder, restraining and/or enjoining conversion of all or part of the Series A Preferred Stock of such Holder shall have been sought and obtained, and the Corporation posts a surety bond for the benefit of such Holder in the amount of 150% of the Stated Value of the Series A Preferred Stock which is subject to the injunction, which bond shall remain in effect until the completion of arbitration/litigation of the underlying dispute and the proceeds of which shall be payable to such Holder to the extent it obtains judgment. In the absence of such injunction, subject to Section 6(d), the Corporation shall issue Conversion Shares and, if applicable, cash, upon a properly noticed conversion. If the Corporation fails to deliver to a Holder such Conversion Shares pursuant to Section 6(c)(i) by the Share Delivery Date applicable to such conversion, other than pursuant to Section 6(d), the Corporation shall pay to such Holder, in cash, as liquidated damages and not as a penalty, for each $5,000 of Stated Value of Series A Preferred Stock being converted, $50 per Trading Day (increasing to $100 per Trading Day on the third Trading Day after the Share Delivery Date and increasing to $200 per Trading Day on the sixth Trading Day after the Share Delivery Date) for each Trading Day after the Share Delivery Date until such Conversion Shares are delivered or Holder rescinds such conversion. Nothing herein shall limit a Holder’s right to pursue actual damages for the Corporation’s failure to deliver Conversion Shares within the period specified herein and such Holder shall have the right to pursue all remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief. The exercise of any such rights shall not prohibit a Holder from seeking to enforce damages pursuant to any other Section hereof or under applicable law. |

| |

iv. |

Compensation for Buy-In on Failure to Timely Deliver Conversion Shares Upon Conversion. In addition to any other rights available to the Holder, if the Corporation fails for any reason to deliver to a Holder the applicable Conversion Shares by the Share Delivery Date pursuant to Section 6(c)(i), and if after such Share Delivery Date such Holder is required by its brokerage firm to purchase (in an open market transaction or otherwise), or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by such Holder of the Conversion Shares which such Holder was entitled to receive upon the conversion relating to such Share Delivery Date (a “Buy-In”), then the Corporation shall (A) pay in cash to such Holder (in addition to any other remedies available to or elected by such Holder) the amount, if any, by which (x) such Holder’s total purchase price (including any brokerage commissions) for the Common Stock so purchased exceeds (y) the product of (1) the aggregate number of shares of Common Stock that such Holder was entitled to receive from the conversion at issue multiplied by (2) the actual sale price at which the sell order giving rise to such purchase obligation was executed (including any brokerage commissions) and (B) at the option of such Holder, either reissue (if surrendered) the shares of Series A Preferred Stock equal to the number of shares of Series A Preferred Stock submitted for conversion (in which case, such conversion shall be deemed rescinded) or deliver to such Holder the number of shares of Common Stock that would have been issued if the Corporation had timely complied with its delivery requirements under Section 6(c)(i). For example, if a Holder purchases shares of Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted conversion of shares of Series A Preferred Stock with respect to which the actual sale price of the Conversion Shares (including any brokerage commissions) giving rise to such purchase obligation was a total of $10,000 under clause (A) of the immediately preceding sentence, the Corporation shall be required to pay such Holder $1,000. The Holder shall provide the Corporation written notice indicating the amounts payable to such Holder in respect of the Buy-In and, upon request of the Corporation, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Corporation’s failure to timely deliver the Conversion Shares upon conversion of the shares of Series A Preferred Stock as required pursuant to the terms hereof. |

| |

|

|

| |

v. |

Reservation of Shares Issuable Upon Conversion. From and after the Reverse Stock Split Date and until no shares of Series A Preferred Stock remain outstanding, the Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued shares of Common Stock for the sole purpose of issuance upon conversion of the Series A Preferred Stock as herein provided, free from preemptive rights or any other actual contingent purchase rights of Persons other than the Holder (and the other holders of the Series A Preferred Stock), not less than the aggregate number of shares of the Common Stock as shall (subject to the terms and conditions set forth in the Purchase Agreement) be issuable (taking into account any adjustments under Section 7) upon the conversion of the then outstanding shares of Series A Preferred Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and nonassessable. |

| |

vi. |

Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of the Series A Preferred Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Corporation shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion Price or round up to the next whole share. Notwithstanding anything to the contrary contained herein, but consistent with the provisions of this subsection with respect to fractional Conversion Shares, nothing shall prevent any Holder from converting fractional shares of Series A Preferred Stock. |

| |

vii. |

Transfer Taxes and Expenses. The issuance

of Conversion Shares on conversion of the Series A Preferred Stock shall be made without charge to any Holder for any documentary stamp

or similar taxes that may be payable in respect of the issue or delivery of such Conversion Shares, provided that the Corporation shall

not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such Conversion

Shares upon conversion in a name other than that of the Holders of such shares of Series A Preferred Stock and the Corporation shall

not be required to issue or deliver such Conversion Shares unless or until the Person or Persons requesting the issuance thereof shall

have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has

been paid. The Corporation shall pay all Transfer Agent fees required for same-day processing of any Notice of Conversion and all fees

to the Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic

delivery of the Conversion Shares. |

d) Beneficial

Ownership Limitation. Notwithstanding anything to the contrary set forth herein, the Corporation shall not effect any conversion of

the Series A Preferred Stock, and a Holder shall not have the right to convert any portion of the Series A Preferred Stock, to the extent

that, after giving effect to the conversion set forth on the applicable Notice of Conversion, such Holder (together with such Holder’s

Affiliates, and any Persons acting as a group together with such Holder or any of such Holder’s Affiliates (such Persons, “Attribution

Parties”)) would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing

sentence, the number of shares of Common Stock beneficially owned by such Holder and its Affiliates and Attribution Parties shall include

the number of shares of Common Stock issuable upon conversion of the Series A Preferred Stock with respect to which such determination

is being made, but shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted

Series A Preferred Stock beneficially owned by such Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion

of the unexercised or unconverted portion of any other securities of the Corporation subject to a limitation on conversion or exercise

analogous to the limitation contained herein (including, without limitation, the Series A Preferred Stock) beneficially owned by such

Holder or any of its Affiliates or Attribution Parties. Except as set forth in the preceding sentence, for purposes of this Section 6(d),

beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated

thereunder. To the extent that the limitation contained in this Section 6(d) applies, the determination of whether the Series A Preferred

Stock is convertible (in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and of

how many shares of Series A Preferred Stock are convertible shall be in the sole discretion of such Holder, and the submission of a Notice

of Conversion shall be deemed to be such Holder’s determination of whether the shares of Series A Preferred Stock may be converted

(in relation to other securities owned by such Holder together with any Affiliates and Attribution Parties) and how many shares of the

Series A Preferred Stock are convertible, in each case subject to the Beneficial Ownership Limitation. To ensure compliance with this

restriction, each Holder will be deemed to represent to the Corporation each time it delivers a Notice of Conversion that such Notice

of Conversion has not violated the restrictions set forth in this Section 6(d) and the Corporation shall have no obligation to verify

or confirm the accuracy of such determination. In addition, a determination as to any group status as contemplated above shall be determined

in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section

6(d), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common

Stock as stated in the most recent of the following: (i) the Corporation’s most recent periodic or annual report filed with the

Commission, as the case may be, (ii) a more recent public announcement by the Corporation or (iii) a more recent written notice by the

Corporation or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request (which

may be via email) of a Holder, the Corporation shall within one (1) Trading Day confirm orally and in writing to such Holder the number

of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving

effect to the conversion or exercise of securities of the Corporation, including the Series A Preferred Stock, by such Holder or its Affiliates

or Attribution Parties since the date as of which such number of outstanding shares of Common Stock was reported. The “Beneficial

Ownership Limitation” shall be 4.99% (or, upon election by a Holder prior to the issuance of any shares of Series A Preferred

Stock, 9.99%) of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common

Stock issuable upon conversion of Series A Preferred Stock held by the applicable Holder. A Holder, upon notice to the Corporation, may

increase or decrease the Beneficial Ownership Limitation provisions of this Section 6(d) applicable to its Series A Preferred Stock; provided,

that the Beneficial Ownership Limitation shall not in any event exceed 9.99% of the number of shares of the Common Stock outstanding immediately

after giving effect to the issuance of shares of Common Stock upon conversion of this Series A Preferred Stock held by the Holder and

the provisions of this Section 6(d) shall continue to apply. Any such increase will not be effective until the 61st day after such notice

is delivered to the Corporation and shall only apply to such Holder and no other Holder. The Beneficial Ownership Limitation shall not

be waived by the Corporation or the Holder and upon issuance of the Series A Preferred Stock by the Corporation, and the purchase thereof

by the Holder, in accordance with the Purchase Agreement, each of the Corporation and the Purchaser shall be deemed to acknowledge such

limitation and to agree not to waive it. The provisions of this Section 6(d) shall be construed and implemented in a manner otherwise

than in strict conformity with the terms of this Section 6(d) to correct this Section (or any portion hereof) which may be defective or

inconsistent with the intended Beneficial Ownership Limitation contained herein or to make changes or supplements necessary or desirable

to properly give effect to such limitation. The limitations contained in this Section shall apply to a successor holder of Series A Preferred

Stock.

Section 7. Certain

Adjustments.

a) Stock Dividends

and Stock Splits. If the Corporation, at any time while the Series A Preferred Stock is outstanding: (i) pays a stock dividend or

otherwise makes a distribution or distributions that is payable in shares of Common Stock on shares of Common Stock or any other Common

Stock Equivalents (which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Corporation upon conversion

of, or payment of a dividend on, the Series A Preferred Stock), (ii) subdivides outstanding shares of Common Stock into a larger number

of shares, (iii) combines (including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares,

or (iv) issues, in the event of a reclassification of shares of the Common Stock, any shares of capital stock of the Corporation, then

the Conversion Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding

any treasury shares of the Corporation) outstanding immediately before such event, and of which the denominator shall be the number of

shares of Common Stock outstanding immediately after such event. Any adjustment made pursuant to this Section 7(a) shall become effective

immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become

effective immediately after the effective date in the case of a subdivision, combination or re-classification. Notwithstanding the foregoing

in no event may the Conversion Price be less than the par value per share of Series A Preferred Stock.

b) Subsequent

Rights Offerings. In addition to any adjustments pursuant to Section 7(a) above, if at any time the Corporation grants, issues or

sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders

of Common Stock or any class thereof (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the

terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the

number of shares of Common Stock acquirable upon complete conversion of such Holder’s Series A Preferred Stock (without regard to

any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on

which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which

the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided,

however, that, to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder

exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase Right to such extent

(or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such Purchase Right to

such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding

the Beneficial Ownership Limitation).

c) Distributions.

During such time as the Series A Preferred Stock is outstanding, if the Corporation declares or makes any dividend or other distribution

of its assets (or rights to acquire its assets) to holders of Common Stock, by way of return of capital or otherwise (including, without

limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin off, reclassification,

corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), then, in each such

case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein

if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of the Series A Preferred Stock (without

regard to any limitations on conversion hereof, including without limitation, the Beneficial Ownership Limitation) immediately before

the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of

shares of Common Stock are to be determined for the participation in such Distribution (provided, however, that, to the extent that the

Holder’s right to participate in any such Distribution would result in the Holder exceeding the Beneficial Ownership Limitation,

then the Holder shall not be entitled to participate in such Distribution to such extent (or in the beneficial ownership of any shares

of Common Stock as a result of such Distribution to such extent) and the portion of such Distribution shall be held in abeyance for the

benefit of the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership

Limitation).

d) Fundamental

Transaction. If, at any time while the Series A Preferred Stock is outstanding, (i) the Corporation, directly or indirectly, in one

or more related transactions effects any merger or consolidation of the Corporation with or into another Person, (ii) the Corporation

(and all of its Subsidiaries, taken as a whole), directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance

or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) any, direct or indirect,

purchase offer, tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which holders of

Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the

holders of at least 50% of the outstanding Common Stock, (iv) the Corporation, directly or indirectly, in one or more related transactions

effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which

the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Corporation, directly or

indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including,

without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person

acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other Person or

other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase

agreement or other business combination) (each a “Fundamental Transaction”), then, upon any subsequent conversion of

the Series A Preferred Stock, the Holder shall have the right to receive, for each Conversion Share that would have been issuable upon

such conversion immediately prior to the occurrence of such Fundamental Transaction (without regard to any limitation in Section 6(d)

on the conversion of the Series A Preferred Stock), the number of shares of Common Stock of the successor or acquiring corporation or

of the Corporation, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”)

receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which the Series A Preferred

Stock is convertible immediately prior to such Fundamental Transaction (without regard to any limitation in Section 6(d) on the conversion

of the Series A Preferred Stock). For purposes of any such conversion, the determination of the Conversion Price shall be appropriately

adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common

Stock in such Fundamental Transaction, and the Corporation shall apportion the Conversion Price among the Alternate Consideration in a

reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock

are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given

the same choice as to the Alternate Consideration it receives upon any conversion of the Series A Preferred Stock following such Fundamental

Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Corporation or surviving entity in such

Fundamental Transaction shall file a new Certificate of Designation with the same terms and conditions and issue to the Holders new preferred

stock consistent with the foregoing provisions and evidencing the Holders’ right to convert such preferred stock into Alternate

Consideration. The Corporation shall cause any successor entity in a Fundamental Transaction in which the Corporation is not the survivor

(the “Successor Entity”) to assume in writing all of the obligations of the Corporation under this Certificate of Designation

and the other Transaction Documents in accordance with the provisions of this Section 7(d) pursuant to written agreements in customary

form and substance reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental

Transaction and shall, at the option of the Holder, deliver to the Holder in exchange for the Series A Preferred Stock a security of the

Successor Entity evidenced by a written instrument substantially similar in form and substance to the Series A Preferred Stock which is

convertible for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares

of Common Stock acquirable and receivable upon conversion of the Series A Preferred Stock (without regard to any limitations on the conversion

of the Series A Preferred Stock) prior to such Fundamental Transaction, and with a conversion price which applies the conversion price

hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental

Transaction and the value of such shares of capital stock, such number of shares of capital stock and such conversion price being for

the purpose of protecting the economic value of the Series A Preferred Stock immediately prior to the consummation of such Fundamental

Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction,

the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions

of this Certificate of Designation and the other Transaction Documents referring to the “Corporation” shall refer instead

to the Successor Entity), and may exercise every right and power of the Corporation and shall assume all of the obligations of the Corporation

under this Certificate of Designation and the other Transaction Documents with the same effect as if such Successor Entity had been named

as the Corporation herein.

f) Calculations.

All calculations under this Section 7 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For purposes

of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the

number of shares of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding.

g) Notice of

Holders.

| |

i. |

Adjustment to Conversion Price. Whenever the Conversion Price is adjusted pursuant to any provision of this Section 7, the Corporation shall promptly deliver to each Holder by facsimile or email a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment. |

| |

|

|

| |

ii. |

Notice to Allow Conversion by Holder. If (A) the Corporation shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Corporation shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Corporation shall authorize the granting to all holders of the Common Stock of rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Corporation shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Corporation is a party, any sale or transfer of all or substantially all of the assets of the Corporation (and all of its Subsidiaries, taken as a whole), or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property or (E) the Corporation shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Corporation, then, in each case, the Corporation shall cause to be filed at each office or agency maintained for the purpose of conversion of the Preferred Stock, and shall cause to be delivered by email to each Holder at its last email address as it shall appear upon the stock books of the Corporation, at least twenty (20) calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which a record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants are to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange, provided that the failure to deliver such notice or any defect therein or in the delivery thereof shall not affect the validity of the corporate action required to be specified in such notice. To the extent that any notice provided hereunder constitutes, or contains, material, non-public information regarding the Corporation or any of the Subsidiaries, the Corporation shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K. The Holder shall remain entitled to convert the Conversion Amount of the Preferred Stock (or any part hereof) during the 20-day period commencing on the date of such notice through the effective date of the event triggering such notice except as may otherwise be expressly set forth herein. |

Section 8. Mandatory

Conversion and Forced Conversion.

a) Mandatory

Conversion. Notwithstanding anything herein to the contrary, subject to Section 8(c), on the Reverse Stock Split Date or, if all of

the Equity Conditions are not satisfied on the Reverse Stock Split Date, on the first such date after the Reverse Stock Split Date, if

and only if such date is within and no later than fifteen (15) Trading Days after the Reverse Stock Split Date, that all of the Equity

Conditions are satisfied (unless waived in writing by a Holder with respect to such Holder) (the “Mandatory Conversion Date”),

the Corporation may deliver written notice of the Mandatory Conversion to all Holders on the Mandatory Conversion Date and, on such Mandatory

Conversion Date, the Corporation shall convert all of each Holder’s shares of Series A Preferred Stock (the “Mandatory

Conversion”) into Conversion Shares at the then effective Conversion Price on the Mandatory Conversion Date, it being agreed

that the “Conversion Date” for purposes of Section 6 herein shall be deemed to be the Mandatory Conversion Date. The Mandatory

Conversion hereunder shall not be effective, unless all of the Equity Conditions are met (unless waived in writing by a Holder with respect

to such Holder) on the Mandatory Conversion Date through and including the Share Delivery Date and the actual delivery of all of the Conversion

Shares to the Holders. For purposes of clarification, a Mandatory Conversion shall be subject to all of the provisions of Section 6, including,

without limitation, Section 6(d) and the provision requiring payment of liquidated damages. If any of the Equity Conditions shall cease

to be satisfied at any time on or after the Mandatory Conversion Date through and including the actual delivery of all of the Conversion

Shares to the Holders, a Holder may elect to nullify the Mandatory Conversion as to such Holder by notice to the Corporation within three

(3) Trading Days after the first day on which any such Equity Condition has not been satisfied (provided that if, by a provision of the

Transaction Documents, the Corporation is obligated to notify the Holders of the non-existence of an Equity Condition, such notice period

shall be extended to the second Trading Day after proper notice from the Corporation) in which case the Mandatory Conversion shall be

null and void, ab initio. Subject to the other terms hereof, the Corporation covenants and agrees that the Corporation will honor all

Notices of Conversion that are tendered by the Holder on or after the Mandatory Conversion Date.

b) Forced Conversion.

At any time after 120 days following the Mandatory Conversion Date, the Corporation may deliver a written notice to all Holders (a “Forced

Conversion Notice” and the date such notice is delivered to all Holders, the “Forced Conversion Notice Date”)

to cause each Holder to convert all or part of such Holder’s Series A Preferred Stock (as specified in such Forced Conversion Notice)

pursuant to Section 6 (a “Forced Conversion”), it being agreed that the “Conversion Date” for purposes

of Section 6 shall be deemed to be the Forced Conversion Notice Date (such date, the “Forced Conversion Date”), provided

that the Corporation shall not deliver a Forced Conversion Notice more than once in any 60 day period. The Corporation may not deliver

a Forced Conversion Notice, and any Forced Conversion Notice delivered by the Corporation shall not be effective, unless all of the Equity

Conditions have been met on the Forced Conversion Notice Date through and including the later of the Forced Conversion Date and the Trading

Day after the date that the Conversion Shares issuable pursuant to such conversion are actually delivered to the Holders pursuant to the

Forced Conversion Notice. Any Forced Conversion Notices shall be applied ratably to all of the Holders based on each Holder’s initial

purchases of Series A Preferred Stock hereunder, provided that any voluntary conversions by a Holder shall be applied against such Holder’s

pro rata allocation, thereby decreasing the aggregate amount forcibly converted hereunder if less than all shares of the Series

A Preferred Stock are forcibly converted. For purposes of clarification, a Forced Conversion shall be subject to all of the provisions

of Section 6, including, without limitation, the provisions requiring payment of liquidated damages and Section 6(d) on Beneficial Ownership

Limitation on conversion.

c) Notwithstanding

the terms of Sections 8(a) and 8(b) above, if the Corporation exercises its right to cause the conversion of Series A Preferred Stock

pursuant to Sections 8(a) or 8(b), then, within two (2) Trading Days following the receipt of a Mandatory Conversion Notice or Forced

Conversion Notice, each such Holder shall be entitled to Deliver a Redemption Notice to the Corporation to cause the Corporation to redeem

its shares of Series A Preferred Stock otherwise subject to conversion, only to the extent the right to cause such redemption would otherwise

be available to such Holder, pursuant to the terms of Section 9(a) below. In the event a Holder delivers a Redemption Notice pursuant

to this Section 8(c), any conversion contemplated by the applicable Mandatory Conversion Notice or Forced Conversion Notice shall be null

and void, ab initio, and the Corporation shall be obligated to redeem such Holder’s Series A Preferred Stock pursuant to Sections

9(a) and 9(b) below.

Section 9. Redemption

a) After the earlier

of (1) the receipt of Authorized Stockholder Approval or (2) the date that is 60 days following the Original Issue Date, each Holder shall

have the right to cause the Corporation to redeem all or part of such Holder’s shares of Series A Preferred Stock at a price per

share equal to 100% of the Stated Value (the “Redemption Consideration”) other than any shares that have theretofore

been called for redemption by the Corporation pursuant and subject to Section 9(c) below.

b) Subject to the

terms of Section 9(a) above, to cause the Corporation to redeem all or part of its shares of Series A Preferred Stock, each Holder shall

deliver written notice to the Corporation (each, a “Redemption Notice”) setting forth the number of shares of Series

A Preferred Stock that each such Holder wishes to redeem. The Corporation shall redeem the shares of Series A Preferred Stock in accordance

with the Redemption Notice, no later than 5 days after the date on which the Redemption Notice is delivered to the Corporation (such date

of redemption, the “Redemption Date”). Upon receipt of full payment in cash for a complete redemption, each Holder

will promptly submit to the Corporation such Holder’s Series A Preferred Stock certificates, if any, and such redeemed shares shall

no longer be deemed to be outstanding.

c) At any time after

the date that is 90 days after the Original Issue Date, the Corporation shall have the option to redeem any or all shares of Series A

Preferred Stock (other than any shares referenced in a Redemption Notice, the redemption of which shall be subject to Section 9(a) and

9(b), or any shares referenced in a Notice of Conversion) at a price per share equal to the Redemption Consideration, subject to the terms

and conditions set forth in this Section 9(c). If the Corporation exercises its option to redeem any such shares, it shall effect such

redemption on the date specified in a notice, which date shall be at least five (5) Business Days after delivery thereof (the “Call

Date”), that shall be sent to each Holder whose shares are to be so redeemed by the Company pursuant hereto (the “Call

Notice”). The Call Notice shall state (i) the Call Date and the number of shares of Series A Preferred Stock to be redeemed

by the Corporation pursuant to this Section 9(c) on such date and (ii) that the Holder is to surrender to the Corporation, in the manner

and at the place designated in the Call Notice, such Holder’s certificate or certificates, if any, representing the shares of Series

A Preferred Stock to be redeemed pursuant to this Section 9(c). On the Call Date, the Corporation shall redeem the shares of Series A

Preferred Stock subject to the Call Notice for the Redemption Consideration. Upon receipt of full payment in cash of the Redemption Consideration

for a complete redemption, each Holder will promptly submit to the Corporation such Holder’s Series A Preferred Stock certificates,

if any, and such redeemed shares shall no longer be deemed to be outstanding.

d) If on the Redemption

Date or Call Date, as applicable, the Redemption Consideration for the shares of Series A Preferred Stock to be redeemed on the Redemption

Date or the Call Date, as applicable, has been paid to the Holders, then, notwithstanding that any certificate representing any share

subject to redemption pursuant to this Section 9 has not been surrendered to the Corporation for cancellation, on the Redemption Date

or the Call Date, as applicable, all shares so submitted or called for redemption shall be cancelled, and all rights with respect to such

shares shall forthwith on such Redemption Date or Call Date, as applicable, cease and terminate, except for the right of the Holders to

receive the Redemption Consideration therefor, without interest.

e) Notwithstanding

the terms of Sections 9(c) or Section 9(d) above, if the Corporation exercises its option to redeem shares of Series A Preferred Stock

pursuant to Section 9(c), then each such Holder shall continue to be entitled to deliver a Notice of Conversion to the Corporation to