Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 Septiembre 2024 - 5:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2024

Commission

File Number: 001-38527

Uxin

Limited

21/F,

Donghuang Building,

No.

16 Guangshun South Avenue

Chaoyang

District,

Beijing 100102

People’s Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):________________

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):________________

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

UXIN

LIMITED |

| |

|

| |

By: |

/s/

Feng Lin |

| |

Name: |

Feng

Lin |

| |

Title: |

Chief

Financial Officer |

Date:

September 13, 2024

Exhibit

Index

Exhibit 99.1—Press Release

Exhibit

99.1

Uxin

Announces Entry into a Memorandum of Understanding for a Proposed Investment

BEIJING,

September 13, 2024 /PRNewswire/ — Uxin Limited (“Uxin” or the “Company”, together with its subsidiaries,

the “Group”) (Nasdaq: UXIN), China’s leading used car retailer, today announced that it has entered into a memorandum

of understanding (“MOU”) with Pintu (Beijing) Information Technology Co., Ltd. ( the “Investor”), an indirect

wholly-owned subsidiary of Dida Inc. (HKEX: 2559), on September 12, 2024 with respect to a proposed investment in the Company by the

Investor (the “Proposed Investment”).

Pursuant

to the MOU, the Investor intends to subscribe for 1,543,845,204 Class A ordinary shares of the Company for an aggregate subscription

amount of US$7.5 million, based on a subscription price of US$0.004858 per share (or US$1.4575 per ADS). The Proposed Investment is subject

to the parties’ execution of definitive agreements and closing conditions to be stipulated therein.

In

connection with the Proposed Investment, the Investor and the Youxin (Anhui) Industrial Investment Co., Ltd. (“Youxin Anhui”)

have entered into a Loan Agreement pursuant to which the Investor agrees to extend a loan in a principal amount of RMB equivalent of

US$7.5 million to Youxin Anhui. Youxin Anhui is a wholly-owned subsidiary of the Company.

About

Uxin

Uxin

is China’s leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and

digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable,

one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform

to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers.

Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established

strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy

development of the used car industry.

Safe

Harbor Statement

This

press release contains statements that may constitute “forward-looking” statements which are made pursuant to the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified

by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,”

“intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements.

Statements that are not historical facts, including statements about Uxin’s beliefs, plans, and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: the risk and uncertainties

as to the timing of the entry into definitive agreements or consummation of the transactions; the risk that certain closing conditions

of the transactions may not be satisfied on a timely basis, or at all; impact of the COVID-19 pandemic; Uxin’s goal and strategies;

its expansion plans and successful completion of certain financing transactions; its future business development, financial condition

and results of operations; Uxin’s expectations regarding demand for, and market acceptance of, its services; its ability to provide

differentiated and superior customer experience, maintain and enhance customer trust in its platform, and assess and mitigate various

risks, including credit; its expectations regarding maintaining and expanding its relationships with business partners, including financing

partners; trends and competition in China’s used car e-commerce industry; the laws and regulations relating to Uxin’s industry;

the general economic and business conditions; and assumptions underlying or related to any of the foregoing.

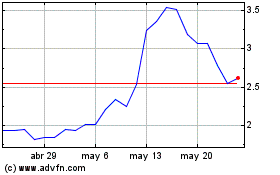

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

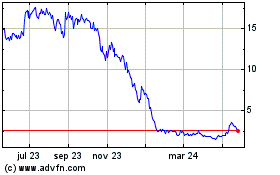

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024