Form 1-A/A - Offering Statement [Regulation A]: [Amend]

08 Agosto 2024 - 4:00PM

Edgar (US Regulatory)

EXPLANATORY NOTE

22nd Century Group, Inc., a Nevada corporation (the “Company”)

has prepared this Amendment No. 1 to Form 1-A (“Amendment”) solely for the purpose of filing the Opinion and Consent of Foley

& Lardner LLP as Exhibits 11.2 and 12.1. Accordingly, this Amendment consists only of this explanatory note, the signature page to

the Form 1-A, the exhibit index, and the exhibits referenced therein. The preliminary offering circular filed August 2, 2024 is unchanged

and therefore has been omitted.

| Exhibit No. |

|

Description |

| |

|

|

| 2.1 |

|

Amended

and Restated Certificate of Incorporation of the Company (incorporated herein by reference to Exhibit 3.2 of the Company’s

Annual Report on Form 10-K for the year ended September 30, 2010 filed with the Commission on December 1, 2010). |

| |

|

|

| 2.1.1 |

|

Amendment

to Certificate of Incorporation of the Company (incorporated by reference to Appendix A to the Company’s Definitive Proxy Statement

filed with the Commission on March 4, 2014). |

| |

|

|

| 2.1.2 |

|

Amendment

to Certificate of Incorporation of the Company (incorporated by reference to Appendix B to the Company’s Definitive Proxy Statement

filed with the Commission on December 11, 2023). |

| |

|

|

| 2.1.3 |

|

Form of

Certificate of Amendment to Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 of the Company’s

Form 8-K filed with the Commission on April 3, 2024). |

| |

|

|

| 2.2 |

|

Amended

and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.2 of the Company’s Annual Report on

Form 10-K for the year ended December 31, 2014 filed with the Commission on January 30, 2014). |

| |

|

|

| 2.2.1 |

|

Amendment

No. 1 to Amended and Restated Bylaws of the Company (incorporated herein by reference to Exhibit 3.2 of the Company’s

Form 8-K filed with the Commission on April 28, 2015). |

| |

|

|

| 3.1 |

|

Form of

Warrant (incorporated by reference from Exhibit 4.1 to the Company’s Form 8-K filed with the Commission on July 25,

2022). |

| |

|

|

| 3.2 |

|

Form of

Amended Original Issue Discount Senior Secured Debentures dated March 3, 2023 (incorporated by reference to Exhibit 4.1

to the Company’s Form 8-K filed with the Commission on December 28, 2023). |

| |

|

|

| 3.3 |

|

Form of

JGB Warrant (incorporated by reference to Exhibit 4.4 to the Company’s Form 10-K filed with the Commission on March 9,

2023). |

| |

|

|

| 3.4 |

|

Form of

Omnia Warrant (incorporated by reference to Exhibit 4.5 to the Company’s Form 10-K filed with the Commission on March 9,

2023). |

| |

|

|

| 3.5 |

|

Form of

Inducement Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Form 8-K filed with the Commission

on November 29, 2023). |

| |

|

|

| 3.6 |

|

Waiver

and Amendment Agreement (Incorporated by reference from Exhibit 10.1 to the Company’s Form 8-K filed with the Commission

on October 16, 2023). |

| 3.7 |

|

Form of

Common Warrant (Incorporated by reference from Exhibit 4.1 to the Company’s Form 8-K filed with the Commission on

October 18, 2023). |

| |

|

|

| 3.8 |

|

Form of

Placement Agent Warrant (Incorporated by reference from Exhibit 4.3 to the Company’s Form 8-K filed with the Commission

on October 18, 2023). |

| |

|

|

| 3.9 |

|

Form of

Common Warrant (Incorporated by reference from Exhibit 4.1 to the Company’s Form 8-K filed with the Commission on

April 9, 2024). |

| |

|

|

| 3.10 |

|

Form of

Pre-Funded Warrant (Incorporated by reference from Exhibit 4.2 to the Company’s Form 8-K filed with the Commission

on April 9, 2024). |

| |

|

|

| 3.11 |

|

Form of

Placement Agent Warrant (Incorporated by reference from Exhibit 4.3 to the Company’s Form 8-K filed with the Commission

on April 9, 2024). |

| |

|

|

| 3.12 |

|

Form of

Common Warrant (Incorporated by reference from Exhibit 4.1 to the Company’s Form 8-K filed with the Commission on

April 30, 2024). |

| |

|

|

| 3.13 |

|

Form of

Pre-Funded Warrant (Incorporated by reference from Exhibit 4.2 to the Company’s Form 8-K filed with the Commission

on April 30, 2024). |

| |

|

|

| 3.14 |

|

Form of

Pre-Funded Warrant (incorporated by reference to Exhibit 4.1 to the Company’s Form 8-K filed with the Commission

on May 10, 2024) |

| |

|

|

| 4.1 |

|

Form of

Subscription Agreement (incorporated by reference to Exhibit 4.1 to the Company’s Form

1-A filed with the Commission on August 2, 2024) |

| |

|

|

| 6.1†† |

|

License

Agreement dated March 6, 2009 between North Carolina State University and 22nd Century Limited, LLC (incorporated by reference

to Exhibit 10.21 to the Company’s Form S-1 registration statement filed with the Commission on August 26, 2011). |

| |

|

|

| 6.1.1 |

|

Amendment

dated August 9, 2012 to License Agreement dated March 6, 2009 between North Carolina State University and 22nd Century

Limited, LLC (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the

Commission on August 20, 2012). |

6.2 |

|

Letter

Agreement between the Company and North Carolina State University dated November 22, 2011 (incorporated by reference to Exhibit 10.1

to the Company’s Form 8-K filed with the Commission on November 23, 2011). |

| |

|

|

| 6.3† |

|

Amended

and Restated 22nd Century Group, Inc. 2021 Omnibus Incentive Plan (incorporated by reference from Appendix B to the Company’s

definitive proxy statement filed April 19, 2024) |

| |

|

|

| 6.4† |

|

Form of

Option Award Agreement under 22nd Century Group, Inc. 2021 Omnibus Incentive Plan (incorporated by reference to exhibit 10.2

of the Company’s Current Report on Form 8-K filed with the Commission on May 21, 2021). |

| |

|

|

| 6.5† |

|

Form of

Executive RSU Award Agreement under 22nd Century Group, Inc. 2021 Omnibus Incentive Plan (incorporated by reference to exhibit

10.3 of the Company’s Current Report on Form 8-K filed with the Commission on May 21, 2021). |

| |

|

|

| 6.6† |

|

Form of

Director RSU Award Agreement under 22nd Century Group, Inc. 2021 Omnibus Incentive Plan (incorporated by reference to exhibit

10.4 of the Company’s Current Report on Form 8-K filed with the Commission on May 21, 2021). |

| |

|

|

| 6.7† |

|

22nd

Century Group, Inc. 2014 Omnibus Incentive Plan, as amended and restated (incorporated by reference from Appendix A to the Company’s

definitive proxy statement filed on March 22, 2019). |

| |

|

|

| 6.8 |

|

Securities

Purchase Agreement dated March 3, 2023 with each of the purchasers party thereto and JGB Collateral, LLC, a Delaware limited

liability company, as collateral agent for the Purchasers (incorporated by reference to Exhibit 10.18 to the Company’s

Form 10-K filed with the Commission on March 9, 2023) |

| |

|

|

| 6.8.1 |

|

Amendment

to Securities Purchase Agreement dated March 3, 2023 with each of the purchasers party thereto and JGB Collateral, LLC, a Delaware

limited liability company, as collateral agent for the Purchasers (incorporated by reference to Exhibit 10.2 to the Company’s

Form 8-K filed with the Commission on December 28, 2023) |

| |

|

|

| 6.9 |

|

Subordinated

Promissory Noted dated March 3, 2023 (incorporated by reference to Exhibit 10.19 to the Company’s Form 10-K

filed with the Commission on March 9, 2023) |

| 6.10 |

|

Equity

Purchase Agreement dated November 20, 2023 (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K

filed with the Commission on November 27, 2023) |

| |

|

|

| 6.10.1 |

|

Amendment

to Equity Purchase Agreement dated December 22, 2023 (incorporated by reference to Exhibit 10.1 to the Company’s

Form 8-K filed with the Commission on December 28, 2023) |

| |

|

|

| 6.11 |

|

Form of

Inducement Letter (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with the Commission

on November 29, 2023) |

| |

|

|

| 6.12 |

|

License

Agreement with NCSU dated November 2, 2023 (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K

filed with the Commission on November 8, 2023) |

| |

|

|

| 6.13 |

|

Letter

Agreement with JGB (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with the Commission

on April 8, 2024) |

| |

|

|

| 6.14 |

|

General

Release and Settlement Agreement (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with

the Commission on April 30, 2024) |

| |

|

|

| 6.15 |

|

May 2024 Letter

Agreement with JGB (incorporated by reference to Exhibit 10.1 to the Company’s Form 8-K filed with the Commission

on May 10, 2024) |

| |

|

|

| 6.16 |

|

May 2024

Exchange Agreement with JGB (incorporated by reference to Exhibit 10.2 to the Company’s Form 8-K filed with the Commission

on May 10, 2024) |

| |

|

|

| 11.1 |

|

Consent of Freed Maxick CPAs, P.C. (incorporated by reference to Exhibit 11.1 to the Company’s Form 1-A filed with the Commission on August 2, 2024) |

| |

|

|

| 11.2* |

|

Consent

of Foley & Lardner LLP (included in Exhibit 12.1) |

| |

|

|

| 12.1* |

|

Opinion

of Foley & Lardner LLP |

* Filed herewith.

† Management contract or compensatory

plan, contract or arrangement.

†† Certain

portions of the exhibit have been omitted pursuant to a confidential treatment order. An unredacted copy of the exhibit has been filed

separately with the United States Securities and Exchange Commission pursuant to the request for confidential treatment.

SIGNATURES

Pursuant to the requirements

of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A

and has duly caused this offering statement to be signed on its behalf by the undersigned, thereunto duly authorized, on August 8, 2024.

| |

22nd CENTURY GROUP, INC. |

| |

|

| |

By: |

/s/ Lawrence D. Firestone |

| |

|

Lawrence D. Firestone |

| |

|

Chief Executive Officer

(Principal Executive Officer) |

This Offering Statement has

been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Lawrence D. Firestone |

|

Chairman of the Board, Chief Executive Officer |

|

August 8, 2024 |

| Lawrence D. Firestone |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Daniel A. Otto |

|

Chief Financial Officer |

|

August 8, 2024 |

| Daniel A. Otto |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Andrew Arno |

|

Lead Director |

|

August 8, 2024 |

| Andrew Arno |

|

|

|

|

| |

|

|

|

|

| /s/ Lucille S. Salhany |

|

Director |

|

August 8, 2024 |

| Lucille Salhany |

|

|

|

|

| |

|

|

|

|

| /s/ Anthony Johnson |

|

Director |

|

August 8, 2024 |

| Anthony Johnson |

|

|

|

|

Exhibit 12.1

|

ATTORNEYS AT LAW

One INDEPENDENT DRIVE

JACKSONVILLE, FLORIDA 32202

904.359.2000 TEL

904.359.8700 FAX

www.foley.com

CLIENT/MATTER NUMBER

045952-0199

|

| 22nd Century Group, Inc. |

August 8, 2024 |

321 Farmington Road, Mocksville

North Carolina 27028

Ladies and Gentlemen:

We have served as counsel to

22nd Century Group, a Nevada corporation (the “Company”), in connection with the filing on August 8, 2024, with the

Securities and Exchange Commission (the “Commission”) of an Offering Statement on Form 1-A (the “Offering

Statement”) relating to the potential sale by the Company of up to 37,500,000 shares of the Company’s common stock, par

value $0.0001 per share (the “Shares”).

In connection with our representation,

we have examined: (i) the Offering Statement and exhibits thereto, (ii) the Amended and Restated Certificate of Incorporation of the Company,

as amended to date, (iii) the Amended and Restated Bylaws of the Company, as amended, (iv) the proceedings and actions taken by the Board

of Directors of the Company to authorize and approve the sale of the Shares pursuant to the Offering Statement and (v) other documents,

agreements and instruments, as we have deemed necessary as a basis for the opinions expressed below. We have also considered such matters

of law and of fact, including the examination of originals or copies, certified or otherwise identified to our satisfaction, of such records

and documents of the Company, certificates of officers, directors and representatives of the Company, certificates of public officials,

and such other documents as we have deemed appropriate as a basis for the opinions set forth below. In our examination of the above-referenced

documents, we have assumed the genuineness of all signatures, the authenticity of all documents, certificates, and instruments submitted

to us as originals, the conformity with the originals of all documents submitted to us as copies and that all Shares will be offered and

sold in compliance with applicable federal and state securities laws and in the manner stated in the Offering Statement (including any

and all post-effective amendments thereto).

The opinions expressed herein

are limited in all respects to the federal laws of the United States of America and the applicable provisions of Title 7 of the Nevada

Revised Statutes, and no opinion is expressed with respect to the laws of any other jurisdiction or any effect which such laws may have

on the opinions expressed herein. This opinion is limited to the matters stated herein, and no opinion is implied or may be inferred beyond

the matters expressly stated herein.

Based upon, subject to and limited

by the foregoing, we are of the opinion that, as of the date hereof, the Shares being sold pursuant to the Offering Statement are duly

authorized and will be, when issued in the manner described in the Offering Statement, legally and validly issued, fully paid and non-assessable.

This opinion is issued as of

the date hereof, and we assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become

aware of any fact that might change the opinion expressed herein after the date hereof. This opinion is limited to the matters set forth

herein, and no other opinion should be inferred beyond the matters expressly stated. We hereby consent to the filing of this opinion letter

as an exhibit to the Offering Statement and to the use of our name under the caption “Legal Matters” in the Offering Statement.

In giving our consent, we do not admit that we are “experts” within the meaning of Section 11 of the Securities Act of

1933, as amended (the “Securities Act”), or within the category of persons whose consent is required by Section 7 of

the Securities Act.

| |

Very truly yours, |

| |

|

| |

/s/ Foley & Lardner LLP |

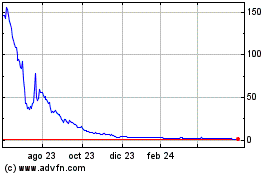

22nd Century (NASDAQ:XXII)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

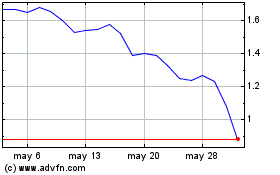

22nd Century (NASDAQ:XXII)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024