|

Registration

Statement No. 333-275898

Filed Pursuant to Rule 424(b)(2) |

| |

| |

|

|

Pricing

Supplement

Pricing Supplement

dated August 8, 2024 to the Prospectus dated December 20, 2023, the Prospectus Supplement dated December 20, 2023 and the Product

Supplement No. 1A dated May 16, 2024 |

|

$5,000,000

Compounded

SOFR to 2-Year U.S. Dollar

SOFR

ICE Swap Rate Floating Rate Notes,

Due

August 12, 2031

Royal Bank of Canada |

| |

|

|

Royal Bank of Canada is offering the Compounded SOFR to 2-Year U.S.

Dollar SOFR ICE Swap Rate Floating Rate Notes (the “Notes”) described below.

| · | The Notes will accrue interest, payable quarterly, at a rate equal to: |

| o | from and including the Issue Date to but excluding February 12, 2031: Compounded SOFR + a Spread of 0.75% (subject to a Coupon Floor

of 0.00% per annum) |

| o | from and including February 12, 2031 to but excluding the Maturity Date: the 2-Year U.S. Dollar SOFR ICE Swap Rate + a Spread of 0.75%

(subject to a Coupon Floor of 0.00% per annum) |

| · | Any payments on the Notes are subject to our credit risk. |

| · | The Notes will not be listed on any securities exchange. |

CUSIP: 78014RXG0

Investing in the Notes involves a number of

risks. See “Selected Risk Considerations” beginning on page P-4 of this pricing supplement and “Risk Factors”

in the accompanying prospectus, prospectus supplement and product supplement.

None of the Securities and Exchange Commission

(the “SEC”), any state securities commission or any other regulatory body has approved or disapproved of the Notes or passed

upon the adequacy or accuracy of this pricing supplement. Any representation to the contrary is a criminal offense. The Notes will not

constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation or any other Canadian

or U.S. governmental agency or instrumentality. The Notes are not bail-inable notes and are not subject to conversion into our common

shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act.

| |

Per Note |

Total |

| Price to public(1) |

100.00% |

$5,000,000 |

| Underwriting discounts and commissions(1) |

0.60% |

$30,000 |

| Proceeds to Royal Bank of Canada |

99.40% |

$4,970,000 |

(1) RBC Capital Markets, LLC will purchase

the Notes from us on the Issue Date at purchase prices between $994.00 and $1,000.00 per $1,000 principal amount of Notes, and will pay

all or a portion of its underwriting discount of up to $6.00 per $1,000 principal amount of Notes to certain selected broker-dealers as

a selling concession. Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts and/or eligible institutional

investors may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing

the Notes in these accounts and/or for an eligible institutional investor may be as low as $994.00 per $1,000 principal amount of Notes.

See “Supplemental Plan of Distribution (Conflicts of Interest)” below.

The initial estimated value of the Notes determined

by us as of the Pricing Date, which we refer to as the initial estimated value, is $983.80 per $1,000 principal amount of Notes and is

less than the public offering price of the Notes. The market value of the Notes at any time will reflect many factors, cannot be predicted

with accuracy and may be less than this amount. We describe the determination of the initial estimated value in more detail below.

RBC Capital Markets, LLC

| |

|

| |

Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

KEY TERMS

The information in this “Key Terms” section is qualified

by any more detailed information set forth in this pricing supplement and in the accompanying prospectus, prospectus supplement and product

supplement.

| Issuer: |

Royal Bank of Canada |

| Underwriter: |

RBC Capital Markets, LLC (“RBCCM”) |

| Minimum Investment: |

$1,000 and minimum denominations of $1,000 in excess thereof |

| Pricing Date: |

August 8, 2024 |

| Issue Date: |

August 12, 2024 |

| Maturity Date:* |

August 12, 2031 |

| Interest Rate: |

For each Interest Period a per annum rate calculated as follows: (a) the Reference Rate for that Interest Period plus (b) the Spread, provided that the Interest Rate will not be less than the Coupon Floor |

| Reference Rates: |

With respect to each Interest Period occurring from and including

the Issue Date to but excluding February 12, 2031 (the “SOFR Period”), Compounded SOFR, determined as set forth under “General

Terms of the Notes—Reference Rates—Daily SOFR and Compounded SOFR” in the accompanying product supplement, for that

Interest Period

With respect to each Interest Period occurring from and including

February 12, 2031 to but excluding the Maturity Date (the “ICE Swap Period”), the 2-Year U.S. Dollar SOFR ICE Swap Rate, determined

as set forth under “General Terms of the Notes—Reference Rates—U.S. Dollar SOFR ICE Swap Rate” in the accompanying

product supplement, for the second U.S. government securities business day immediately preceding the first day of that Interest Period |

| Coupon Floor: |

0.00% per annum |

| Spread: |

0.75% |

| Interest Payment Dates:* |

Quarterly, on the 12th calendar day of February, May, August and November of each year, beginning on November 12, 2024 and ending on the Maturity Date. If an Interest Payment Date is not a business day, interest will be paid on the next business day, without adjustment to the end date of the relevant Interest Period, and no additional interest will be paid in respect of the postponement. |

| Interest Period: |

Each period from and including an Interest Payment Date (or, for the first Interest Period, the Issue Date) to but excluding the next following Interest Payment Date |

| Day Count Convention: |

30 / 360 |

| Calculation Agent: |

RBCCM |

* Subject to postponement. See “General Terms of the Notes—Postponement

of a Payment Date” in the accompanying product supplement.

| P-2 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together

with the prospectus dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior

Global Medium-Term Notes, Series J, of which the Notes are a part, and the product supplement no. 1A dated May 16, 2024. This pricing

supplement, together with these documents, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements

as well as any other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for

implementation, sample structures, fact sheets, brochures or other educational materials of ours.

We have not authorized anyone to provide any

information or to make any representations other than those contained or incorporated by reference in this pricing supplement and the

documents listed below. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. These documents are an offer to sell only the Notes offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in each such document is current only as of its date.

If the information in this pricing supplement

differs from the information contained in the documents listed below, you should rely on the information in this pricing supplement.

You should carefully consider, among other things,

the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the documents

listed below, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal,

tax, accounting and other advisers before you invest in the Notes.

You may access these documents on the SEC website at www.sec.gov

as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299520/d645671d424b3.htm

| · | Prospectus Supplement dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299523/d638227d424b3.htm

| · | Product Supplement No. 1A dated May 16, 2024: |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324006777/dp211286_424b2-ps1a.htm

Our Central Index Key, or CIK, on the SEC website is 1000275. As

used in this pricing supplement, “Royal Bank of Canada,” the “Bank,” “we,” “our” and “us”

mean only Royal Bank of Canada.

| P-3 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

SELECTED RISK CONSIDERATIONS

The Notes involve risks not associated with

an investment in ordinary floating rate notes. We urge you to consult your investment, legal, tax, accounting and other advisers before

you invest in the Notes. Some of the risks that apply to an investment in the Notes are summarized below, but we urge you to read also

the “Risk Factors” sections of the accompanying prospectus, prospectus supplement and product supplement. You should not purchase

the Notes unless you understand and can bear the risks of investing in the Notes.

Risks Relating to the Terms and Structure of the Notes

| · | The Interest Rate

on the Notes Is a Floating Rate and May Be Equal to the Coupon Floor — Interest payable on the Notes will be based on, in part,

on the applicable Reference Rate for the relevant Interest Period. The applicable Reference Rate could decline significantly, including

to a rate equal to or less than zero. If the Interest Rate for any Interest Period is equal to the Coupon Floor, no interest will be payable

with respect to that Interest Period. Accordingly, you may not receive any interest payments during the term of the Notes. |

| · | Payments on the Notes Are Subject to Our Credit

Risk, and Market Perceptions about Our Creditworthiness May Adversely Affect the Market Value of the Notes — The Notes are our

senior unsecured debt securities, and your receipt of any amounts due on the Notes is dependent upon our ability to pay our obligations

as they come due. If we were to default on our payment obligations, you may not receive any amounts owed to you under the Notes and you

could lose your entire investment. In addition, any negative changes in market perceptions about our creditworthiness may adversely affect

the market value of the Notes. |

Risks Relating to the Initial Estimated Value of the Notes

| · | The Initial Estimated Value of the Notes Is

Less Than the Public Offering Price — The initial estimated value of the Notes is less than the public offering price of the

Notes and does not represent a minimum price at which we, RBCCM or any of our other affiliates would be willing to purchase the Notes

in any secondary market (if any exists) at any time. If you attempt to sell the Notes prior to maturity, their market value may be lower

than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the level of the applicable

Reference Rate, our credit ratings and financial condition, the internal funding rate we pay to issue securities of this kind (which is

lower than the rate at which we borrow funds by issuing conventional fixed rate debt), and the inclusion in the public offering price

of the underwriting discount, if any, our estimated profit and the estimated costs relating to our hedging of the Notes. These factors,

together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may

be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. Assuming no

change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your Notes prior to maturity

may be less than your original purchase price, as any such sale price would not be expected to include the underwriting discount, if any,

our estimated profit or the hedging costs relating to the Notes. In addition, any price at which you may sell the Notes is likely to reflect

customary bid-ask spreads for similar trades. In addition to bid-ask spreads, the value of the Notes determined for any secondary market

price is expected to be based on a secondary market rate rather than the internal funding rate used to price the Notes and determine the

initial estimated value. As a result, the secondary market price will be less than if the internal funding rate were used. The Notes are

not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold the Notes to maturity. |

| · | The Initial Estimated Value of the Notes Is

Only an Estimate, Calculated as of the Pricing Date — The initial estimated value of the Notes is based on the value of our

obligation to make the payments on the Notes, together with the mid-market value of the derivative embedded in the terms of the Notes.

See “Structuring the Notes” below. Our estimate is based on a variety of assumptions, including our internal funding rate

(which represents a discount from our credit spreads), expectations as to interest rates and volatility and the expected term of the Notes.

These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Notes

or similar securities at a price that is significantly different than we do. |

| P-4 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

The value of the Notes at any time after

the Pricing Date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a

result, the actual value you would receive if you sold the Notes in any secondary market, if any, should be expected to differ materially

from the initial estimated value of the Notes.

Risks Relating to Conflicts of Interest

| · | RBCCM’s Role as Calculation Agent May

Create Conflicts of Interest — As Calculation Agent, our affiliate, RBCCM, will determine any levels of the applicable Reference

Rate and make any other determinations necessary to calculate any payments on the Notes. In making these determinations, the Calculation

Agent may be required to make discretionary judgments, including those described under “— Risks Relating to the Reference

Rates” below. In making these discretionary judgments, the economic interests of the Calculation Agent are potentially adverse to

your interests as an investor in the Notes, and any of these determinations may adversely affect any payments on the Notes. The Calculation

Agent will have no obligation to consider your interests as an investor in the Notes in making any determinations with respect to the

Notes. |

Risks Relating to the Reference Rates

| · | The 2-Year U.S. Dollar SOFR ICE Swap Rate and

SOFR Are Relatively New Reference Rates and SOFR’s Composition and Characteristics Are Not the Same as LIBOR — The publication

of the U.S. Dollar SOFR ICE Swap Rate began in November 2021, and, therefore, has a limited history. ICE Benchmark Administration (“IBA”)

launched the U.S. Dollar SOFR ICE Swap Rate for use as a reference rate for financial instruments in order to aid the market’s transition

to the SOFR and away from LIBOR. However, the composition and characteristics of SOFR differ from those of LIBOR in material respects,

and the historical performance of LIBOR and the U.S. Dollar LIBOR ICE Swap Rate will have no bearing on the performance of SOFR or the

2-Year U.S. Dollar SOFR ICE Swap Rate. |

The publication of SOFR began in April

2018, and, therefore, it has a limited history. In addition, the future performance of SOFR cannot be predicted based on the limited historical

performance. The level of SOFR during the term of the Notes may bear little or no relation to the historical actual or historical indicative

SOFR data. Prior observed patterns, if any, in the behavior of market variables and their relation to SOFR, such as correlations, may

change in the future. While some pre-publication historical data has been released by the Federal Reserve Bank of New York, production

of such historical indicative SOFR data inherently involves assumptions, estimates and approximations. No future performance of SOFR may

be inferred from any of the historical actual or historical indicative SOFR data. Hypothetical or historical performance data are not

indicative of, and have no bearing on, the potential performance of SOFR.

The composition and characteristics of

SOFR are not the same as those of LIBOR, and SOFR is fundamentally different from LIBOR for two key reasons. First, SOFR is a secured

rate, while LIBOR is an unsecured rate. Second, SOFR is an overnight rate, while LIBOR is a forward-looking rate that represents interbank

funding over different maturities (e.g., three months). As a result, there can be no assurance that SOFR (including SOFR, compounded as

described in this document) will perform in the same way as LIBOR would have at any time, including, without limitation, as a result of

changes in interest and yield rates in the market, market volatility or global or regional economic, financial, political, regulatory,

judicial or other events. For example, since publication of SOFR began in April 2018, daily changes in SOFR have, on occasion, been more

volatile than daily changes in comparable benchmark or other market rates. For the same reasons, SOFR is not expected to be a comparable

substitute, successor or replacement for LIBOR.

| · | The Reference Rates Will Be Affected by a Number

of Factors and May Be Volatile — Many factors may affect the Reference Rates including, but not limited to: |

| · | supply and demand for overnight U.S. Treasury repurchase agreements; |

| · | sentiment regarding underlying strength in the U.S. and global economies; |

| · | expectations regarding the level of price inflation; |

| P-5 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

| · | sentiment regarding credit quality in the U.S. and global credit markets; |

| · | central bank policy regarding interest rates; |

| · | inflation and expectations concerning inflation; |

| · | performance of capital markets; and |

| · | any statements from public government officials regarding the cessation of

the Reference Rates. |

These and other factors may have a negative

impact on the payments on the Notes and on the value of the Notes in the secondary market. Additionally, these factors may cause the Reference

Rates to be volatile, and volatility of the Reference Rates may adversely affect your return on the Notes.

| · | The Reference Rate with Respect to a Particular

Interest Period during the SOFR Period Will Be Capable of Being Determined Only Near the End of the Relevant Interest Period —

The Reference Rate applicable to a particular Interest Period during the SOFR Period is Compounded SOFR and, therefore, the amount of

interest payable with respect to that Interest Period cannot be determined until near the end of that Interest Period. As a result, you

will not know the amount of interest payable with respect to a particular Interest Period during the SOFR Period until shortly prior to

the related Interest Payment Date, and it may be difficult for you to reliably estimate the amount of interest that will be payable on

that Interest Payment Date. |

| · | SOFR May Be Modified or Discontinued and the

Notes May Bear Interest by Reference to a Rate Other than SOFR, which Could Adversely Affect the Value of the Notes — SOFR is

published by the Federal Reserve Bank of New York based on data received by it from sources other than us, and we have no control over

its methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time. There can be no guarantee,

particularly given its relatively recent introduction, that SOFR will not be discontinued or fundamentally altered in a manner that is

materially adverse to the interests of investors in the Notes. If the manner in which SOFR is calculated, including the manner in which

SOFR is calculated, is changed, that change may result in a reduction in the amount of interest payable on the Notes and the trading prices

of the Notes. In addition, the Federal Reserve Bank of New York may withdraw, modify or amend the published SOFR data in its sole discretion

and without notice. The interest rate for any Interest Period will not be adjusted for any modifications or amendments to SOFR data that

the Federal Reserve Bank of New York may publish after the interest rate for that Interest Period has been determined. |

| · | Uncertainty as to Some of the Potential Benchmark

Replacements and any Benchmark Replacement Conforming Changes We Make May Adversely Affect the Return on and the Market Value of the Notes

— If the Calculation Agent determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred

in respect of SOFR, then the Interest Rate will no longer be determined by reference to Compounded SOFR, but instead will be determined

by reference to a different rate, plus a spread adjustment, which we refer to as a “Benchmark Replacement,” as further described

below. |

If a particular Benchmark Replacement

or Benchmark Replacement Adjustment cannot be determined, then the next-available Benchmark Replacement or Benchmark Replacement Adjustment

will apply. These replacement rates and adjustments may be selected, recommended or formulated by (i) the Relevant Governmental Body (such

as the Alternative Reference Rates Committee), (ii) the International Swaps and Derivatives Association (“ISDA”) or (iii)

in certain circumstances, the Calculation Agent. In addition, the terms of the Notes expressly authorize the Calculation Agent to make

Benchmark Replacement Conforming Changes with respect to, among other things, changes to the definition of “Interest Period,”

the methodology, timing and frequency of determining rates and making payments of interest and other administrative matters. The determination

of a Benchmark Replacement, the calculation of the interest rate on the Notes by reference to a Benchmark Replacement (including the application

of a Benchmark Replacement Adjustment), any implementation of Benchmark Replacement Conforming Changes and any other determinations, decisions

or elections that may be made under the terms of the Notes in connection with a Benchmark Transition Event, could adversely affect the

value of the Notes, the return on the Notes and the price at which you can sell such Notes.

| P-6 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

In addition, (i) the composition and

characteristics of the Benchmark Replacement will not be the same as those of SOFR, the Benchmark Replacement may not be the economic

equivalent of SOFR, there can be no assurance that the Benchmark Replacement will perform in the same way as SOFR would have at any time

and there is no guarantee that the Benchmark Replacement will be a comparable substitute for SOFR (each of which means that a Benchmark

Transition Event could adversely affect the value of the Notes, the return on the Notes and the price at which you may sell the Notes),

(ii) any failure of the Benchmark Replacement to gain market acceptance could adversely affect the Notes, (iii) the Benchmark Replacement

may have a very limited history and the future performance of the Benchmark Replacement may not be predicted based on historical performance,

(iv) the secondary trading market for Notes linked to the Benchmark Replacement may be limited and (v) the administrator of the Benchmark

Replacement may make changes that could change the value of the Benchmark Replacement or discontinue the Benchmark Replacement and has

no obligation to consider your interests in doing so.

| · | The 2 Year U.S. Dollar SOFR ICE Swap Rate May

Be Determined by the Calculation Agent in Its Sole Discretion or, if It Is Discontinued or Ceased to Be Published Permanently or Indefinitely,

Replaced by a Successor or Substitute Rate — If no relevant rate appears on the applicable Bloomberg Screen Page on a relevant

day at approximately 11:00 a.m., New York City time, then the Calculation Agent will have the discretion to determine the Reference Rate

for that day. |

Notwithstanding the foregoing, if the

Calculation Agent determines in its sole discretion on or prior to the relevant day that the relevant rate for U.S. dollar swaps referencing

SOFR has been discontinued or that rate has ceased to be published permanently or indefinitely, then the Calculation Agent will use as

the Reference Rate for that day a substitute or successor rate that it has determined to be a commercially reasonable replacement rate.

If the Calculation Agent has determined a substitute or successor rate in accordance with the foregoing, the Calculation Agent may determine

in its sole discretion to make adjustments to the definitions of business day and interest determination date and any other relevant methodology

for calculating that substitute or successor rate, including any adjustment factor, spread and/or formula it determines is needed to make

that substitute or successor rate comparable to the relevant rate for U.S. dollar swaps referencing SOFR.

Any of the foregoing determinations or

actions by the Calculation Agent could result in adverse consequences to the value of the Reference Rate used on the applicable interest

determination date, which could adversely affect the return on and the market value of the Notes.

| P-7 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

THE REFERENCE RATES

Compounded SOFR on any date of determination

is the rate of return of a daily compound interest investment over that interest period. SOFR is a broad measure of the cost of borrowing

cash overnight collateralized by Treasury securities as published by the administrator of that rate as of 5:00 p.m. (New York City time)

on the date of that determination, subject to the provisions set forth under “General Terms of the Notes—Reference Rates—

Daily SOFR and Compounded SOFR” in the accompanying product supplement.

The 2-Year U.S. Dollar SOFR ICE Swap Rate on

any date of determination is the swap rate for a fixed-for-floating U.S. Dollar SOFR-linked interest rate swap transaction with a two-year

maturity as published by the administrator of that rate as of 11:00 a.m. (New York City time) on that date of determination, subject to

the provisions set forth under “General Terms of the Notes—Reference Rates—U.S. Dollar SOFR ICE Swap Rate” in

the accompanying product supplement. In a fixed-for-floating U.S. Dollar SOFR-linked interest rate swap transaction, one party pays a

fixed rate (the “swap rate”) and the other pays a floating rate based on SOFR, compounded in arrears for 12 months using standard

market conventions. SOFR is intended to be a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Historical Information

The graphs below set forth the information relating

to the historical performance of SOFR for the period from April 2, 2018 to August 8, 2024, and the 2-Year U.S. Dollar SOFR ICE Swap Rate

for the period from November 18, 2021 to August 8, 2024. The historical rates do not reflect the compounding method used to calculate

Compounded SOFR. We obtained the information in the graph from Bloomberg Financial Markets, without independent investigation.

SOFR

PAST

PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

| P-8 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

2-Year

U.S. Dollar SOFR ICE Swap Rate

PAST

PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

| P-9 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

UNITED STATES FEDERAL INCOME

TAX CONSIDERATIONS

You should review carefully the section in the

accompanying product supplement entitled “United States Federal Income Tax Considerations.” The following discussion, when

read in combination with those sections, constitutes the full opinion of our counsel, Davis Polk & Wardwell LLP, regarding the material

U.S. federal income tax consequences of owning and disposing of the Notes.

Generally, this discussion assumes that you purchased

the Notes for cash in the original issuance at the stated issue price and does not address other circumstances specific to you.

We intend to treat the Notes for U.S. federal

income tax purposes as “variable rate debt instruments” that provide for two qualified floating rates issued with original

issue discount (“OID”), as described in the section in the accompanying product supplement entitled “United States Federal

Income Tax Considerations—Tax Consequences to U.S. Holders—Notes Treated as Debt Instruments—Notes Treated as Variable

Rate Debt Instruments—Interest on VRDIs That Provide for Multiple Rates.” In the opinion of our counsel, which is based on

current market conditions and representations provided by us, this treatment of the Notes is reasonable under current law. OID is generally

required to be recognized over the term of the Notes under constant yield principles. The amount of qualified stated interest and OID

on the Notes can be obtained by calling RBC Capital Markets, LLC toll free at 1-877-688-2301.

You should consult your tax adviser regarding

the U.S. federal income tax consequences of an investment in the Notes, as well as tax consequences arising under the laws of any state,

local or non-U.S. taxing jurisdiction.

SUPPLEMENTAL PLAN OF DISTRIBUTION

(CONFLICTS OF INTEREST)

After the initial offering of the Notes, the

public offering price of the Notes may change.

The value of the Notes shown on your account

statement may be based on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market

in the Notes (which it is not obligated to do). That estimate will be based upon the price that RBCCM may pay for the Notes in light of

then-prevailing market conditions, our creditworthiness and transaction costs. For a period of up to approximately six months after the

Issue Date, the value of the Notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the

Notes at that time. This is because the estimated value of the Notes will not include the underwriting discount, if any, or our hedging

costs and profits; however, the value of the Notes shown on your account statement during that period may initially be a higher amount,

reflecting the addition of RBCCM’s underwriting discount, if any, and our estimated costs and profits from hedging the Notes. This

excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Notes, it expects

to do so at prices that reflect their estimated value.

RBCCM or another of its affiliates or agents

may use this pricing supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this pricing

supplement in a market-making transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise

in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

For additional information about the settlement

cycle of the Notes, see “Plan of Distribution” in the accompanying prospectus. For additional information as to the relationship

between us and RBCCM, see the section “Plan of Distribution—Conflicts of Interest” in the accompanying prospectus.

STRUCTURING THE NOTES

The Notes are our debt securities. As is the

case for all of our debt securities, including our structured notes, the economic terms of the Notes reflect our actual or perceived creditworthiness.

In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow

the funds under structured notes at a rate that is lower than the rate that we might pay for a conventional fixed or floating rate debt

security of comparable maturity. The lower internal funding rate, the underwriting discount, if any, and the hedging-related costs relating

to the Notes reduce the economic terms of the Notes to you and result in the initial estimated value for the Notes being less than their

public offering price. Unlike the initial estimated value, any value of the Notes determined for

| P-10 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

purposes of a secondary market transaction may

be based on a secondary market rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under

the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives)

with RBCCM and/or one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including

our creditworthiness, interest rate movements, volatility and the tenor of the Notes. The economic terms of the Notes and the initial

estimated value depend in part on the terms of these hedging arrangements.

See “Selected Risk Considerations—Risks

Relating to the Initial Estimated Value of the Notes—The Initial Estimated Value of the Notes Is Less Than the Public Offering Price”

above.

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada

LLP, as Canadian counsel to the Bank, the issue and sale of the Notes has been duly authorized by all necessary corporate action of the

Bank in conformity with the indenture, and when the Notes have been duly executed, authenticated and issued in accordance with the Indenture

and delivered against payment therefor, the Notes will be validly issued and, to the extent validity of the Notes is a matter governed

by the laws of the Province of Ontario or Québec, or the federal laws of Canada applicable therein, will be valid obligations of

the Bank, subject to the following limitations: (i) the enforceability of the indenture may be limited by the Canada Deposit Insurance

Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization, receivership, moratorium,

arrangement or winding-up laws or other similar laws of general application affecting the enforcement of creditors’ rights generally;

(ii) the enforceability of the indenture is subject to general equitable principles, including the principle that the availability of

equitable remedies, such as specific performance and injunction, may only be granted at the discretion of a court of competent jurisdiction;

(iii) under applicable limitations statutes generally, including that the enforceability of the indenture will be subject to the limitations

contained in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find any provision of

the indenture to be unenforceable as an attempt to vary or exclude a limitation period under such applicable limitations statutes; (iv)

rights to indemnity and contribution under the Notes or the indenture which may be limited by applicable law; and (v) courts in Canada

are precluded from giving a judgment in any currency other than the lawful money of Canada and such judgment may be based on a rate of

exchange in existence on a day other than the day of payment, as prescribed by the Currency Act (Canada). This opinion is given as of

the date hereof and is limited to the laws of the Provinces of Ontario and Québec and the federal laws of Canada applicable therein.

In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture

and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all

as stated in the opinion letter of such counsel dated December 20, 2023, which has been filed as Exhibit 5.3 to the Bank’s Form

6-K filed with the SEC dated December 20, 2023.

In the opinion of Davis Polk & Wardwell LLP,

as special United States products counsel to the Bank, when the Notes offered by this pricing supplement have been issued by the Bank

pursuant to the indenture, the trustee has made, in accordance with the indenture, the appropriate notation to the master note evidencing

such Notes (the “master note”), and such Notes have been delivered against payment as contemplated herein, such Notes will

be valid and binding obligations of the Bank, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency

and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability

(including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions

or applications giving effect to governmental actions or foreign laws affecting creditors’ rights, provided that such counsel

expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or stay law or (ii) the effect of fraudulent

conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of

the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion involves matters governed by the

laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received, and we understand that you are relying

upon, the opinion of Norton Rose Fulbright Canada LLP, Canadian counsel for the Bank, set forth above. In addition, this opinion is subject

to customary assumptions about the trustee’s authorization, execution and delivery of the indenture and the authentication of the

master note and the validity, binding nature and enforceability of the indenture with respect to the trustee, all as stated in

| P-11 | RBC Capital Markets, LLC |

| | |

| | Compounded SOFR to 2-Year U.S. Dollar SOFR ICE Swap Rate Floating Rate Notes |

the opinion of Davis Polk & Wardwell LLP

dated May 16, 2024, which has been filed as an exhibit to the Bank’s Form 6-K filed with the SEC on May 16, 2024.

| P-12 | RBC Capital Markets, LLC |

424B2

EX-FILING FEES

0001000275

333-275898

0001000275

2024-08-09

2024-08-09

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

F-3

ROYAL BANK OF CANADA

Narrative Disclosure

The maximum aggregate offering price of the securities to which the prospectus relates is $5,000,000. The

prospectus is a final prospectus for the related offering(s).

v3.24.2.u1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FnlPrspctsFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvMaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

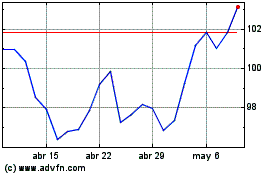

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Royal Bank of Canada (NYSE:RY)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024