UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

WHITESTONE REIT

(Name

of Issuer)

Common Shares of Beneficial Interest, $0.001 par value per share

(Title

of Class of Securities)

966084204

(CUSIP

Number)

David Bramble

2002 Clipper Park Rd.

Suite 105

Baltimore, MD 21211

(410) 340-1665

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 18, 2024

(Date

of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. o

| Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent. |

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 966084204

| 1 |

Name of Reporting Person

MCB PR Capital LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

Delaware |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

OO (Limited Liability Company) |

| |

|

|

|

CUSIP No. 966084204

| 1 |

Name of Reporting Person

MCB Acquisitions Manager LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

Maryland |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

OO |

| |

|

|

|

CUSIP No. 966084204

| 1 |

Name of Reporting Person

P. David Bramble |

| 2 |

Check the Appropriate Box if a Member of a Group

(A): o (B): o |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

OO |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

o |

| 6 |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned by Each Reporting Person with |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,690,000 shares, all of which are directly owned by MCB PR Capital

LLC, a Delaware limited liability company (“MCB”).

MCB Acquisitions Manager LLC, a Maryland limited liability company

(“Acquisitions”) is the sole Manager of MCB and has the sole right to make any and all decisions and take any and all actions

on behalf of MCB and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB.

P. David Bramble is the sole member of Acquisitions with full control

of Acquisitions and may therefore be deemed to indirectly beneficially own the shares of the Issuer directly owned by MCB. |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

See response to Row 8. |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,690,000 Common Shares |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

o |

| 13 |

Percent of Class Represented by Amount in Row (11)

9.4% |

| 14 |

Type of Reporting Person

IN |

| |

|

|

|

Explanatory Note

This statement constitutes Amendment

No. 2 to the Schedule 13D relating to the common shares of beneficial interest, $0.001 par value per share (the “Common Shares”),

of Whitestone REIT, a Maryland real estate investment trust (the “Issuer”), and hereby amends the Schedule 13D filed

with the Securities and Exchange Commission on June 3, 2024 (the “Initial Schedule 13D”), as amended by Amendment No.

1 to the Initial Schedule 13D filed with the Securities and Exchange Commission on October 9, 2024 ( “Amendment No. 1” and,

together with the Initial Schedule 13D, the “Schedule 13D”). Except as specifically amended and supplemented

by this Amendment No. 2, the Schedule 13D remains in full force and effect.

| Item 4. |

Purpose of Transaction |

Item 4 of the Schedule 13D is hereby amended to add the following:

Over a month following delivery of the Revised

Proposal to the Board of Trustees of the Issuer (the “Board”), the Board has continued both to rebuff discussions

with MCB regarding a potential transaction and to decline to commence any strategic alternatives process more broadly. Faced with the

Board’s ongoing refusal to consider all opportunities to maximize value for the Issuer’s shareholders, on November 18, 2024,

MCB delivered to the Board a letter (the “November 18 Letter”) notifying the Board that MCB was withdrawing the Revised

Proposal, effective immediately. In the November 18 Letter, MCB informed the Board that it will continue to consider all options available

to MCB and other shareholders of the Issuer to ensure that the Board upholds its responsibilities.

The foregoing description of

the November 18 Letter does not purport to be complete and is qualified in its entirety by

reference to the full text of the November 18 Letter, which is attached hereto as Exhibit

7.03, and is incorporated herein by reference.

| Item 7. |

Materials to be Filed as Exhibits |

Item 7 of the Schedule 13D is

hereby amended to add the following:

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 18, 2024

| |

/s/ P. David Bramble |

| |

David Bramble, Individually, and |

| |

|

| |

On behalf of MCB Acquisitions Manager LLC, as the sole member

of MCB Acquisitions Manager LLC |

| |

|

| |

On behalf of MCB PR Capital LLC, as the sole manager of

MCB PR Capital LLC |

Exhibit 7.03

|

2002 Clipper Park Rd. Suite 105 | Baltimore,

MD 21211

dbramble@mcbrealestate.com

(410) 662-0105 |

November 18, 2024

Via Email

Board of Trustees

C/O David K. Holeman

Whitestone REIT

2600 S. Gessner Rd, Suite 500

Houston, TX 77063

Dear Whitestone REIT Board of Trustees:

MCB Real Estate (“MCB” or “we”) delivered an

attractive, fully-financed proposal to the Whitestone Board to acquire Whitestone for $15 per share in an all-cash transaction. Our proposal

would maximize value to Whitestone’s shareholders, delivering immediate and certain value in the form of a 14.5% premium to Whitestone’s

share price prior to our initial proposal on June 3, 2024, and a 61.8% premium to Whitestone’s unaffected share price prior to the

rumored Fortress proposal on October 26, 2023. We have made repeated efforts to engage with the Whitestone Board over the last several

months, but each of those attempts has been summarily rebuffed. The Board’s refusal to grant due diligence, engage in any meaningful

discussions, or commence a strategic alternatives process is not consistent with its duties and indicates a boardroom culture of entrenchment.

While we continue to believe our proposal is the best path forward

for shareholders, our attempts to engage have been rebuffed at every turn, so we are withdrawing our proposal to acquire Whitestone at

this time.

This is not a decision taken lightly. We are disappointed and disturbed

at the Board’s intransigence, entrenchment and apparent self-interest. The Company’s recent public comments make it painfully

clear that the Board is not open-minded or even willing to give real consideration to opportunities to advance shareholders’ best

interests.

Just a few weeks ago, Whitestone defended its entrenched position with

unsupported and unrealistic claims of Whitestone’s greater hypothetical “intrinsic value.” Notably, however, that value

was not actually provided, proven or even explained. Whitestone also attempted to rationalize the Board’s refusal to consider alternatives

by relying on a period of stock price outperformance that was driven by multiple acquisition rumors and proposals, including ours, that

inflated Whitestone’s share price.

When pressed on whether the Board is open to opportunities to enhance value on Whitestone’s third quarter 2024 earnings call, Whitestone

CEO David Holeman falsely asserted that the Board is actively looking at strategic options. Further, he seemingly didn’t even understand

what such a process to maximize value would actually entail. When asked, he said:

“I would tell you that our

board reviews the best things for shareholders all the time. So we are actively looking at what are the best ways to add value, what

are the best ways to produce a return to our shareholders. So I think we are actively doing that just like we should, and so I'm not

sure I'm clear with your question.”

Given the Board’s refusal to engage with us regarding our proposal

or conduct a process to explore whether other parties may have an interest in transacting with Whitestone, Mr. Holeman’s comments

are at best a naïve sidestep to the question, and at worst a downright lie to shareholders.

We have heard from a number of other shareholders that they are supportive

of a potential transaction and share our frustration with the Whitestone Board. We believe some of these shareholders have reached out

to Whitestone directly to demand answers. Unfortunately, it appears that the Whitestone Board has ignored these concerns and refused to

engage with them, just as it has consistently refused to engage with MCB.

As Whitestone’s largest actively managed shareholder, with ownership

of 4,690,000 shares representing 9.4% of Whitestone’s common shares, we note the addition of Kristian M. Gathright and Donald A.

Miller to the Whitestone Board. Ms. Gathright and Mr. Miller are two new and well-regarded independent trustees whom we hope will bring

fresh perspective to the Board and ensure that the Whitestone Board acts in accordance with its fiduciary duties, including taking appropriate

steps to maximize value for Whitestone shareholders.

The reputations and careers of these professionals, as well as the

rest of the Board, are on the line, and we call on them to act in shareholders’ best interests. We believe the inherent disadvantages

of Whitestone as a standalone company, and the upside for shareholders from a well-run strategic review process, are obvious.

As we have said from the onset of this process, our interests are aligned

with other Whitestone shareholders. Whitestone shareholders deserve a board that is committed to considering all opportunities to maximize

value. If the Whitestone Board continues its pattern of delay and entrenchment, MCB believes the entire Board should be removed at the

next annual meeting of shareholders.

While we are withdrawing our proposal at this time, we remain a significant

shareholder of the company and will continue to consider all options available to MCB and other Whitestone shareholders to ensure that

the Board upholds its responsibilities.

Sincerely,

| /s/ P. David Bramble |

|

| P. David Bramble, Managing Partner |

|

cc:

Via email, under separate cover:

Peter Pinkard, Managing Partner

Gina Baker Chambers, President

Drew Gorman, Principal

Mike Trail, Chief Investment Officer

Brian Mendell, Managing Director

Daniel LeBey, Vinson & Elkins L.L.P.

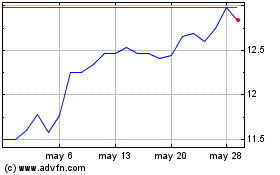

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

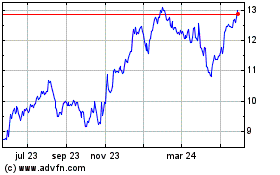

Whitestone REIT (NYSE:WSR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024