Solana Bull Flag Signals A Breakout To $300 – Analyst Shares Key Levels

18 Diciembre 2024 - 3:00PM

NEWSBTC

Solana (SOL) finds itself at a critical juncture as it tests demand

at a price level that previously acted as key resistance. Since

late November, SOL’s price has been in a retrace, dampening the

hype surrounding the cryptocurrency. The prolonged decline has left

investors uncertain about the next move for Solana, with many

questioning whether it can regain its bullish momentum. Related

Reading: XRP Consolidation Could End Once It Clears $2.60 – Top

Analyst Expects $4 Soon Top analyst Jelle recently shared a

technical analysis on X, shedding light on Solana’s current setup.

According to Jelle, Solana has formed a falling wedge pattern—a

classic bullish formation—into what was once a critical resistance

level. The price has confirmed this level as support, providing a

potential foundation for a significant rally in the near term. If

the support holds, it could reignite bullish sentiment and position

Solana for another strong run. However, a failure to sustain this

level may signal further downside, potentially eroding confidence

in its long-term trajectory. As Solana navigates this pivotal

moment, all eyes are on whether it can reclaim its former glory and

capitalize on the momentum. Solana Finding Fuel To Take Off Solana

has experienced a 23% retrace from its local high of $264, set on

November 22. Despite this decline, the cryptocurrency is holding

firm above the $210 level, a crucial support zone that has analysts

optimistic about a potential rally to new all-time highs. The

resilience shown by SOL at this level suggests that bullish

momentum may be building as the price consolidates. Top analyst

Jelle recently shared his insights on X, highlighting a bullish

technical setup for Solana. According to Jelle, SOL has formed a

falling wedge pattern, a structure often indicative of an upcoming

breakout. Importantly, the wedge aligns with a key resistance level

that has now been confirmed as support, strengthening the case for

further upward movement. Jelle also points out that Solana has

formed its first higher low during this retracement, a potential

signal that the asset is poised to resume its bullish trend. He

believes Solana could re-enter price discovery before Christmas,

forecasting a target of $300 in the coming days. Related Reading:

Ethereum Whales Load Up: Bullish Sign Or Bear Trap? However, risks

remain, particularly if the consolidation phase continues for

longer than expected. Should SOL fail to break out decisively, it

could struggle to regain the upward momentum necessary to challenge

new highs. For now, Solana’s ability to hold above $210 will be

critical in determining its next move. Testing Reactive Demand

Solana finds itself at a critical turning point, trading at $216

and holding firm above the $210 mark—a level that once acted as

significant resistance. This key support level now plays a pivotal

role in determining whether SOL can ignite a historic rally. The

current price action reflects growing optimism among investors,

with many anticipating that staying above $210 for just a few days

could trigger a sharp recovery. Analysts suggest that if SOL

maintains its foothold above this critical level, a swift move

toward $250 would likely follow. Such a recovery would position

Solana to regain its bullish momentum and potentially challenge its

all-time high (ATH). While this scenario might seem ambitious, SOL

has previously demonstrated its capacity for rapid upward moves

during similar conditions. Related Reading: Bitcoin Breaks ATH

Pushing Back Into Price Discovery – BTC To $130K? A strong

confirmation of support at the $210 level could attract fresh

buying interest, creating the foundation for the next leg of its

rally. With momentum on the horizon, the coming days will be

critical in determining whether Solana can make history and aim for

unprecedented price levels. Featured image from Dall-E, chart from

TradingView

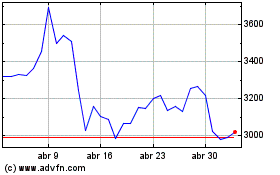

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024